President Trump has no fear of (protectionist) consequences

Trade negotiations have a strategic aspect with a cooperative or conflictual dimension. Game theory makes it possible to rather precisely formalize different types of options and actors implicated in such interactions.

In 1930, in the beginning of the Great Depression, the United States implemented the Hawley-Smoot tariffs to protect domestic industries from further damages and other countries followed suit and implemented tariffs on their own. The tariffs and the trade war that followed, however, are believed to have harmed every economy and accentuated the impact of the Great Depression.

The 1930s trade war was akin to a classic “Prisoners’ Dilemma” – which well-known outcome is a bad Nash equilibrium even when a good equilibrium is available through cooperation: both countries end up imposing tariffs, leading to a trade war and to further deterioration of global macroeconomic conditions. The GATT in 1947, then the WTO in 1995 were therefore set up to prevent such negative outcome again and ensure cooperation and negotiation between countries instead of unilaterally imposed tariffs.

Similarly with other aspects of the US economic policy, President Trump has upended the way of negotiating with trade partners, expressing no fear of protectionism and harshly criticizing existing trade agreements.

As a result, the US decided to increase tariffs on aluminium, copper, washing machines and a series of Chinese products worth USD 200 bn. In terms of average US tariffs, we are now back in 1980 as it reaches 5.2% compared with 3.5% before President Trump’s elections. This new approach of trade policy therefore implies a better understanding of the President’s strategy to have a better idea on how to negotiate with him.

Enter President Trump, the maxi-max player

President Trump, who is openly sceptical about trade, believes that “trade wars are easy” to win and is keenly aware of the importance of the US as a trade partner for many countries. This accounts for his maximax strategy in a game theory setting i.e. he develops of strategy consisting of maximizing his expected payoff without consideration for the risks that a trade war involves. He knows that smaller countries are more likely to cooperate because their economy is dependent on US imports and more at risk than America’s in a trade war. By comparison with his predecessors, President Trump is willing to bear the adverse consequences of tariffs and a trade feud because he knows that the US economy is big enough to do so. For another country hugely reliant on the US market, say Mexico, consequences are starker.

All in all, his whole reasoning relies on the asymmetrical payoff that characterizes this new game and on the basis that existing trade deals already hurt the US. President Trump thus expects to bring countries with which he deems trade relations “unfair” to the table in order to negotiate deals that would advantage the US – and he does so by using the fear that comes with the US economic power.

This maximax approach can be visible under different aspect of President’s Trump:

- Maximax and fiscal policy: the objective of the US President consists of maximizing growth with a lower weight given to the importance of debt stabilization (implying high risks in terms of debt sustainability)

- Maximax and foreign affairs : There is now a clear link between security and economic issue with an implicit request from the US of economic compensations

- Maximax and environment policy: the US President’s decision to withdraw from the Paris agreement also shows a sense of prioritization in favor of growth with a lower consideration for (climate) risks .

In the end, how to negotiate with President Trump? An example

We attempted to explain President Trump’s negotiating strategy using game theory, in which an accord found between countries would be described as an equilibrium.

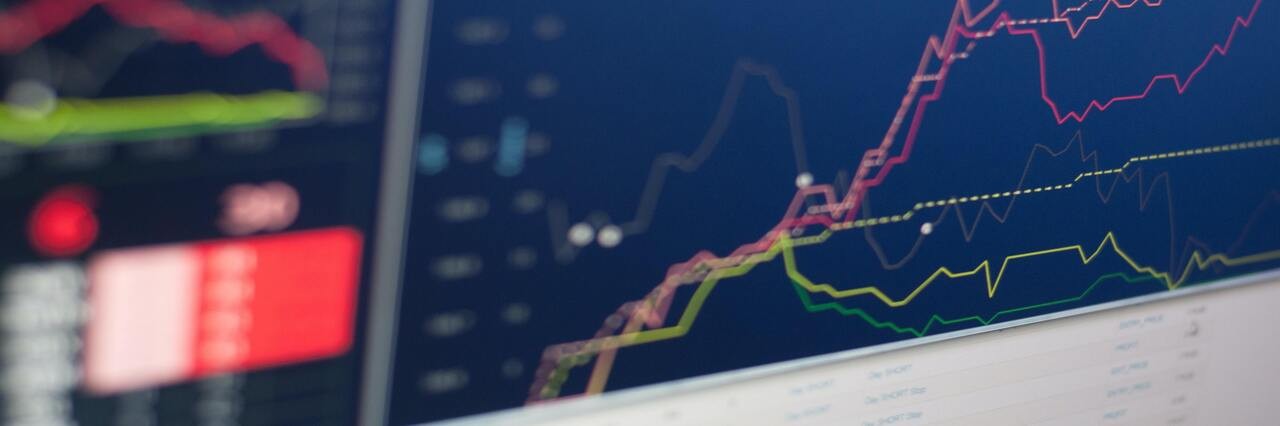

The result of this game (i.e. the existence or not of an equilibrium) might serve as a guide to players currently in negotiations with the U.S. In order to build a relevant game, we must first describe a rule of action for the players. President Trump maximizes his expected payoffs without consideration for the downside risks (i.e. a trade war), which in game theory translates into a Maximax strategy. Take Mexico and the US. The game described below is sequential, in which each branch of the tree represents an outcome with a respective pay-off (x, y) where x represents the American pay-off and y the Mexican pay-off. In the end, the Nash equilibrium found by backward induction is the one where Mexico cooperates by actually buying an insurance policy.

We also illustrated the withdrawal on both sides from the NAFTA with the following payoffs : (-0.1, -1), which represent the 0.1ppt and 1ppt loss of GDP induced by such event, for the U.S. and Mexico respectively.

The best possible solution for the country negotiating with the US is to buy an insurance by doing a payment to the US (diverse concessions on US value added content for example or dairy products for Canada) in order to avoid the worst case scenario i.e. a trade war.

Nash equilibrium between US and Mexico for trade discussions