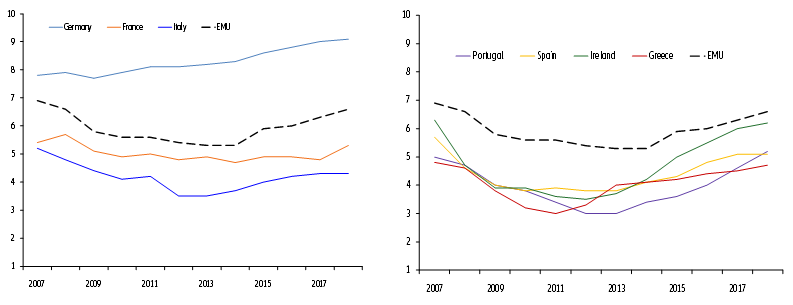

Sources: Thomson Reuters Datastream, Eurostat, Allianz Research

Six countries in focus: Germany, France, Italy, Spain, the Netherlands and Greece

Germany: Once again in pole position, but reform complacency is a concern

Despite a slight decline in the overall score from 8.1 points in 2017 to 8.0, Germany for the fifth consecutive year successfully defended its top ranking in the Euro Monitor ranking.

However, if Germany does not step up its reform game, the Euro Monitor pole position will soon be occupied by another Eurozone country. Reform momentum in Germany – as measured by the progress indicator – declined to 6.9 points (2017: 7.2) – the lowest rating since 2013. As a result, Germany now occupies the lower mid-field position (rank 13) within the Eurozone – down from 2nd place as recently as 2014. This is Germany’s lowest ranking position in the progress indicator since the inception of the Euro. The apparent reform complacency could clearly put Germany’s economic prosperity at risk. By comparison, at 9.1 points, Germany still fares exceptionally well in the level indicator, thanks to the country's low debt ratios, strong labor market and an overall favorable international competitive position.

Weak labor productivity has been the Achilles heel of the German economy for some years now. Once again, it increased by less than 0.5% in 2017, despite the very robust economic conditions. Worryingly, with a rating of 4 points, this indicator now registers in the critical territory.

France: Bottom place and dim prospects for improvement

France has been treading water for some time now. With an overall score of 5.5, the country has now taken the Euro Monitor’s bottom spot for the third consecutive year – even if in 2018 the honor is not exclusive but rather shared with Italy. A consistently weak progress indicator compared to other Eurozone countries – since 2014 France has ranked among the bottom three in the progress indicator sub-rating – highlights that the country has failed to keep up with its peers. Prospects for a near-term boost to Macron’s reform agenda are however rather dim in light of the persistent momentum around the “Yellow West’” movement.

There are two indicators for which France receives the lowest possible score of 1, namely its share in global exports and the level of corporate debt. The latter towers at more than 140% of GDP and while the upward trend moderated slightly in 2018 it remains unbroken. On the positive side, however, unit labor costs continue to develop quite favorably, with the annual change registering below the one observed in Germany for the seventh consecutive year now.

Compared to 2017, France’s performance in the category ‘Employment & productivity’ deteriorated the most. With an overall score of 5.4 points, France now has the worst rating in this area after Greece and Italy. Worryingly, the positive labor market trend lost momentum in 2018, despite unemployment at 9% still registering above the pre-crisis level. Productivity growth also declined in 2018 but still slightly exceeded the Eurozone average of 0.7%.

Italy: Stagnation in 2018 does not yet reflect recent reform backtracking

Italy together with France occupies the bottom spot in the 2018 Euro Monitor ranking with a rating of 5.5 points – unchanged from the previous year. While Italy’s level indicator has remained stuck at 4.3 points, the lowest rating among Eurozone countries and just above the critical mark, the progress indicator has in fact hinted at a timid positive trend in 2018. However, the populist government’s reversal of structural reforms and increase in non-productive public consumption towards the turn of 2018/19 is likely to trigger a clear deterioration in Italy’s 2019 Euro Monitor rating.

