Shortages of semiconductors have highlighted Europe’s vulnerability to components imported from Asia. While limited supply is nothing new in an industry characterized by boom-and-bust cycles, tensions have now garnered more attention because they have been particularly acute in the automotive and industrial sectors where Europe still holds significant market shares. Reflecting current worries, semiconductors were identified as a strategic area by the European Commission in a working document published in May 2021 identifying strategic dependencies and capacities, an update to its 2020 New Industrial Strategy. European industrial policy is set to target up to 20% of the European Recovery and Resilience plans to digital transition, or about EUR145bn, for the next three years, a fraction of which will be allocated to support Europe’s semiconductor industry. Among its most ambitious objectives, the European Commission wants to bring Europe’s share of semiconductor production to 20% of global output and host more advanced manufacturing capacities, with fabrication plants capable of producing 5nm or below chips by 2030. But our diagnosis of Europe’s current capacities and capabilities in semiconductors suggest those targets are neither needed nor a cure for the current woes facing the European industrial sector.

The European industry is less chip intensive now than it was in 2005

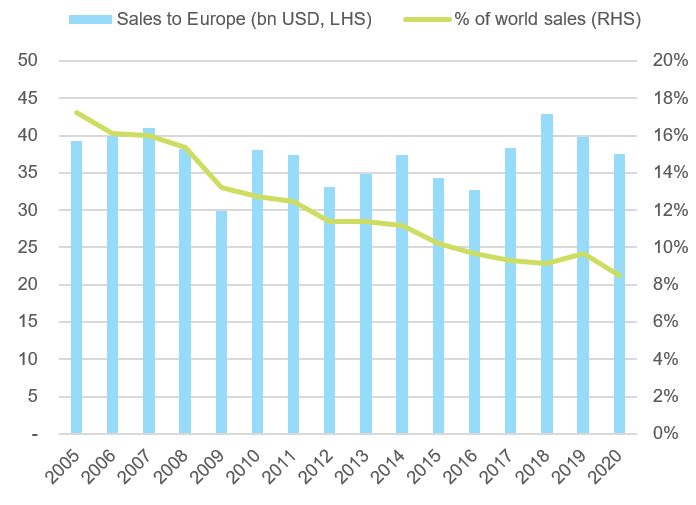

Europe’s semiconductor bill has remained broadly unchanged over the past 15 years, oscillating around USD35bn on average, while global demand for chips over the same period doubled and industrial production grew by about 10%. In other words, the European manufacturing industry is comparatively less chip-intensive now than it was in 2005, and Europe’s share in total semiconductor sales fell from 17% to 8.5%. At the time, Europe was still a heavyweight in advanced electronic product design and manufacturing, with local champions including Sagem, Alcatel, Siemens, Philips, Nokia and Ericsson. Major foreign firms including Motorola, HP, Dell, Acer, Mitsubishi Electric, Sony, Toshiba, Fujitsu, NEC and Panasonic also contributed to make Europe a major designer and manufacturer of computers, servers, mobile phones, TV sets and audio equipment. Since then, a mix of growing Asian competition (South Korea, China) and shifts in business models (the outsourcing of manufacturing operations to contract manufacturers) have decimated the European consumer electronics ecosystem. Europe is now virtually absent from industries absorbing the vast majority of semiconductor sales, with only sales going to the automotive and wider industrial sectors growing steadily. In times when their manufacturing capacities are running at full speed, semiconductor foundries have a natural incentive to prioritize their largest and most profitable customers at the expense of their secondary and less-profitable customers. Because chips used in cars and industrial machinery rely mostly on well-established manufacturing technologies, they are comparatively less profitable to make than the computing, memory or telecom chips used in the average smartphone.

