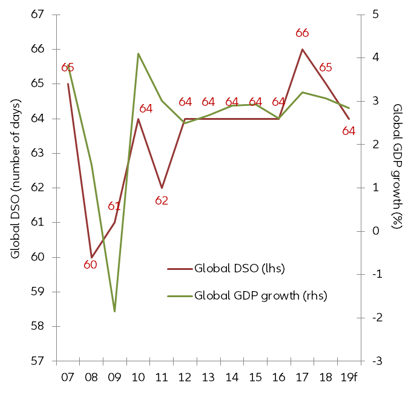

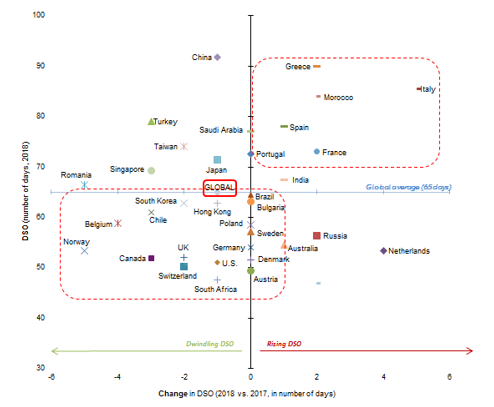

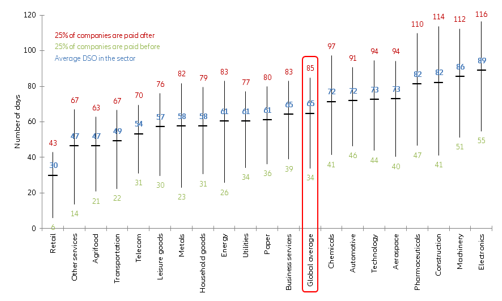

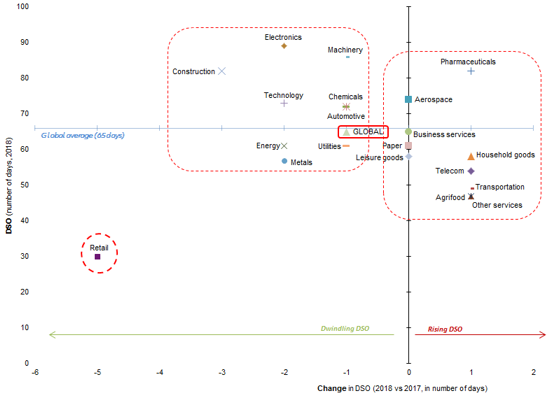

- After hitting a 10-year high in 2017, global average Days Sales Outstanding (DSO), a measure of how long it takes companies to collect cash from customers, fell by -1 day to 65 days in 2018, a sign of caution in line with the economic slowdown. As world GDP growth slows further this year, we expect DSO to reach 64 days in 2019.

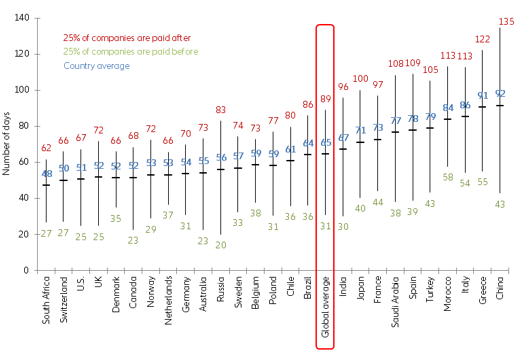

- In China, one in four companies is paid after four months. While Chinese companies managed to reduce their DSO by -1 day in 2018, they still recorded the longest average payment term at 92 days, mirroring their important role as “invisible banks” at a domestic level and for the rest of Asia as well. Mediterranean countries are back to their bad habit of paying late: Italy, France, Greece and Spain saw their average DSO lengthen by +5 days, +2 days, +2 days and +1 day, respectively, in 2018.

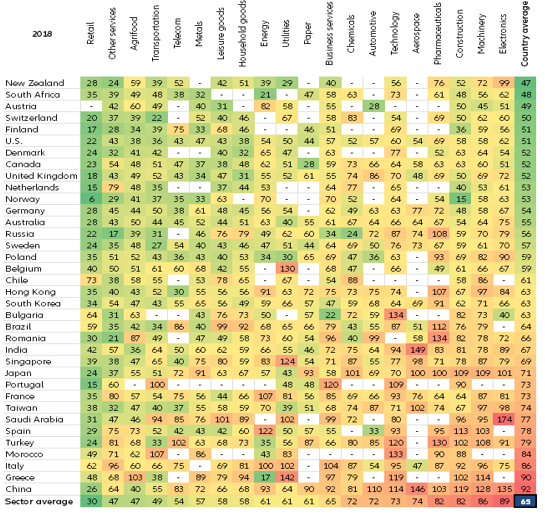

- Companies in sectors closer to consumers experienced longer payment terms in 2018: household goods (+1 day), agrifood (+1 day), transportation (+1 day), pharmaceuticals (+1 day) and telecom (+1 day). On the contrary, in industrial sectors where DSO is already high, such as construction (- 3 days), electronics (-2 days), technology (-2 days), machinery (-1 day), energy (-2 days) and chemicals (-1 day), companies’ fears of not being paid on time by clients pushed them to reduce payment terms.

Summary Heatmap