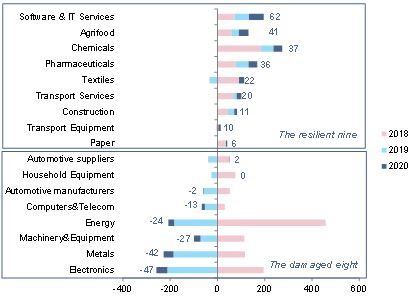

- Global trade: The force weakens. In 2019, global trade of goods and services could grow at its slowest pace in a decade (+1.5%). Globally, exporters are likely to lose USD420bn. China (-USD67bn), Germany (-USD62bn) and Hong Kong (-USD50bn), as well as the Electronics (-USD212bn), Metals (-USD186bn), and Energy (-USD183bn) sectors, are the main victims of the trade recession.

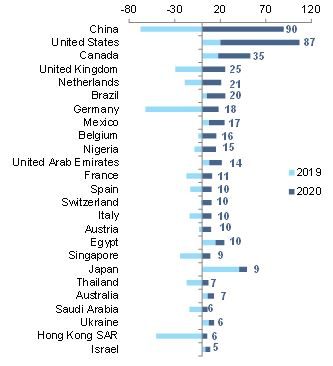

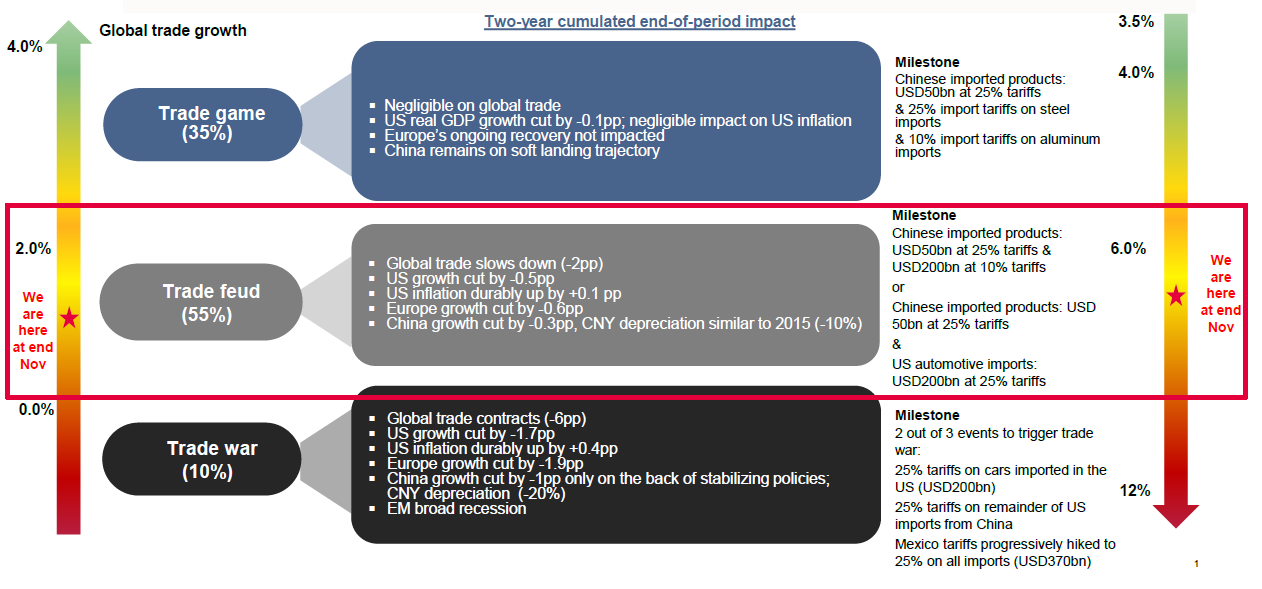

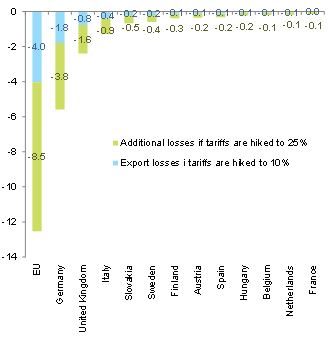

- Will the U.S. and China empires strike back in 2020? The worst could be behind us but despite a slight acceleration we expect global trade to remain in this low-growth regime in 2020 (+1.7%), and our scenario of a Trade Feud continues (see Protectionism: Trade Games, Trade Feud or Trade War?). A superficial “mini-deal” between the U.S. and China, a slowdown in trade in services and a busy political year in 2020 leave no hope for sizable improvement. The sectors software and IT services (USD62bn), agrifood (USD41bn) and chemicals (USD37bn), as well as China (USD90bn) and the U.S. (USD87bn) will see the largest trade gains in 2020 (USD87bn and USD90bn, respectively). However, trade tensions have taken a toll: export gains would be roughly half of what they were in 2018 for both. In addition, Germany and the UK could be targeted by U.S. tariffs on cars.

