Sources: Euler Hermes, Allianz Research

Policy

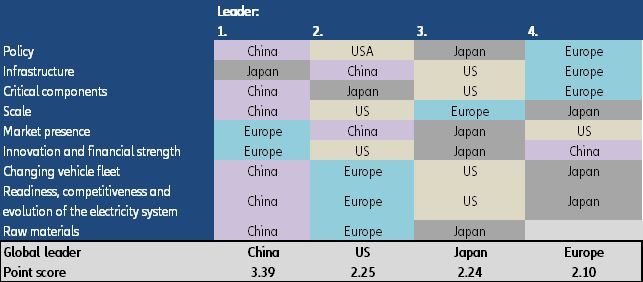

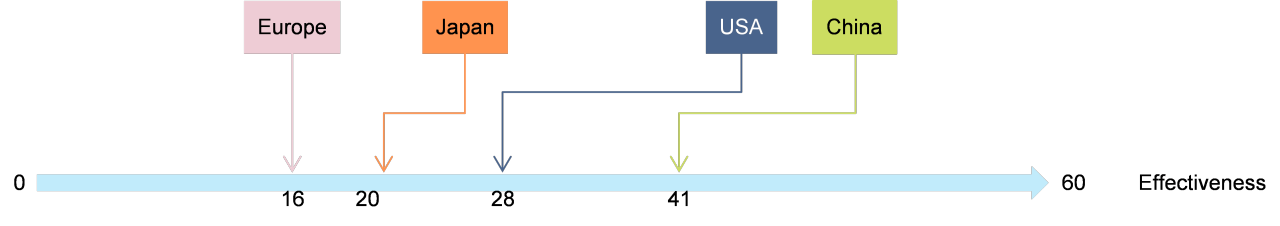

We attribute a point rating range to each type of policy for its effectiveness by nature. We then attribute a particular rating within that range for each policy by country. The highest overall point score defines the leader. Chinese policy clearly stands out as the most powerful due to the combination of financial support, imposed mandatory norms and end-consumer action. Industrial, fiscal and trade policy tie in with public procurement and local initiatives. While a planned significant reduction of subsidies for EVs will bring consolidation to the industry, we believe the country has succeeded in building a handful of strong leaders around whom the sector will evolve. In the US, mandatory quotas in a number of large states are an effective policy step, which, alongside purchase/tax incentives, are working better than Europe’s policy focus on strong disincentives for conventional cars.

Infrastructure

We give the highest point score to the region with the best infrastructure coverage, i.e. charging stations per EV. The region with the highest point score is considered the leader. While Japan shows the highest EV charging-point penetration per EV (6 EV/station), we still consider China to be the leader because of the sheer size of its credible expansion plan to 500k charging stations by 2020. Though EV infrastructure is heavily concentrated in the provinces around Shanghai, Beijing and the industrial hotspots of the country, i.e. the South East, this still means that the areas where 95% of the Chinese population lives are characterized by dense coverage. Conversely, 76% of European infrastructure is situated in the Central/Northern hemisphere, on a continent where large distance north-south driving is common.

Critical components

The battery is one of the most expensive and critical components of EVs. But because of low IP content and barriers to entry, economies of scale are crucial for competitiveness. The region where the greatest number of GW of manufacturing capacity are installed and announced gets the highest point score and is the leader. In this context, China’s subsidies for EV manufacturers, conditional on the use of approved battery manufacturers, have led to the rapid expansion of the latter in the country. This despite competition from Korean and Japanese manufacturers. While European politicians have picked up on this, announcing billions of euros in government funding that could double capacity to 6GWh in the region, it will still only account for a fraction of installed and announced capacity in China (over 50GWh).

Scale

Scale is measured by market share. The region with the highest cumulative market share of its leading manufacturers in EVs gets the highest point score and is the leader. At this point, China is strongly in the lead with a global market share of 17%, followed by the US, whose market is dominated by Tesla. For European manufacturers to build volume leadership, they need a competitive edge and growth in their own market, as well as significant market share in the US, or meaningful access to the Chinese market.

Market presence

While new models of EVs will have varying degrees of success, we believe manufacturers with a busy launch calendar stand greater chances of success. We attribute the highest point score to the region with the greatest number of upcoming launches. We have estimated launch schedules based on announced strategies, calendars and our view on the transition to electrification by manufacturers. For this indicator, Europe is the leader with 130 out of a total of 350 global upcoming EV launches, according to our expectations. But there is a high degree of concentration amongst manufacturers. Furthermore, we interpret the number of launches as a catch-up effort in light of late starts when compared to Chinese manufacturers, which partly explains why the Chinese launch schedule is lighter. The number of brands in a region also makes a difference. Japan leads ahead of the US in our model largely due to a greater number of brands and greater number of models that we assume will transition to electrification.

