Executive Summary

- The invasion of Ukraine will propel Europe's already high energy prices even higher: We expect at least +30% increase in the energy bill for 2022, hitting low-income households in the UK and Germany the hardest. For 2022, we calculate a total energy bill per household of EUR3400 in Germany, over EUR3000 in the UK, EUR2800 in France and just below EUR2000 in Italy and Spain.

- Compared to the pre-war situation, for the average consumer, this represents an additional loss of -2pp in the UK, -1.5pp in Germany and -1pp in France, Italy and Spain. In the worst-case scenario where energy supply is partially cut and energy prices increase by an additional 70% (20% probability), disposable income for the average European household would be cut by an additional -2.5pp. This would bring the total cost to more than -4pp in the UK and Germany, equivalent to an additional cost of more than EUR1200 per household.

- For more than half of households, excess savings are not enough to absorb the income squeeze from higher energy bills. Without further state support measures, the resulting reduction in consumer spending could cut GDP growth by -0.6pp in the UK, -0.5pp in Germany and -0.4pp in France, Italy and Spain. In the worst case scenario, the cost on growth from lower consumer spending could reach up to -1.1pp.

- In this context, additional state support of more than EUR20bn will be needed in Germany, EUR14bn in the UK, EUR17bn in France and close to EUR10bn in Italy and Spain. In the worst case scenario, the additional support needed could reach EUR75bn in Germany and EUR50bn in the UK and France. Acting on both demand (i.e; rationing of non-essential activities) and supply (i.e. strategic reserves) could help: a supply cut for non-energy uses of oil & gas would increase the supply for energy use by +10% in Germany, +9% in France and about +6% for both Italy, Spain and the UK.

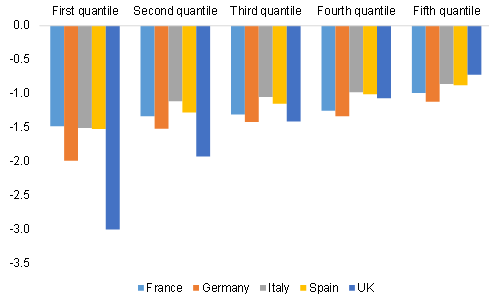

The invasion of Ukraine will propel Europe's already high energy prices even higher: We expect a +30% increase in the energy bill for 2022, hitting low-income households in the UK and Germany the hardest. For 2022, we calculate a total energy bill per household of EUR3400 EUR in Germany, over EUR3000 EUR in the UK, EUR2800 in France and just below EUR2000 in Italy and Spain. Low-income households will bear the brunt of the rise in oil and gas prices as their energy bills tends to account for a larger share of consumption, ranging from around 5% in France and Spain to 6.5% in Italy, over 7% in the UK and close to 8% in Germany (where energy prices are the highest in Europe). Applying the increase of the energy bill to households’ consumption structure by quintile of income, and taking into account the expected increase in incomes , we find the rise in energy costs puts the highest burden on British and German households (see Figure 1). Household disposable incomes in these economies could drop by -3pp and -2pp, respectively, compared to -1.5pp in France, Italy and Spain.

Figure 1 – Estimated energy cost in 2022 (total increase of +30%), pp of disposable income

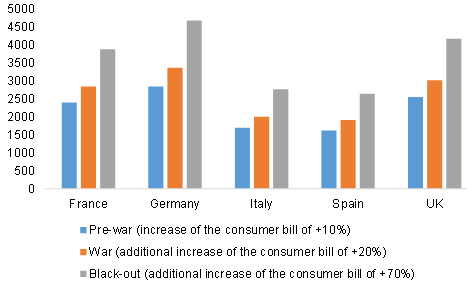

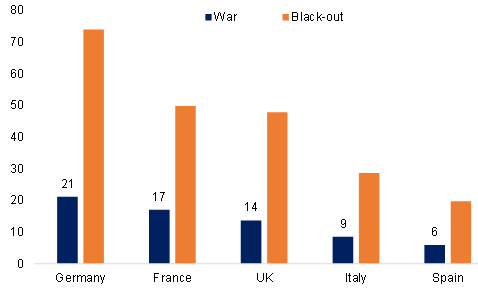

Compared to the pre-war situation, for the average consumer, this represents an additional disposable income loss of -2pp in the UK, -1.5pp in Germany and -1pp in France, Italy and Spain. In the worst-case scenario where the energy supply is partially cut and energy prices increase by an additional +70% (20% probability, our “Black-out” scenario ), the total energy bill would reach EUR85bn in Germany and EUR55bn in the UK. In this scenario, disposable income for the average household would be cut by an additional -2.5pp, bringing the total cost to more than -4pp in the UK and Germany. This would be equivalent to an additional cost of more than EUR1200 per household (see Figure 2).

