- The most pressing threat ahead of Europe’s car industry isn’t Brexit or potential U.S. tariffs. It’s the EU’s own regulations for limiting carbon dioxide (CO2) emissions: On April 15th 2019, the bloc finalized its regulatory framework, adding two ambitious targets to reduce CO2 emissions, due to be met by 2025 and 2030, on top of the existing target of -20% in just two years.

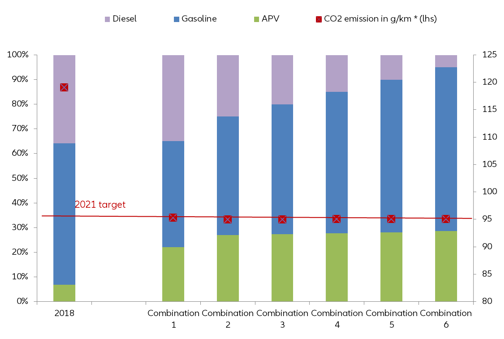

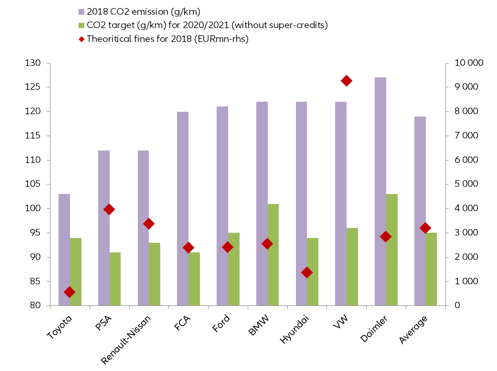

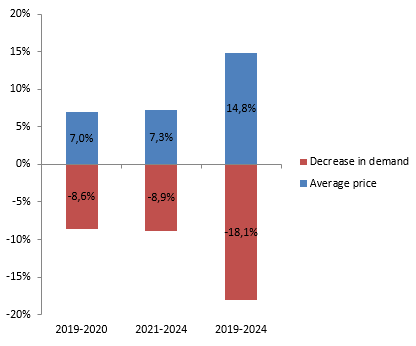

- The emissions targets could potentially cause an adverse scenario for the car industry by creating a three-pronged challenge: First, an industrial challenge since such targets will require a drastic adjustment in the powertrain mix in favor of alternatively powered vehicles (APVs), notably electric vehicles (EVs). Second, a financial challenge: Based on 2018 figures, the total amount of the fines would reach EUR30bn, equivalent to half of the combined net profits registered by car manufacturers. As for production costs, they could increase by as much as +7% by the end of 2020 and by +15% by 2025. Last, a commercial challenge: A full pass-through of the extra costs of production to customers would lead to a decline of -9% in car sales by the end of 2020, and -18% by 2025. This would cost -0.1 pp of both French and German GDP growth in both 2019 and 2020, and put 160K jobs at risk. In addition, growing competition by EV manufacturers would add downside pressure on turnovers and margins.

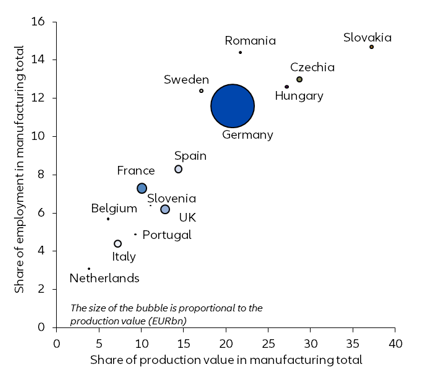

- Car makers will do their best to avoid this perfect storm by using accrued financial buffers and reducing costs, tapping into “super credits”, entering partnership agreements called “pools” and consolidating further. This partial adaptation strategy will only enable them to fulfill 30% of their obligations. As a result, by the end of 2020, we expect a +2.6% increase in average car prices; a -3.1% decline in new car registrations; a loss of EUR2.9bn in car sales; 60K jobs to be at risk and an almost certainty that car makers will fail to comply with the CO2 targets. Given the size of the European auto industry, which accounts for 13% of manufacturing production and 13.3mn direct and indirect jobs, consumers and policymakers will have to chip in.

CO2 emissions regulation is high on the agenda of carmakers in Europe

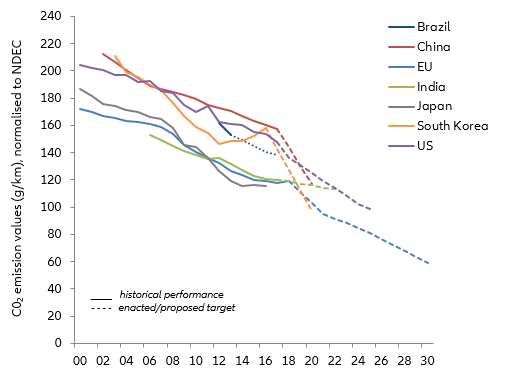

On April 15th 2019, after several rounds of meetings, representatives of the European Commission, the European Council and the European Parliament agreed on reducing the average CO2 emissions from new passenger cars by -15% in 2025, and by -37.5% in 2030, to achieve the international objectives set out in the COP21/Paris Agreement. Tougher than the original proposals (-30% by 2030), these new targets are the most ambitious in the world (see Figure 1) and more than what carmakers expected. They also come on top of a -20% target set for 2021.

These emissions regulations could cause an adverse situation for Europe’s car industry by posing a three-pronged challenge.

Figure 1: Passenger car CO2 emissions - International comparison