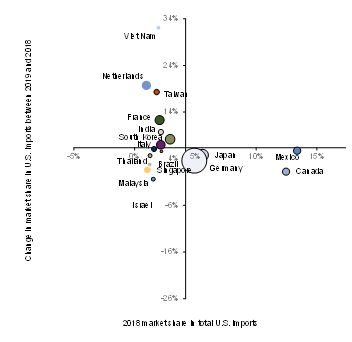

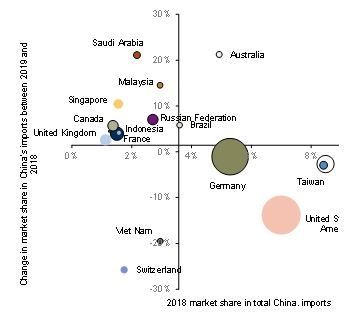

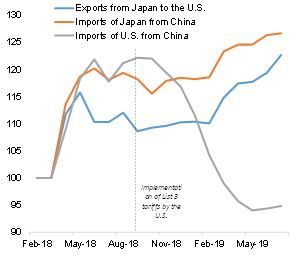

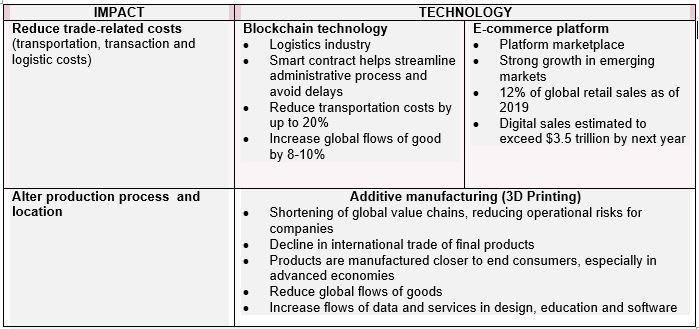

- The phantom trade menace. Trade diversion shows that a few winners are capturing export market share to the U.S. (Vietnam, France, the Netherlands and Taiwan) and China (Malaysia, Singapore, Russia and Saudi Arabia). However, these winners (like Vietnam) could be next on the hit-list. Meanwhile, phantom trade, whereby companies ship their merchandise to a third market (such as Taiwan, Japan) before exporting it to their trade partner, is unveiling tariff circumvention mechanisms and artificially inflating trade figures. Also note that Trade Tech is reshuffling trade cards in the backdrop: e-commerce platforms and blockchain technology are expected to reduce trade-related costs, while 3D printing could alter the cross-border production process by shortening global value chains, reducing operational risks but decreasing trade flows.

