EXECUTIVE SUMMARY

- The race to energy sovereignty sparked by Russia’s invasion of Ukraine could push Germany’s green transition well past the finish line. Despite the increased use of coal for electricity generation in the short term, the EU ETS will limit additional emissions, and coal is still on track to be phased out by 2030. In the medium term, Germany’s ambitious new targets should push the renewable energy share of its electricity mix even beyond what would be needed to meet the Paris climate goals by 2035.

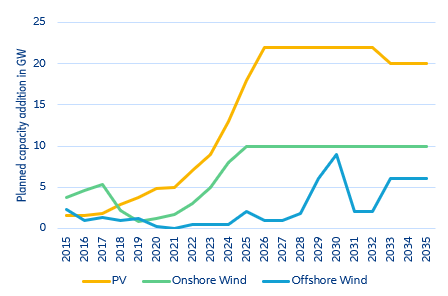

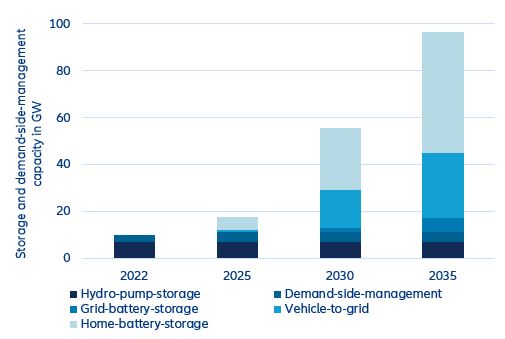

- Achieving the target of a fourfold increase in renewable energy capacity requires a paradigm shift in core areas of the electricity system. Planning and approval procedures for renewable energy, electricity and hydrogen networks must be consistently simplified and accelerated. In addition, the infrastructure expansion for electricity, gas and hydrogen networks is in urgent need of coordination, which is unlikely to happen without an integrated system-development plan.

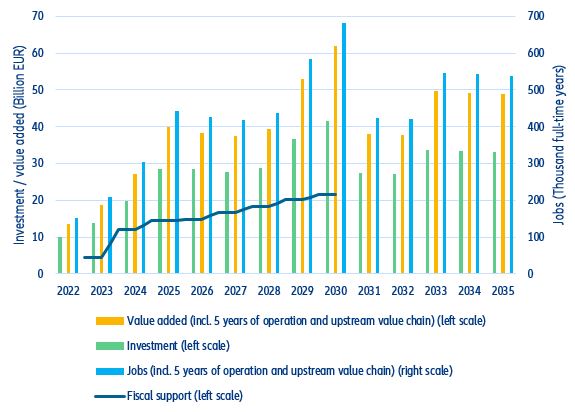

- The renewable expansion will provide a large economic stimulus: EUR40bn of value added per year until 2035 (1.1% in 2021 GDP) and 440,000 jobs in Germany alone.

The race to energy sovereignty sparked by Russia's invasion of Ukraine could push Germany's green transition well past the finish line.

The looming threat of a suspension of gas imports from Russia has put Germany’s energy dependence in the spotlight. The short-term fix has been to rely more on coal for electricity generation, raising concerns about the country’s green transition going off track. However, this is unlikely for three reasons:

- More electricity generation by coal will not increase CO2 emissions in the EU as they are limited by the EU emission trading system (EU ETS). Additional coal usage will however increase CO2 prices in this system, leading to less CO2 emissions in other industries under the EU ETS.

- EU ETS prices will remain above levels that would allow coal to be competitive in the electricity market. Coal requires EU ETS prices below EUR60 while current prices fluctuate between EUR80-90 and are expected to rise further.

- The German government continues to be committed to phasing out coal by 2030, though this commitment is not legislated yet. Given the elevated EU ETS prices, it is very unlikely that coal will overstay its welcome as a substitute for Russian gas; it will be priced out of the market.

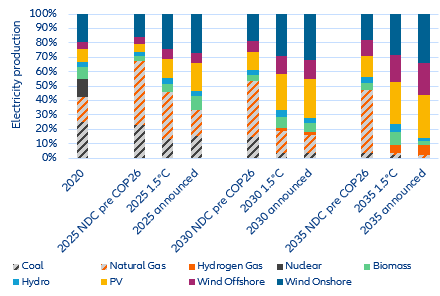

- In the medium term, Germany’s ambitious new targets aim for a more than fourfold increase in renewable capacities, which will accelerate the shift away from Russian gas. In Figure 1, the bars labeled as “announced” display how the electricity mix will evolve if the announced policy goals are achieved. In comparison, the bars labeled “NDC pre COP26” show the expected development of the electricity mix before the more ambitious transition targets that Germany submitted for the COP26 in Glasgow in the form of “Nationally Determined Contributions” (NDCs). Finally, the bars labelled “1.5°C” illustrate the development of the electricity mix for Germany that would be compatible with achieving the Paris climate goal of limiting climate change to 1.5°C. [1] The graph reveals a pleasant surprise: The silver lining of the energy crisis is that in its aftermath the 1.5°C goal might even be surpassed as the planned electricity mix for 2030 is very close (and even slightly more ambitious) compared to the necessary mix for 1.5°C. By 2035, Germany could have a substantially higher share of wind energy as well as hydrogen power plants than what would be necessary in the displayed 1.5°C scenario.

Figure 1: Planned energy-mix vs. 1.5°C requirements and “old” NDC targets