Figure 2 – Estimated energy cost in 2022 by scenario, EUR per household

Excess savings accumulated through the Covid-19 crisis will not be enough to absorb the income squeeze from higher energy bills. Without further state support measures, the resulting reduction in consumer spending could cut GDP growth by -0.6pp in the UK, -0.5pp in Germany and -0.4pp in France, Italy and Spain. We estimate that excess savings stood at close to EUR100bn in Germany, EUR87bn in the UK (GBP72bn), more than EUR80bn in France, more than EUR70bn in Italy and more than EUR40bn in Spain, as of end-2021. However, looking at the distribution of wealth by quantile of income, the first three quantiles appear to hold around 10% of the total excess savings. As a result, excess savings could not compensate for the increase in consumers’ energy bills (see Figure 3). In the worst case scenario (black-out), the cost on GDP growth from lower consumer spending could reach up to -1.1pp.

Figure 3 – Excess household savings smaller than the increase in the energy bill (base case), EURbn

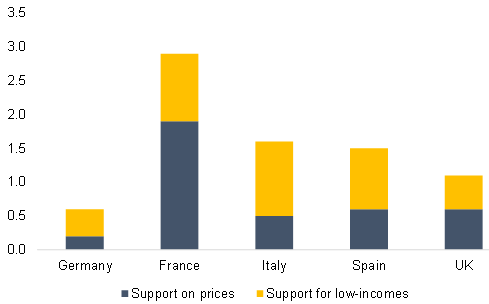

In this context, maintaining the status quo ante i.e., limiting the income impact to the pre-war level, is essential. This will require additional state support measures of more than EUR20bn in Germany, EUR14bn in the UK, EUR17bn in France and close to EUR10bn in Italy and Spain. European governments had already enacted a host of measures to mitigate the blow of higher energy prices to households, in particular the poorer ones. All in all, the direct (energy price caps) and indirect support (energy cheques) has been highest in France and Italy (+3pp and +1.6pp to disposable incomes). Spain and the UK followed with +1.4pp and +1.1pp while Germany remains the laggard for now (+0.6pp). Fiscal support measures are also in place, though the scope and scale has varied across countries. The most widely-used measures include energy-cost compensation through (targeted) direct transfers to households, gas and electricity price caps (in France), reduced special levies (Italy, Spain) or even the full withdrawal of them (Germany in the second half of 2022), as well as VAT tax cuts (Italy, Spain).

Figure 4 – Additional fiscal support measures needed compared to pre-war, EURbn

Responding quickly to the rapid surge in energy prices poses a classical dilemma for governements, i.e. the trade-off between implementation simplicity/rapidity and correctly targeting those in need. Direct subsidies to households are a point in case. If based on income thresholds, for example, they hardly reflect the mobilily and heating needs of the recipients. The impact of other measures on price developments is hard to gauge. VAT cuts, for example, might be imperfectly transmitted to selling prices and run the risk of being partially absorbed into the profit margins of already profitable energy-distribution companies, rather than reaching the poorest households. On the other hand, price caps are costly (due to their regressivity) and blur price signals, leaving little incentive to consumers to adjust the quantities they consume. Furthermore, price caps could significantly increse public debt if the energy-distribution companies are owned by the state and make significant losses in order to offer regulated prices.

Given these constraints, how effective have these measures been in curbing inflation and cushioning incomes? If the energy price shock is temporary, these measures could help to prevent strong volatility and an overshoot of inflation that would weigh on consumer confidence and be a drag on future consumption, as well as limit the loss of purchasing power. Indeed, in France, where a cap on regulated gas prices was introduced as early as 01 October 2021, the latest inflation data do point to a delayed transmission of energy inflation to manufactured goods until February 2022. However, as Germany cut the levy on the price of electricity only on 01 January 2022, a greater share of German manufacturing firms are still expecting to increase their selling prices (59% compared to 50% in the Eurozone, as of February 2022).

