Trade credit insurance built to help small businesses grow

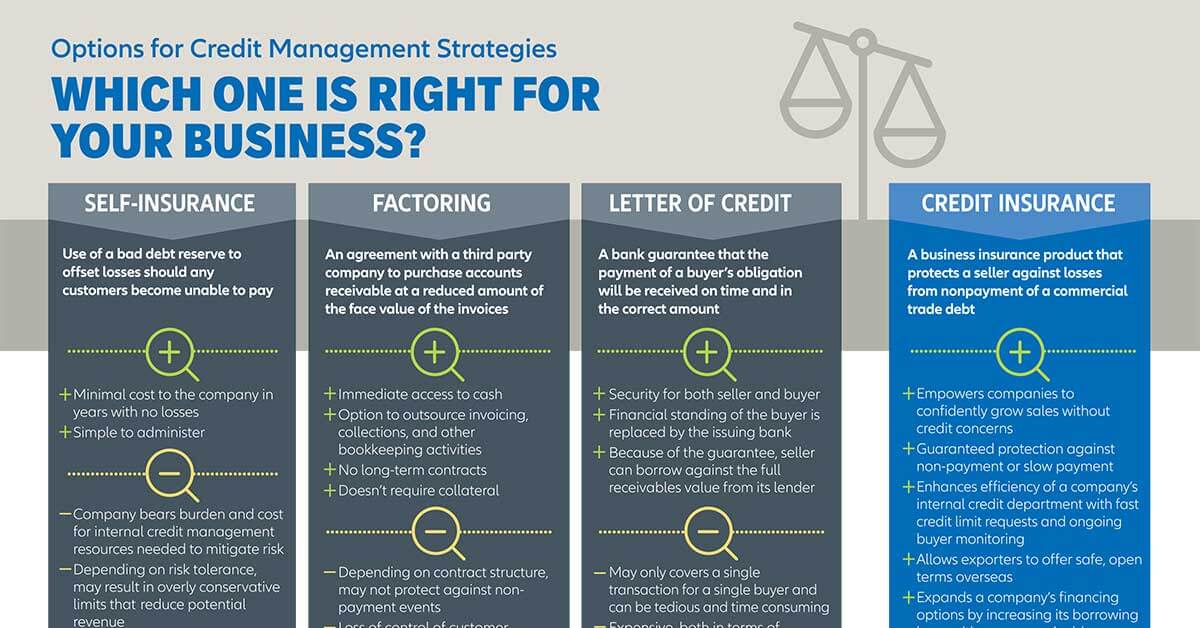

You may think that credit insurance is complex or only suited for large or multinational companies. However, credit insurance can be essential to ensuring a small business’ continued success. It can provide powerful information and support that your business might not have otherwise.