EXECUTIVE SUMMARY

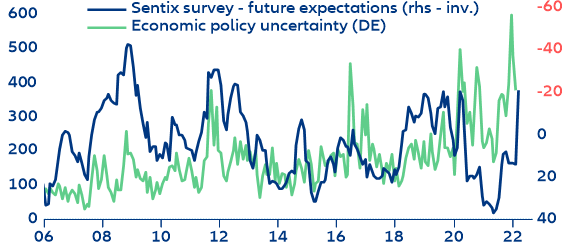

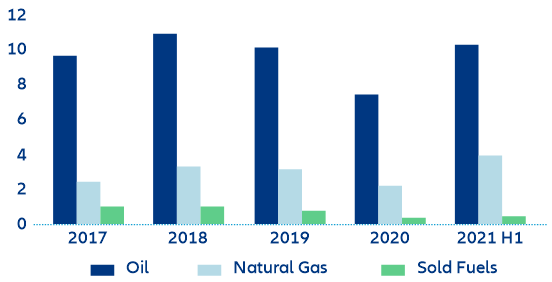

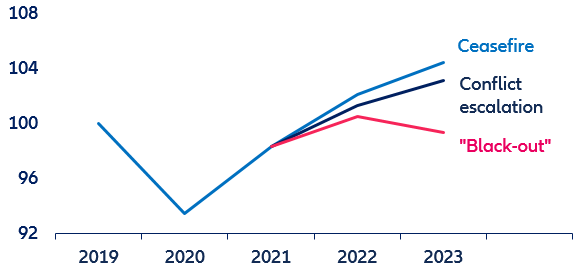

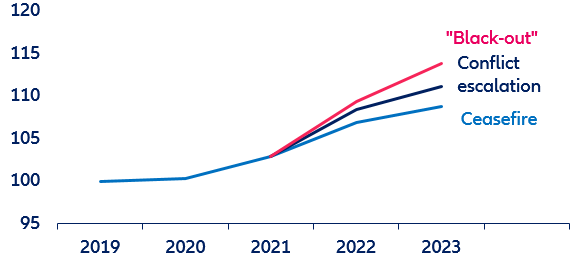

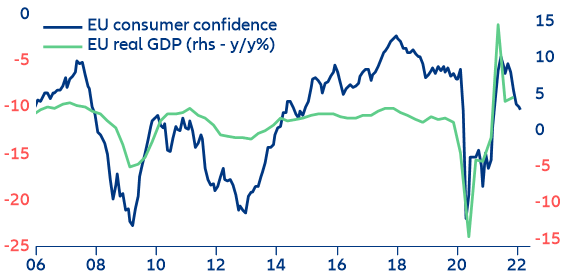

- The invasion of Ukraine has created a significant negative supply-side shock to the Eurozone. Inflation continues to rise while financial sanctions have effectively shut down non-energy trade with Russia. Consumer confidence has already deteriorated and suggests slowing growth during the latter part of the year.