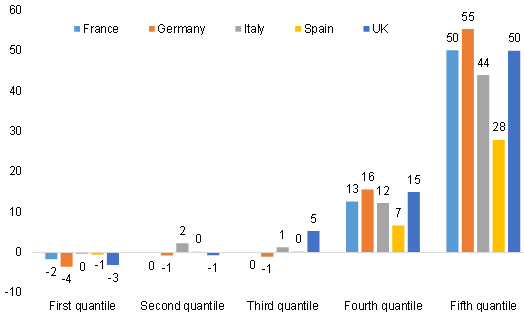

We estimate that the 4% gas and electricity price cap in France means an average loss of -0.2pp of disposable income compared to -2.1pp for the initial shock, with high discrepency amid income categories (-2.5pp for the first quantile and -1.7pp for the fifth quantile). In addition, the EUR4bn of “energy cheques” is supporting the first two quantiles of income by around +1pp of disposable income.

In Germany, the full withdrawl of the EEG EUR6.5 cents on the wholesale electricity price per kilowatt-hour (estimated at EUR5bn) in the second half of 2022 should reduce the pressure on disposable incomes by only +0.2pp of disposable income. Abolishing this renewables surcharge, paid directly by consumers with their electricity bills, is expected to ease overall inflation by -0.3pp in the second half of this year. In addition, a mini “energy bonus” will be given to around 2.1mn low-income households next summer, totalling EUR200mn. Hence, this cheque will only reach one fourth of the households in the first quantile of income, equivalent to a total of an estimated +0.4pp of their gross disposable income.

In the UK, the government announced a "rebate and clawback” scheme (total cost of EUR10bn), which will loan energy companies funds to give all households (around 28mn) a GBP200 rebate on their annual energy bills from April 2022, with GBP150 extra for lower-income households. These measures will limit the increase of electricity prices next April to +39% instead of +54%. Overall, we estimate that on average these measures reduce the impact on gross disposable income from -2.7pp to -2.1pp.

Figure 5 – Impact of state support on household disposable income, pp

Some governments have already announced the prolongation of measures (the 4% price cap until year-end in France, extension of tax breaks until June in Spain) while others (Germany) announced the willigness to increase fiscal support.

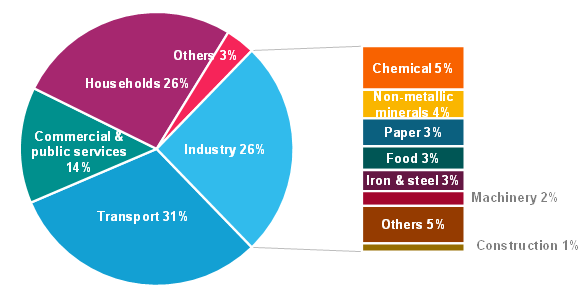

Governments can also try to some extent to act both on demand (i.e; rationning) and supply (i.e. strategic reserves). From the demand perspective, rationing could be a potential solution to avoid an energy crunch. Such rationning would probably first hit non-energy and non-essential uses. A supply cut for non-energy uses of oil & gas would allow a rerouting and increase in supply for energy use by +10% in Germany, +9% in France and about +6% for Italy, Spain and the UK. The cost associated with this move would be a squeeze in activity in industries such as fertilizers, plastics and road equipment. Should governments decide to impose power cuts for non-essential sectors, it could free up more energy for households as well. However, the associated economic cost of a full blackout would be too high and governments could decide to ration supply: imposing a 10% supply cut on industries, services, government services and transport could boost energy available to households by + 7% in the EU .

“Softer” regulatory measures are also a possibility. For instance, back in 2013, France passed a law to force stores to turn off lights after 1am. At the time, the estimated annual energy savings stood at 3450 GWh, which only represents 0.2% of the country’s total energy consumption. Compliance with this law is quite low in France but enforcing similar measures across Europe could add up rapidly.

Figure 6 – Energy consumption by sector in the EU-27 (2019)

Although taken individually, most nations do not have ample strategic reserves, under the International Energy Agency (IEA) a group of 31 nations has the ability to decide collectively to release some reserves to alleviate supply squeezes on crude oil markets. As of end-2021, combined IEA reserves stood at around 4.bn barrels – which represents about 42 days of global consumption. As recently as 01 March, 60 millions barrels have been released – with half of that volume coming from the US. However, this has not managed to cool down markets yet: The Brent price shot above USD110 per barrel despite the announcement.