What Is A Bad Debt Reserve?

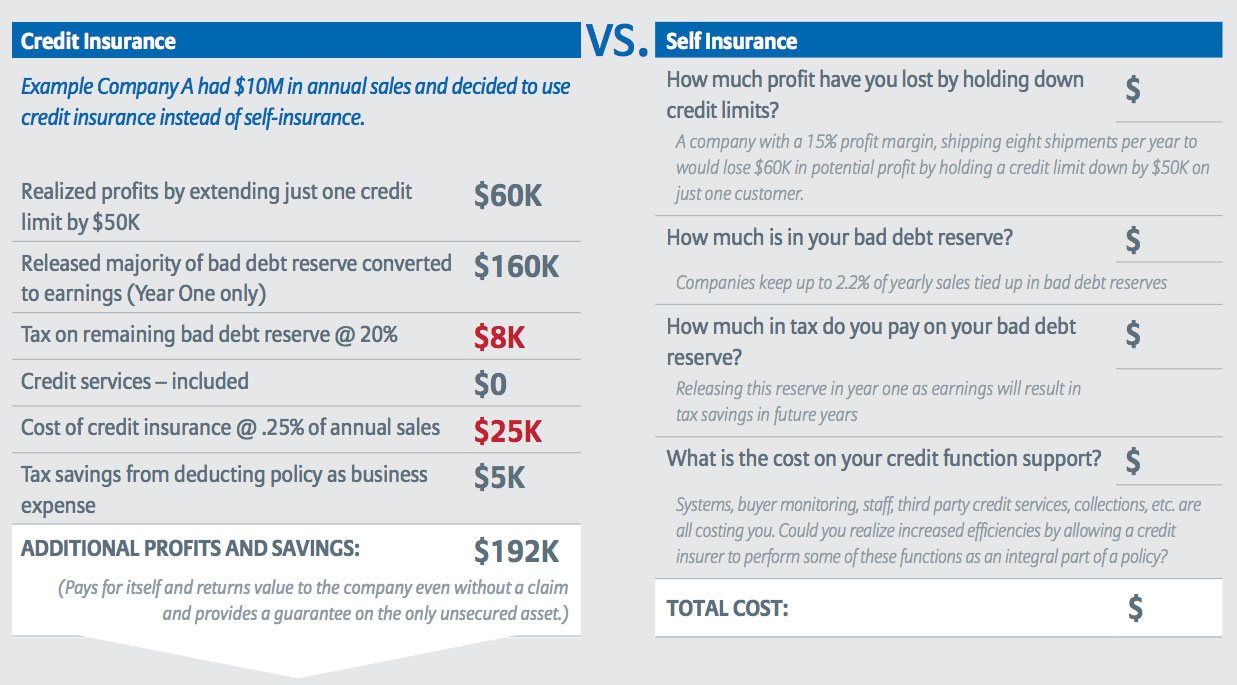

A bad debt reserve, also known as an allowance for doubtful accounts (ADA), is money set aside by a company to cover receivables that might not be paid by their customers over a given time period. It's the total amount of receivables the company never expect to collect.

How Do You Calculate Bad Debt Reserve?

To establish an adequate bad debt reserve, a company must calculate its bad debt percentage. To make that calculation, divide the amount of bad debt by the company’s total accounts receivable for a period of time and then multiply that number by 100.

(Amount of bad debt/ Company’s total accounts receivable) X 100 = Percentage of bad debt

Using the bad debt reserve calculation, if a company has $100 million in their accounts receivable in a given year, and $5 million of that amount cannot be collected from customers, that company’s percentage of bad debt would be five percent. This is known as the direct write-off method and reveals the exact bad debt percentage.

However, many in the financial industry avoid using this bad debt reserve calculation method because of the length of time that can elapse between a sale and the determination that a debt is uncollectible. This lag can throw off a company’s accounts receivable numbers on a balance sheet.

Instead of the bad debt reserve calculation, companies may use the allowance method, which anticipates that some of a company’s existing debt will be uncollectible and accounts for that prediction right away.