The expected deceleration of Poland’s economic growth in 2019 has been confirmed. Real GDP expanded by +4.0% in the year as a whole, down from +5.1% in 2018 and slightly below the consensus forecast (+4.2%), according to preliminary estimates. Demand-side details are only partly available as yet but indicate that growth in 2019 was mainly driven by domestic uses (+3.6pp), while net exports contributed +0.4pp. Private consumption grew by +3.9%, down from +4.3% in 2018. Thanks to a continued utilization of EU funding for eligible projects, fixed investment rose by a still rapid +7.8% last year, though slightly below the +8.9% posted in 2018. However, inventories subtracted -0.8pp from overall GDP growth in 2019, thus being a major contributor to the annual slowdown.

The full-year data suggest a marked deceleration of growth in the final quarter of 2019, completing a steady downtrend in quarterly growth rates in the course of the year. GDP figures for Q4 are not provided as yet but the data for the year as a whole indicate that year-on-year (y/y) growth decelerated markedly to +2.7% in Q4 from +3.9% in Q3, +4.6% in Q2 and +4.8% in Q1. This conclusion is supported by a similarly steady slowdown in industrial production growth, which fell to a three-year low of +3.0% y/y in Q4. Moreover, the Manufacturing PMI dropped to a quarterly average of 46.8 points in Q4, a more than 10-year low.

For 2020, we forecast a further slowdown of full-year economic growth to +3.2%, but with a gradual recovery from quarter to quarter. Looking at monthly data, the Manufacturing PMI as well as its sub-components new orders and new export orders actually reached their lows in October 2019 and registered a slight recovery towards the end of last year. As a result, we expect real GDP growth to have bottomed out at the turn of the year and forecast a gradual recovery (from the +2.7% y/y posted in Q4) in the course of 2020.

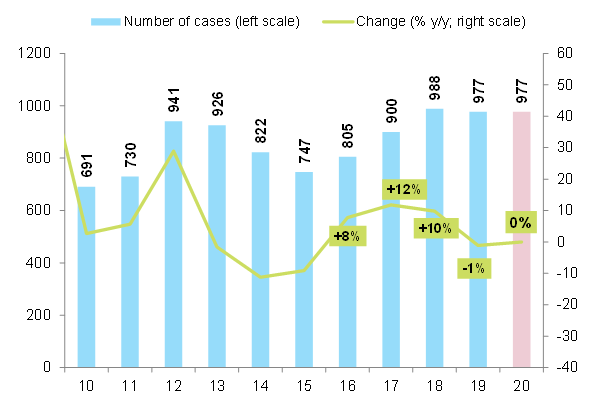

What does this mean for companies? Recently published data show that the number of corporate insolvencies stabilized in 2019 (977 cases, -1% down from 988 cases in 2018), after three years of marked increases. This reflects, at least in part, that the decline in profit margins of non-financial corporates came to an end last year. Combined with our economic growth outlook as descrived above, we thus expect another year of steadiness in the number of insolvencies in 2020.