Executive Summary

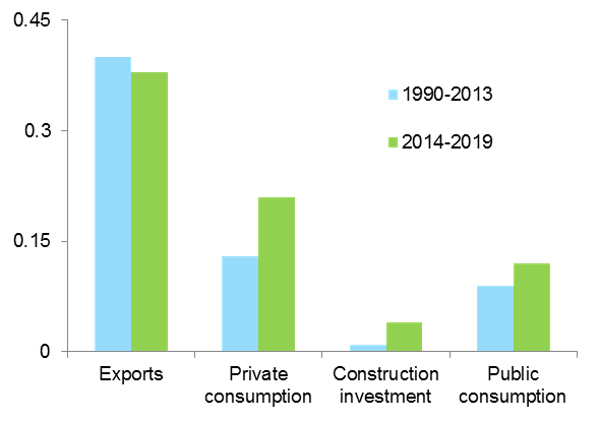

- 2019 was a year to forget for the German economy…: At 0.6%, the German economy recorded its weakest GDP growth rate since the Eurozone sovereign debt crisis. Only thanks to solid growth contributions from private and public consumption as well as investment in construction a recession was avoided.

- …that ended on a weak note…: The worst is probably behind us, but the German economy has yet to enter into a clear recovery mode. High-frequency hard data for the final quarter of 2019 for now fails to reflect the fresh – albeit timid – optimism observed in leading sentiment indicators at the turn of 2019/20. The meagre expected Q4 GDP growth performance – we expect 0.1% q/q) – suggests that German economic momentum for now has at best stabilized at low levels

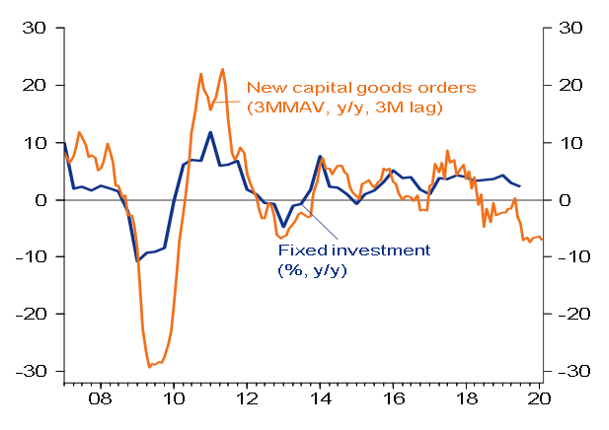

- …and 2020 will not bring much relief: For one, ongoing structural headwinds will hold back German GDP growth including the subdued global trade outlook as well as regulatory and technological challenges for the German car sector. Secondly, even though the negative inventory drag should start to fade and base effect will become more favorable as industry embarks on a gradual recovery, the acceleration in momentum will prove too weak to prop up fixed investment growth. As a result the latter should come to a standstill in 2020. Meanwhile consumption – private and public – will remain the key pillar of the German economy, but a further acceleration in spending is unlikely. Overall we expect 2020 German GDP growth to come in at a seasonally-adjusted +0.6%.

2019 was a year to forget for the German economy…

At 0.6%, the German economy last year recorded its weakest GDP growth rate since 2013. Resilient domestic demand saved the day as buoyant consumption – public (2.5%) and private (1.6%) – as well as investment in contruction (3.8%) kept the German economy from slipping into recession. Meanwhile investment in machinery & equipment also showed meagre growth (0.4%) while the contribution from the external sector (-0.4ppt) was negative as imports (1.9%) grew more than exports (0.9%).

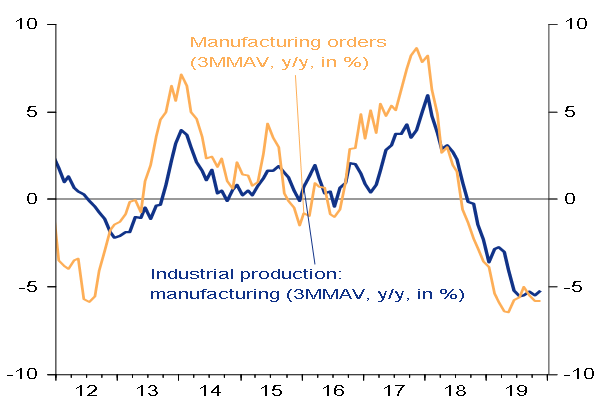

German manufacturing remained stuck in the dolddrums in the final quarter of 2019.

2019 full-year GDP growth suggests that the German economy ended the year on a weak note, with GDP probably rising by a meagre 0.1% q/q. Therefore despite the recent turnaround in some leading – but also highly unreliable indicators when it comes to gauging economic momentum – sentiment indicators including the Sentix and the ZEW, German industry has not yet entered into a clear recovery mode.