What is a Letter of Credit?

Letters of credit have been around almost as long as commercial trade itself. A letter of credit is a guarantee from the buyer’s bank that states the payment of a buyer’s obligation will be received on time and in the correct amount. Letters of credit take many forms; a standby letter of credit is used for multiple transactions while a commercial letter of credit is used for just one.

Typically, a business will require a letter of credit from a buyer when they're unsure of the risk; specifically, if the buyer is perceived to have a higher risk of non-payment because they are new to the business, and/or if the buyer is foreign.

A commercial letter of credit cost is up to 3% of the total transaction amount, with other letters of credit fees included.

What are the drawbacks of letters of credit?

In today’s digital world, letters of credit can be a cumbersome, expensive, and time-consuming tool for facilitating a transaction. More importantly, letters of credit place a burden on buyers at a time when they want a transaction to go as smoothly and as quickly as possible.

Consider the following issues buyers often face with letters of credit:

- It is up to the buyer, not the seller, to obtain and pay for any letters of credit.

- For commercial letters of credit, buyers must obtain a letter from their banks for every shipment.

- Letters of credit can tie up the buyer’s lines of credit with its bank, reducing their financial flexibility.

- Even the smallest errors or problems with a letter of credit can cause a bank involved to refuse to issue payment once the shipment arrives.

- The claims process can be lengthy and laborious and can be derailed by minor discrepancies in paperwork.

Because of these drawbacks, buyers may resist using letters of credit, especially if they are used to dealing with open account terms that allow payment after they have received a shipment.

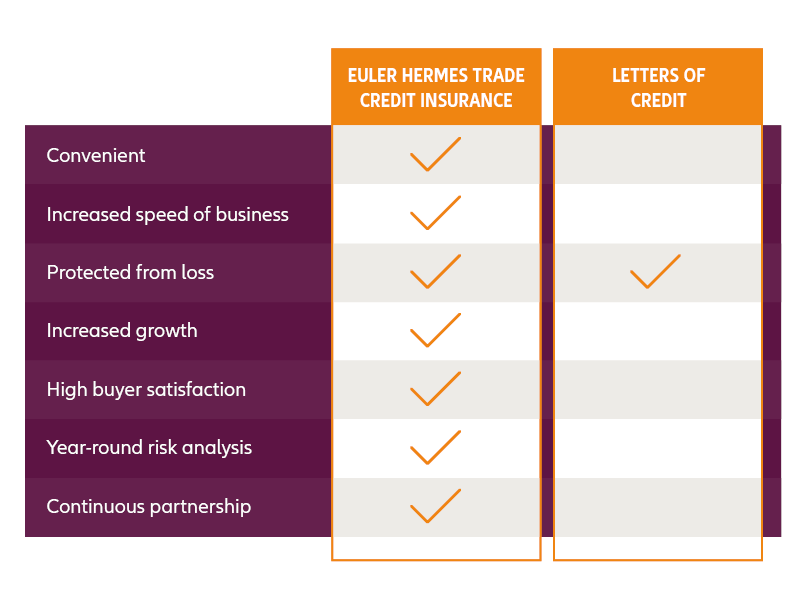

Fortunately, there are alternatives to letters of credit—such as trade credit insurance—that offer a more convenient and inexpensive option to streamline a transaction.