Figure 1: Semiconductor sales to Europe

Europe has a modest chip-making industry because it has modest needs

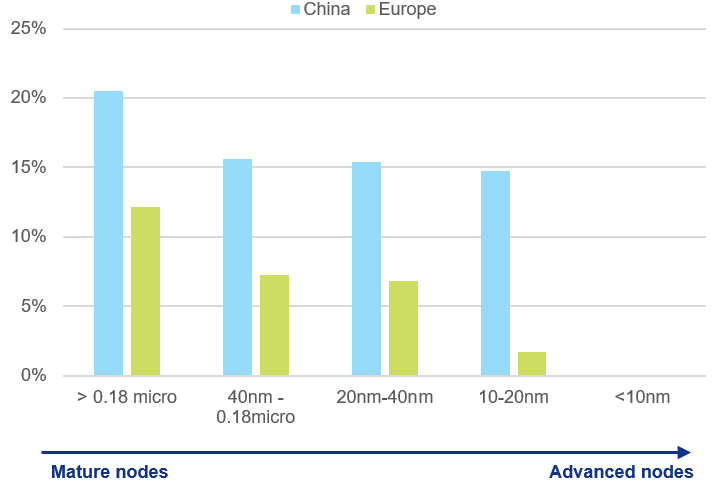

This is not to say that Europe is absent from semiconductor manufacturing: The region hosts about 6% of world capacities across all manufacturing technologies. In particular, the region is home to Infineon, NXP and ST Micro, three leading designers and manufacturers of automotive and industrial chips. Because the local production mix fits the local demand mix, Europe has virtually no manufacturing capacities for the chips with <22nm nodes first introduced ten years ago. Compared with China, which is also striving to increase its presence in the semiconductor industry , Europe’s position looks very modest but broadly aligned to its needs (Figure 2).

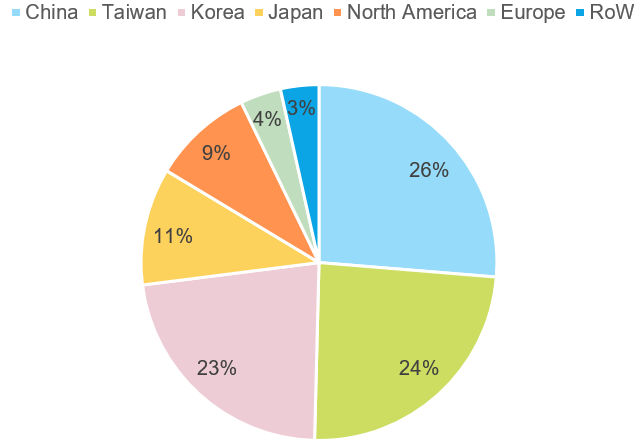

Data on semiconductor manufacturing equipment sales point to further erosion of Europe’s share in global manufacturing capacities in the coming years. While China ranked first and captured more than of a quarter of all equipment sales in 2020, Europe’s share stood below 4% (Figure 3).

Figure 2: Europe’s and China’s shares of manufacturing capacities

Figure 3: Semiconductor manufacturing equipment sales by region (2020)

The assigned targets appear far out of reach…

While ambitious targets are necessary to achieve anything substantial, we believe the very structure of the European industry means that they will be met with failure in their two most prominent dimensions:

- For Europe to jump from 6% to 20% of global chip output, whether in value or in volume, it would need to invest far more than the overall industry. However, the equipment sales mentioned above show that Europe’s position will further erode for the foreseeable future. We find further confirmation of a growing investment gap between Asia and the rest of the world when looking at the reported and announced capital expenditure of major chip manufacturers, which are vastly superior among Chinese, Taiwanese and South Korean players compared to their European peers. If anything, given the industry’s long development cycles, Europe’s share in global output looks set to further shrink by 2025, making a 20% target by 2030 yet more unrealistic even if local capacities were to boom dramatically in the second half of the decade.

- Looking beyond the 2030 time frame, for Europe to control 20% of global chip output, it would need to have corresponding needs. The vast majority of chips manufactured in the world serve regional needs because proximity matters in the industry, between chip-makers and chip designers and/or chip-makers and client industries. Europe’s need for chips mostly comes from the automotive and industrial sectors, which together account for less about 20% of global chip sales. Europe is virtually absent from the industries generating the remaining 80% of global chip sales (the wider electronics market – smartphones, computers, servers, audio and video equipment, etc.).

