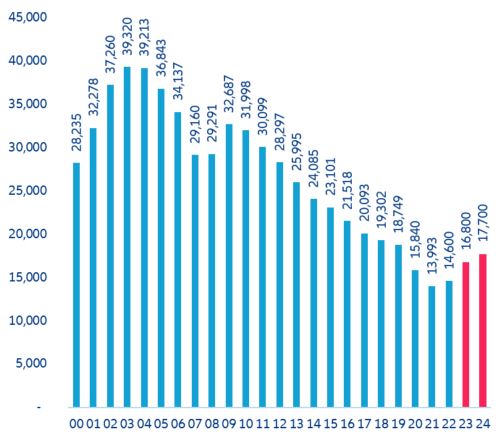

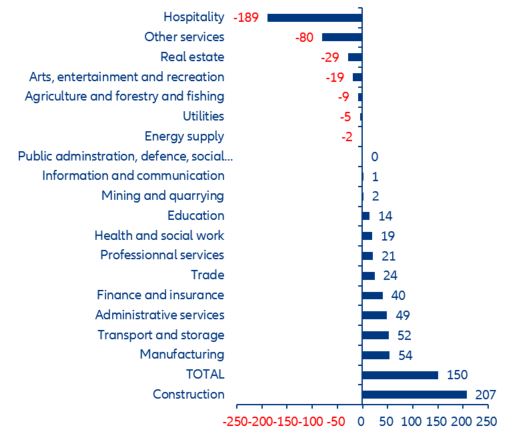

- German stagnation—rising insolvencies? German business insolvencies are rebounding albeit from a low level.

- US real estate—trouble (still) ahead? Some housing market indicators have stabilized, but downside risks continue due to weaker domestic activity. The outlook for commercial real estate remains negative, especially for the office sector.

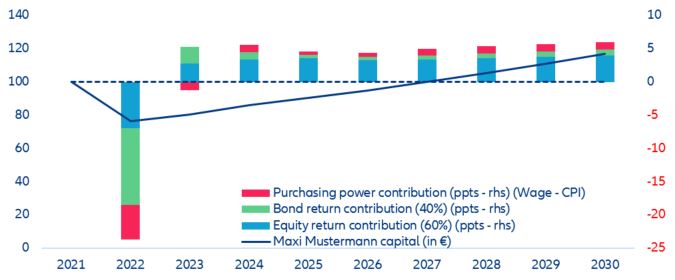

- Making up for inflation—how Jane and Maxi can get their groove back. Investors holding a 60/40 portfolio of equities/bonds lost about ~20% on average last year; it will take them more than three years to fully recover their losses.

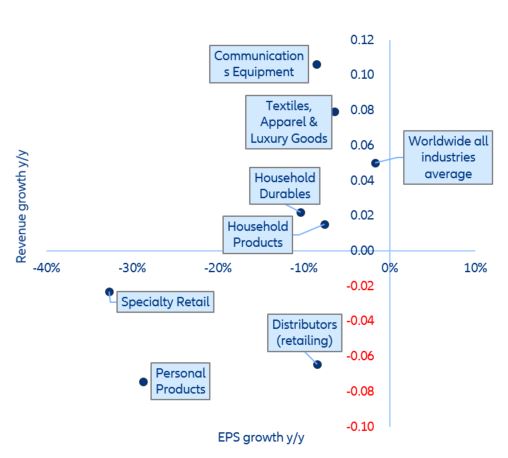

- Corporate performance—will inflation continue muting spending in 2023? Earnings have been weak for discretionary sectors, with EPS growth averaging -1.6% globally, though distributors and specialty retail performed significantly worse.

In focus – monetary policy in Central and Eastern Europe ahead of the curve?

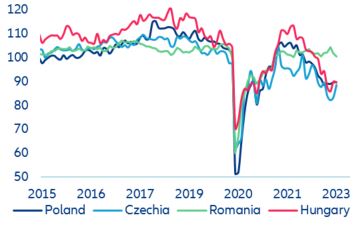

- The outlook for Central and Eastern Europe (CEE) has slightly improved in recent weeks due to diminishing headwinds from lower-than-expected energy prices.

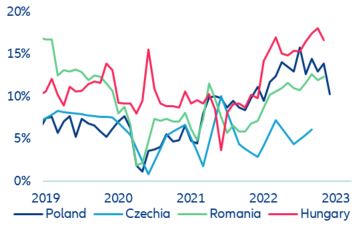

- Nonetheless, growth in the CEE-4 (Poland, Czechia, Romania, Hungary) remains subdued overall as the impact of continued high inflation, increased interest rates, weaker external demand and lower business confidence will take full effect this year.

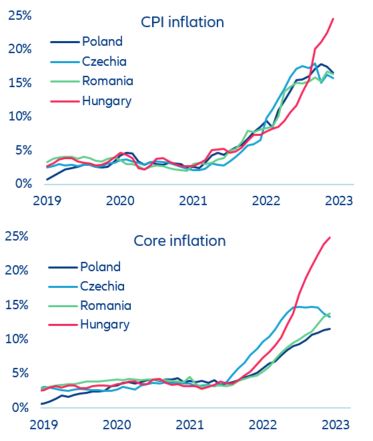

- Inflation has peaked in most CEE economies and the disinflation process may be happening slightly quicker than previously expected. However, inflation will remain above central banks’ targets over the next two years.

- Central banks in the CEE-4 were the first to halt their interest rate hiking cycles and, barring any new shocks, we expect some of them to also be ahead of the curve when it comes to the pivot. We expect Czechia to start easing in June 2023, followed by Poland in Q3 and Romania and Hungary at the end of the year.