Innovation and financial strength

An important differentiator will be companies’ ability to dedicate capex budgets and R&D spend to electrification. Financial ratios are translated into a point rating by the greatest cash flow swing, largest absolute amounts of capex and lowest leverage as components. The Chinese companies within our EV basket are expected to see an aggregate USD 5bn cash flow swing from 2018 to 2020 when compared to 2015-17 (source: Bloomberg consensus). While there is a greater absolute swing in Europe, this results from the large Dieselgate payments. Also, cash flows in Europe are much more diversified than the Chinese ones, which are very concentrated around EVs. Considering absolute numbers, there is more cash available in Europe, the US and Japan (USD 42bn, USD 37bn and USD 18bn of cash flows over 2018-20, respectively) than in China. One could argue that those amounts could be channelled towards EVs and therefore Europe should be considered the leader. We think, though, that the “traditional” car manufacturers do not have that choice as they need to maintain their presence and spend in the conventional markets. Those markets still account for the lion’s share of their business. Chinese companies have another advantage: access to finance. The Chinese names exhibit significantly higher rates of gearing, evidenced by net debt to Ebitda 2018e of 3.7x vs 1.1x for our peer group universe, and we are of the view that supportive banks are an important contributor to that. This view is further supported by a capex to sales ratio in China exceeding that of the global average by 150bps in 2018.

Changing vehicle fleet

EV penetration is indicative of market acceptance, yet that very acceptance can change very quickly depending on policy, availability of attractive models and cost. The highest level of EV penetration as percentage of new sales determines the highest point rank for the leader. China is in the lead for this indicator as well, with the highest degree of penetration in a very large market - 4.2% of new car sales as compared to 2.5% in Europe.

Readiness, competitiveness and evolution of the electricity system

Here we consider cost of energy, carbon, and the ability of the system to absorb EVs. We judge on a combination of EV demand as the lowest percentage of total electricity demand, lowest cost of growth in de-rated capacity, lowest degree of likely peak strain and lowest average retail electricity price for the combined highest point ranking. Chinese de-rated power generation capacity growth to 2030 amounts to ten times that of Europe so the country is, in our view, in a better position to absorb incremental EV demand. But beyond pure volume, there are other issues:

- System strain from peak reinforcement, particularly the evening peak when motorists charge EVs after returning home. Particularly Europe may require investment for peak capacity build. We estimate that Chinese EV demand will account for 1.1% of total power demand in 2030, compared to about 3-5% in Europe, thus Europe is likely to see a more important peak squeeze, investment requirement and incentive for charging to move away from peaks. Our calculations indicate European peak demand could increase by 18-41% as a result of EVs.

- Strain on local distribution systems that are not designed to cope with concentrated demand from EVs

- Cost of energy. Initially, the cost of electricity may be subsidized by either car manufacturers, infrastructure owners or the taxpayer. We assume there is readiness to accept such costs as part of market penetration, respectively development, strategies. But ultimately, either manufacturers or the public hand or the consumer will make cost of energy on a relative basis part of the consideration. We see China’s lead as remaining if not consolidating. Currently the average retail price of electricity in Europe is almost four times as high as that in China, at Eur 226c/kWh. The energy mix will evolve globally, but we estimate that Chinese new build across all sources has an advantage in terms of levelised cost of energy (LCOE) in the order of Eur 37-50/MWh vs Europe.

Raw materials

The access to and cost of metals required for batteries, namely lithium and cobalt, are a key factor of success. But none of the major regions have a dominant position in mining. The leading regions with the highest point score are those with the greatest refining tonnage. China leads in terms of processing raw materials, refining 48% of global cobalt, and is Africa’s largest trading partner (57% of cobalt is produced in the Democratic Republic of Congo). We have seen M&A activity by Chinese mining companies worth USD 7bn in 2018 (source: Dealogic) across 14 transactions with high-risk characteristics in critical metals. A great risk appetite gives Chinese miners an advantage over Western peers, who have much reluctance to engage in these areas due to risk levels and shareholder pressure related to ethics and governance. Western miners have refrained from major M&A at a point where the commodities cycle may be near its peak.

Figure2: Euler Hermes point rating of regional EV-related policies