- The absence of local demand also makes the objective of having local state-of-the-art chip-making capacities in Europe questionable. No European manufacturer has the needs nor the financial clout nor the required technology to build a large-scale foundry capable of producing 5nm chips. Such a foundry would necessarily be owned by Intel (US), Samsung Electronics (South Korea) or TSMC (Taiwan) and require significant financial support to lure investment that would otherwise be made in North America or Asia. Intel’s new CEO has put the price tag for the construction of a new foundry in Europe at EUR8bn in subsidies at least.

… while current shortages show there are more pressing matters

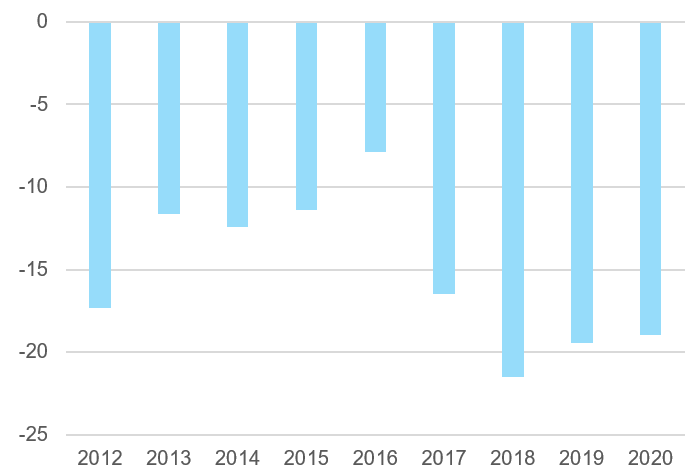

Industrial policy for semiconductors would more surely yield positive results by focusing on more pressing matters. Accounting for 6% of semiconductor capacities but 8.5% of final sales, Europe has a structural deficit for semiconductors (Figure 4) which, consistent with past observations on local semiconductor needs, is neither significantly widening nor of macroeconomic significance (imports are about 2% of total European imports). It is however this deficit which, when demand exceeds supply in the rest of the world, leaves local industries vulnerable to shortages.

European industrial policy could help bridge this deficit by encouraging manufacturing investment where shortages are the most felt, that is for automotive and industrial chips. While such a target may lack the prestige or grandeur of a multibillion euro foundry producing advanced chips, it would make business sense because local needs exist and will only grow with the digitization of the industrial and automotive sectors in the decade to come. Moreover, Europe is home to dominant players in those segments, which have both the financial means and the technological expertise to supply local demand. Typical measures found in Asia and America to stimulate investment in semiconductor manufacturing include, among others, lower corporate income tax on manufacturing operations, accelerated depreciation and cheap financing schemes. Greater autonomy would not only benefit the domestic semiconductor ecosystem, but also help local industries hedge against future tensions on supply.

Figure 4: Europe's trade balance for semiconductors (bn USD)

The comparative advantages of countries and companies operating in the semiconductor industry were built upon decades of investment in R&D and manufacturing facilities. No country can claim complete control of the semiconductor value chain, and even leading semiconductor companies generally dominate a narrow segment when looking at the entire ecosystem (silicon material, semiconductor manufacturing equipment, chip manufacturing, chip design). Rather than playing catch-up in markets where it stands little chance, Europe could place its bets on the next games to come where competition seems comparatively more open and which the European Commission is right to consider as of a strategic significance. Europe could focus on industries where chip content is on the rise and where it still plays a major role in global competition. This is particularly the case of the automotive, healthcare, and wider industrial machinery sectors. Across applications, artificial intelligence (AI) has only just begun to take off and has the potential to find markets across virtually every industry. The market for AI chips is still nascent and, while already being invested in by well-established semiconductor and technology companies, open to competition. A European industry with a growing content of chips designed in Europe would logically see additional investment in local chip manufacturing.