As expected The Federal Reserve held interest rates steady at its Wednesday meeting. In a unanimous decision the Federal Open Market Committee (FOMC) voted to maintain the overnight Federal Funds Rate at between 1.5% and 1.75%.

The language of the accompanying statement was virtually identical to the statement from the previous meaning, but there were two significant changes. First, the statement said that “household spending has been rising at a moderate pace” as opposed to “a strong pace” from the previous meeting. The change no doubt reflects the fact that growth in overall personal consumption is indeed slowing; this morning’s GDP report showed consumption grew at an annualized rate of only 1.8% in Q4 after 3.2% in Q3 and 4.6% in Q2. Second, the statement read that inflation is “returning” to the 2% target as opposed to “near” from the previous meeting. Since the Fed’s favored gauge of inflation has actually crept down slightly over the past few months, it appears the Fed is trying to create inflationary expectations so that inflation itself will later turn up towards the elusive 2% target.

Repated language is also worth noting. The statement reiterated the phrase “the current stance of monetary policy is appropriate” suggesting that the Fed is on hold for some time. However the Fed also said “business fixed investment and exports remain weak”. Combined with the softer outlook on the consumer, it appears the Fed may be acknowledging that in fact the economy is decelerating. Indeed, with the manufacturing sector already in recession, the Fed may be more dovish that it appears.

For that reason, we expect a rate cut in 2020, perhaps as early as June. The Fed Funds futures market is also pricing in a cut, but a bit later in the year. In the first half of 2020, the Fed may well encounter waning GDP growth, a slowing labor market, and continued weakness in manufacturing due in part to the trade situation. Note that the “Phase 1” deal leaves the majority of tariffs in place, the USMCA has yet to be ratified by Canada and even then it won’t go into effect for another 90 days, and new trade tensions could easily flare. As a mirror of this challenging environnement for companies, the release of US Q4 GDP growth confirmed a third consecutive negative growth of non residential investment in Q4 (-1.5% at an annualized rate).

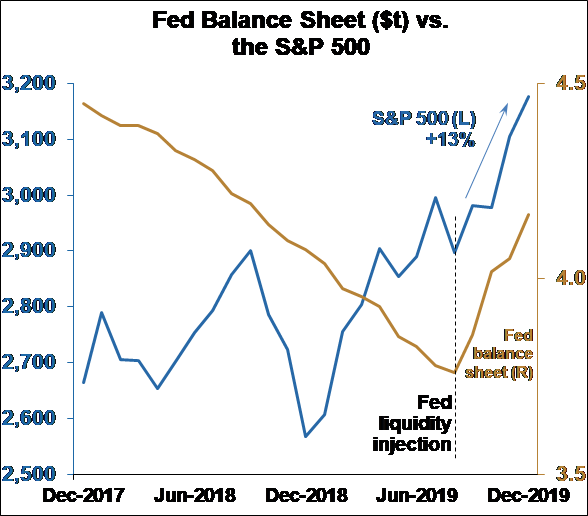

Finally, the Fed is continuing its repo operations and balance sheet expansion into April. Last September, interest rates in the overnight lending market suddenly spiked well above the Fed Funds rate, causing the Fed to inject huge amounts of liquidity into the market at the pace of $60 billion per month. As a result the Fed’s balance sheet has expanded again. The Fed had started shrinking the balance sheet more than four years ago to unwind years of Quantitative Easing (QE), and as of August 2019, it had reduced the balance sheet by $740 billion. However in just the past four months, well over half that amount, $406 billion has been added back. While the liquidity injections are in theory not intended to simulate the economy like QE was, it is having an effect like QE was intended to do, that is propping up equity prices. Since the injections started, the S&P 500 has risen a remarkable 13% in just five months, and while not all of that rise can be attributed to the liquidity, it’s a precarious situation. When the injections stop in April at the same time the economy may be slowing, asset prices may be at risk.