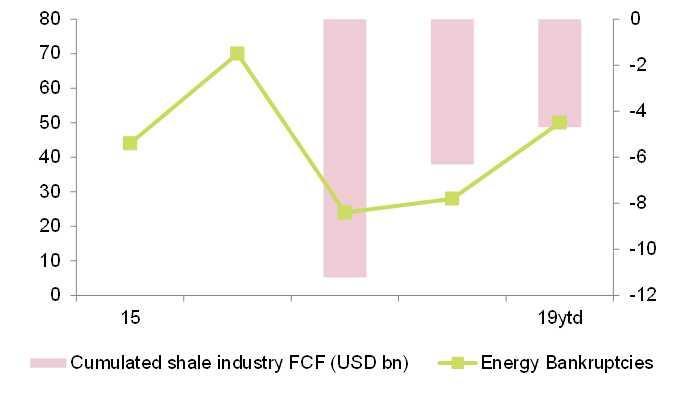

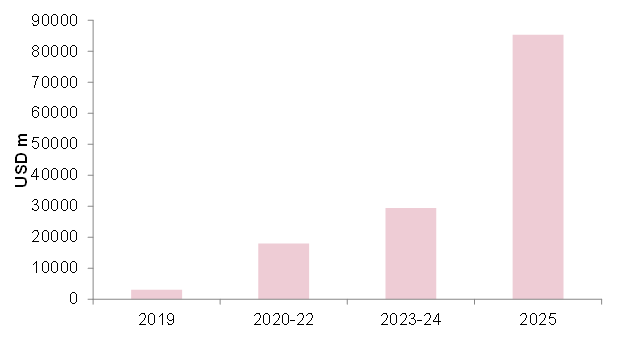

The bankruptcy of U.S. oil services provider McDermott, which filed for Chapter 11 this week, is a perfect reminder of the current challenges of the U.S. energy sector. Tight finances and weak growth are pushing up insolvencies since 2019.

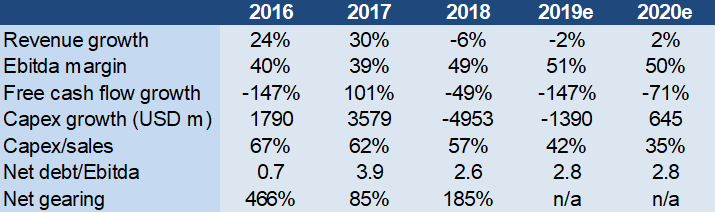

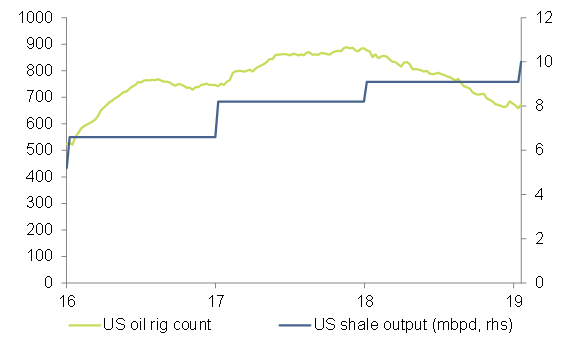

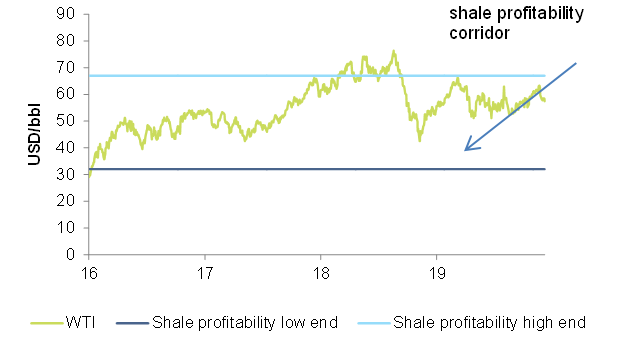

Tight finances and weak growth. The U.S. energy sector, particularly shale oil, is highly leveraged, with an averge gearing close to 200% and net debt to Ebitda ratio of 2.8x for our independent/shale basket of quoted companies. That, however, masks ratios at the high end reaching 8x net debt/Ebitda and also the fact that most of these companies have gone through recent fundraisings. We gauge that the smaller and privately held end of the sector presents yet weaker financials. The majority of independent energy companies in the U.S. are cash-burning and thus require incremental fundraising. However, declining investor appetite and patience, as well as a less bullish oil price backdrop, have dried up available liquidity for the sector. Lack of funding deprives companies of growth from new wells, but not only that: Little upside from oil prices means no growth from existing assets and erosion of liquidity. Completing the vicious circle, this not a pattern prone to attracting fresh funds.