How can credit insurance help companies obtain better lines of credit?

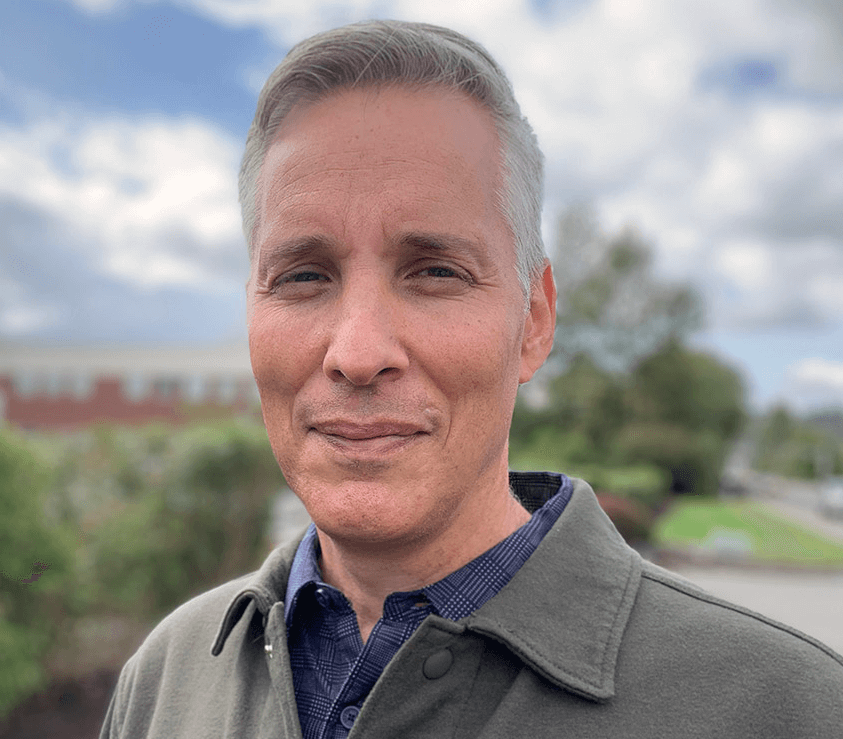

In the video above, trade credit insurance expert Greg McBride, Regional VP, Midwest of Euler Hermes, discusses how companies increase their business line of credit with trade credit insurance. Here's how Greg explains it:

“One of the benefits of our policy is that our policyholders and customers can actually obtain access to more capital by utilizing our product with their lender.

“Basically how it works is when companies get advances on any receivables that are aging, typically what you’ll see here in the United States – with domestic banks in particular – maybe [businesses will] get an 80% advance on that receivable. But then there’s a lot of restrictive language.

“If there’s a foreign receivable, it’s kicked out of the borrowing base. If it’s more than 60, 70 days old, if it’s a concentration issue, banks don’t like that, it’s too much risk.

“Then the banks find out the receivable is insured by credit insurance with Euler Hermes, and it minimizes their risk significantly.

“So now the bank is happy because they can extend more credit to their customer, our customer is extremely happy because now they have additional capital that they can now leverage for their own business, and all the while they’re also getting all the other benefits of a credit insurance policy.

“It’s truly a situation where everybody wins. “