Apart from the category private & foreign debt, where Italy is at an advantage due to moderate and declining household and corporate debt, as well as a robust current account surplus, the country’s Euro Monitor scores are well below the European average in all other categories. Its major weak spots are government debt (131% relative to GDP, the second highest in the Eurozone) and the still precarious labor market situation. In this context, encouragement can be taken from the progress made in reducing the budget deficit to below 2% of economic output and the sustained growth in employment of around 1% annually since 2016. However, the dim economic outlook for Italy, together with the government’s fiscal policy, suggests no further improvements should be expected on this front.

In 2018, Italy saw a strong deterioration in the category competitiveness due to an unfavorable development in the unit labor cost trend, as well as a weak performance of Italian exports in relation to global trade dynamics. This is a major concern with the export nation’s economic wealth heavily dependent on its external competitiveness.

Spain: Too early to loosen the reform reigns

A decline of 0.2 points in its Euro Monitor rating – one of the largest observed among all Eurozone countries in 2018 – saw Spain slide down five places to rank 17. This is the first setback for Spain after nine consecutive years of progress in reducing its macroeconomic imbalances, a painstaking process driven by ambitious structural reforms and, more recently, buoyant economic growth. The loss of reform momentum, which is most pronounced in the Euro Monitor category competitiveness, is clearly premature: Spain’s ongoing poor position in the level indicator ranking (15) highlights that the clean-up process is not complete yet.

The Spanish labor market is clearly on the rebound. Although the ratings for the unemployment (15.3%) and employment rate (62.2%) are still in critical territory, significant progress has been made over the past few years with regard to these two indicators, which has been rewarded with top grades in 2018 for the fourth consecutive year.

Relative to the country's strong economic recovery, the consolidation of Spain’s public finances is making only sluggish headway. Although Spain’s real GDP has risen by more than 2.5% each year since 2015, government debt has fallen little more than three percentage points in total over the same period. At 97% of GDP, this remains notably above its pre-crisis low (36% in 2007). The Spanish budget deficit finally complying with the Maastricht deficit criterion (2.7% of GDP) in 2018 - after being in violation for ten consecutive years - provides evidence that fiscal consolidation is at least moving in the right direction, albeit slowly.

The Netherlands: A worthy contender for the top spot

The Netherlands successfully defended its silver medal but with an overall rating of 7.9 points in 2018 is sharing the honor with Slovenia. A good score in the level indicator (7.6 points), coupled with a strong faring in the progress indicator (8.3 points), makes the Netherlands a worthy contender for the Euro Monitor’s top spot going forward.

The country does particularly well in the categories fiscal sustainability and ‘Employment & productivity’. Its Achilles heel nevertheless remains the high level of household and corporate debt. Encouragingly, though, debt levels in both sectors have embarked on a pronounced downward trend since 2014, helped by the strong economic upswing.

In 2018, the Netherlands saw a marked decline in the ratings of several indicators related to its competitive position. A less favorable trend in unit labor costs, a weakening export performance in relation to global trade dynamics and slowing productivity growth bode ill for the country’s growth prospects, given its export-dependence.

Greece: Recovery process shifts up a gear

Thanks to a 0.5 point improvement in its overall assessment to 6.8 points, Greece moves up four places in the Eurozone ranking to number 12, leaving core countries, including Belgium and Finland, behind it.

The imbalances are, however, still too great and the progress is still too little in comparison. Although the progress indicator sub-ranking shows Greece in second place with 8.8 points, the level indicator at 4.7 points is only enough to get the country the 18th spot. The acceleration in the economic recovery (we expect annual economic growth of above 2% for 2018-20) is likely to help reduce the macroeconomic imbalances going forward. In particular, the already very positive labor market trend (employment growth came in at around 2% in 2018) is likely to continue. Nevertheless, Greece will have to stay on a reform course for some years to come to ensure a full recovery of its economy.

The very favorable development of unit labor costs shows that the reforms are bearing fruit. Relative to their level in 2010, these costs have fallen by more than 11%. Greek exports are clear beneficiaries: Greece is one of only three Eurozone countries – together with Portugal and Slovenia – where exports have grown faster than global trade for five consecutive years. As a result, Greece has seen its share in world trade rise in 2018.