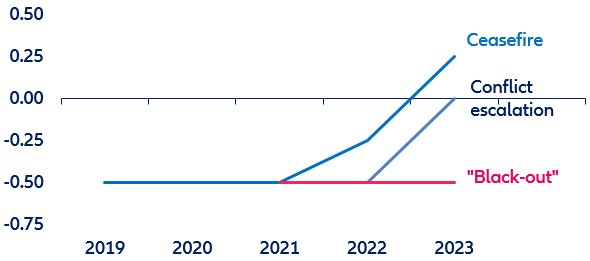

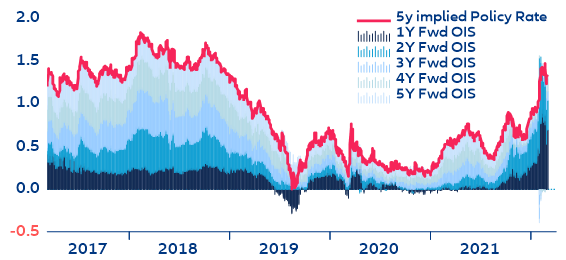

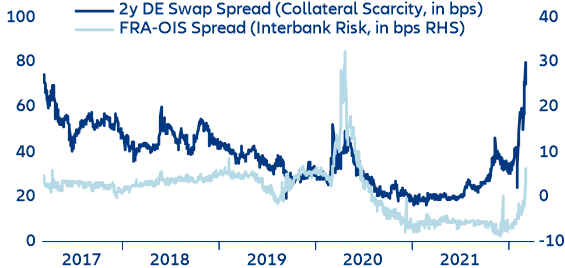

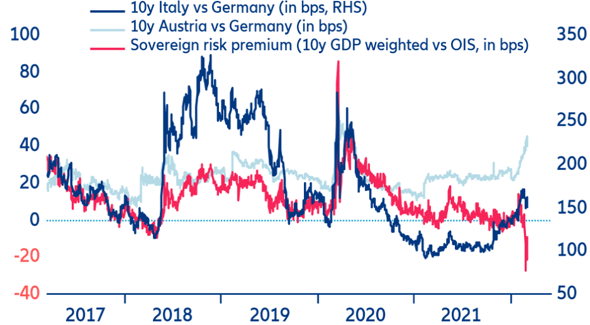

- Given the uncertain outlook, we believe that the ECB will remain in a wait-and-see mode at the March meeting as concerns about slowing growth and tighter financial conditions will outweigh inflation fears. Under current conditions, maintaining as much policy flexibility and optionality as possible will remain essential. The ECB should not pre-commit to either a notably lower pace of asset purchases in Q2 or ending asset purchases this year. We expect that QE will continue throughout 2022, which would push back the first rate hike (which prior to Russia’s invasion of Ukraine we expected for December) into Q1 2023.

- If the baseline conditions no longer apply, the ECB would need to re-assess its monetary stance at the next policy meeting. We could see a more dovish shift if a shut-off of Russian oil and gas triggers a significant deterioration of the growth outlook and requires further monetary easing. Counter-cyclical fiscal policy would ideally complement aggregate demand support from the ECB and help bring forward expectations of normalization during the recovery.

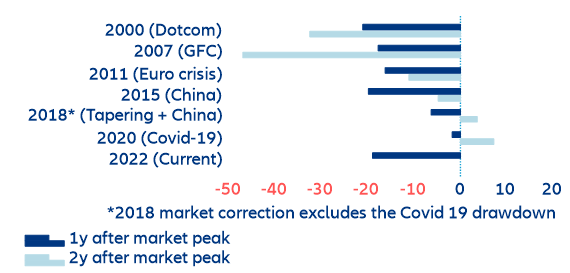

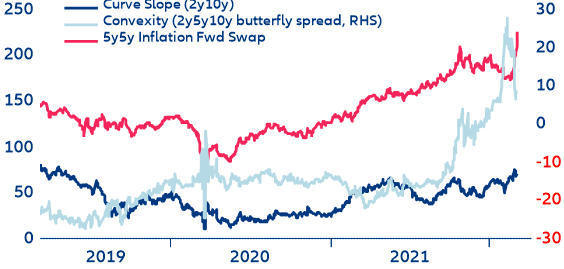

- We expect that stabilizing real rates and higher inflation will still be supportive for corporate earnings growth while long-term nominal rates remain contained by safe haven flows. This should also slow current spread widening, with investment grade corporate spreads reverting back to 120bps by the end of the year.

Hawkishness – past the peak or just on pause? Only six weeks ago, the ECB’s Governing Council appeared ready to pivot towards a hawkish monetary stance during the second half of the year. However, heightened uncertainty about the economic outlook due to Russia’s invasion of Ukraine has added a layer of additional complexity to the question of when and how quickly to tighten monetary policy in the face of a sizeable supply-side shock to the Eurozone economy. The March meeting, which was previously considered a potential turning point for the ECB’s monetary stance, could now well prove to become a non-event.

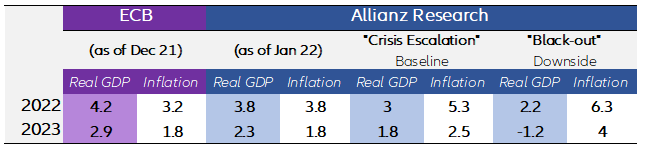

Table 1: Forecast for Eurozone growth and inflation (%)