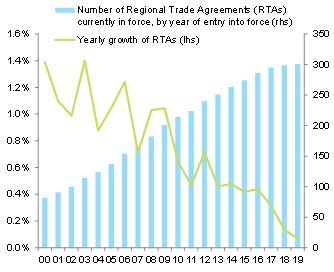

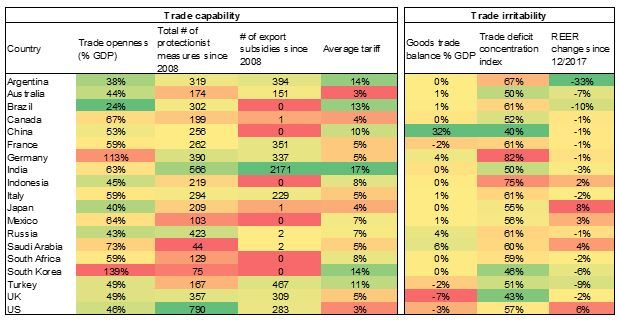

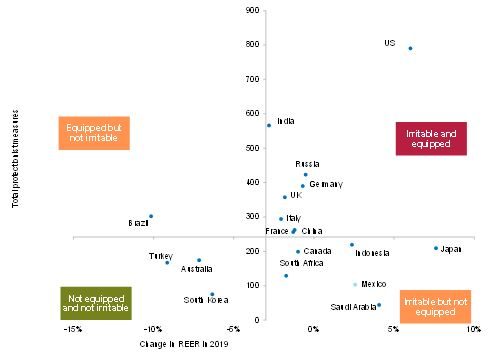

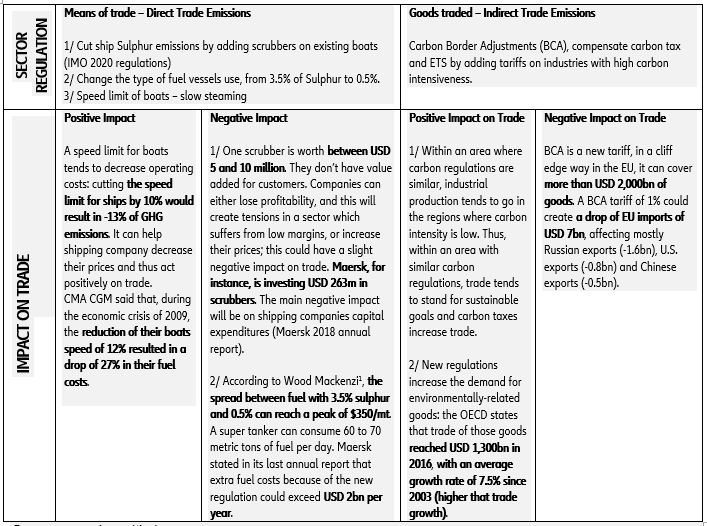

- The return of the trade Jedis. Pervasive protectionism (~1,290 new trade barriers in 2019, number of new regional trade agreements divided by three and average U.S. tariffs more than doubled since 2017) has pushed countries to sharpen their trade arsenals. We identify countries that are irritable (i.e. could be tempted) and capable to wage trade wars (the U.S., India, Russia, China, France); those that are irritable but not equipped (Japan, Mexico, South Africa) and those that are neither equipped nor irritable (Australia, South Korea). Last, we expect new rules of the game, as part of the shift towards more sustainable trade (regulation of trade transportation and carbon emissions of traded products). Simplifying and considering the EU Border Carbon Adjustment tax (BCA) to be an outright tariff on EU imports, we estimate that a 1% tariff could result in a loss of USD7bn of exports to the EU, affecting Russian, U.S. and Chinese exports.

Global trade outlook in 2020: The force weakens

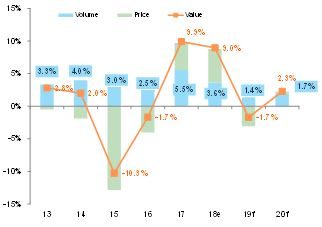

In 2019, the volume of global trade of goods and services could grow at its slowest pace in a decade (+1.5%, see Figure 1). On top of decelerating global growth (+2.5% in 2019, after +3.1% in 2018), 2pp over two years (2019 and 2020) can be directly attributed to high uncertainty, and higher global tariffs, according to our estimates.

Global trade went into recession end-2018, exiting negative territory only in the fall of 2019. The latest CPB data show that in August, trade of goods in volume stood at a level last seen in November 2018. The automotive and semi-conductor sectors particularly drove this slump. In addition, in H2 2019, trade in services was also affected. The new business sub-component of the Markit Services PMI shows signs of deceleration, and the WTO trade in services barometer predicts a slowdown as early as H2 2019. This explains why services barely compensate for the poor performance of trade in goods. However, the depth of the slowdown will be stronger in countries where services depend more on manufacturing. For example, in Germany, 26% of total national services inputs are used as inputs in industry, against 16% in France, 14% in the U.S. or 11% in the UK.

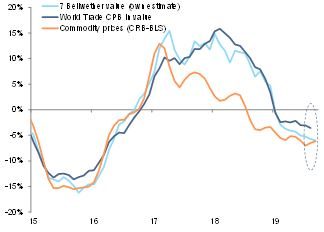

In value terms, trade could have contracted -1.7% in 2019, due to a negative price effect, as illustrated by the drop in commodity prices. Globally, exporters lost USD420bn in 2019. Our bellwether advanced indicator shows still contracting value growth of trade, but a recent stabilization of commodity prices in the last months of this year. October has seen the first rise in commodity prices since last March, as measured by the Commodity Research Bureau (CRB) – BLS Spot index. This echoes the stabilization we see in oil prices in 2020, as evidenced by our oil forecast of USD66/bbl in 2019 and USD67/bbl in 2020. Hence, while we do not expect a strong rebound of commodity prices, this means the slump could have bottomed out.

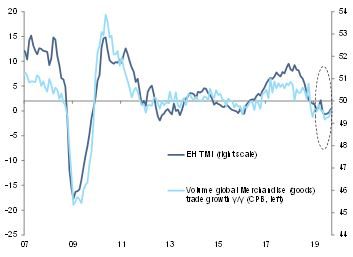

Our proprietary leading indicators show that the worst is behind us. Our Trade Momentum Index (TMI) has stopped deteriorating, while still remaining in contractionary territory (below 50, see Figure 2). Q3 2019 should be positive overall (around +0.6% q/q, after -0.8% in Q2 and -0.3% in Q1). This would be the first positive quarter since Q3 2018. In other words, we should have technically escaped the recession (i.e. two consecutive quarters in contraction) in trade in Q3.