Source: Allianz Research

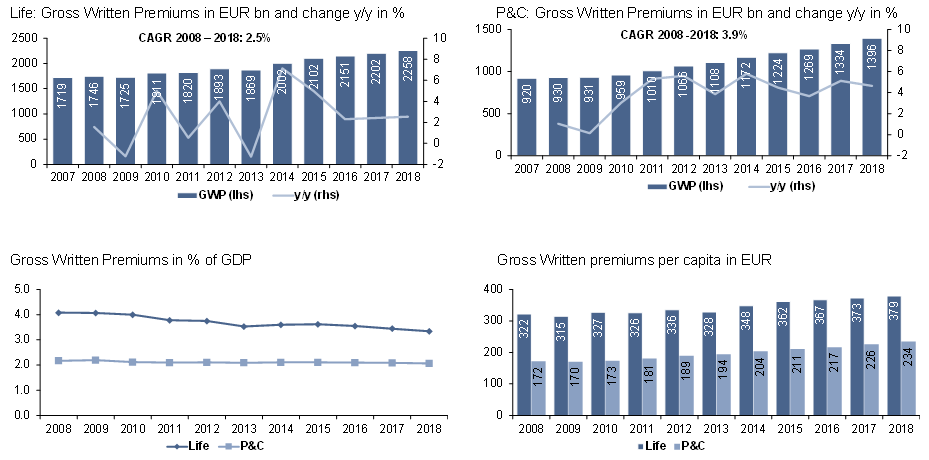

In 2018, premium income in Western Europe grew by +2.1% on a year-on-year basis, a slight increase from the +1.9% growth of the previous year. Our projections for 2018 suggest that p&c growth in Western Europe picked up from +1.9% in 2017 to +3.1% in 2018, the fastest increase since 2003. The life insurance market, on the other hand, slowed to +1.7% (from +1.9% in 2017), mainly due to the contractions of premium incomes in markets like Austria (-3.2%), France (-0.2%), the Netherlands (-4.6%) and Spain (-1.6%).

As a consequence, life insurance penetration in the region has dramatically declined, from 5.6% back in 2007, just before the Great Financial Crisis, to 4.4% in 2018. (Penetration in p&c remained more or less the same: 2.1% vs 2.3% before the crisis.) Against the backdrop of the unrelenting demographic change, which leaves no doubt about the necessity of private provision, this sharp decline is disturbing. Long-term savings efforts are obviously decreasing. The severe economic crisis in many European countries is certainly one reason for this. The European Central Bank's low-interest policy also plays an inglorious role here. But waiting for the ECB to change course and interest rates to rise again is no longer an option. The younger generation will be much more dependent on private reserves in their old age than the current generation of pensioners. They have to save – now. The key is to adapt savings behaviors – accepting more risks – as well as savings products – offering less guarantees – to the new realities. Life insurance has to release itself from its over-dependence on interest rates.

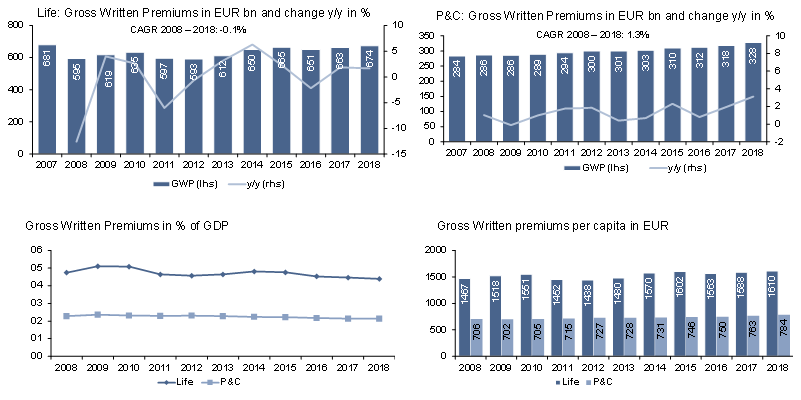

Life insurance, however, still makes up 67% of the total premium income in Western Europe , amounting to EUR674bn. The business line plays an important role in social security systems in many but not all European countries. Therefore, insurance penetration differs significantly: from a high 7.1% in the UK or 6.2% in Denmark to 1.5% in Austria or a mere 1% in Greece. Furthermore, as revenues of life insurance are often driven by bancassurance strategies and legislative changes, volatility is high. A case in point are the rollercoaster-like developments in Italy – where growth rates changed between +49% and -18% over the last decade – or Sweden (between +18% and -12%).

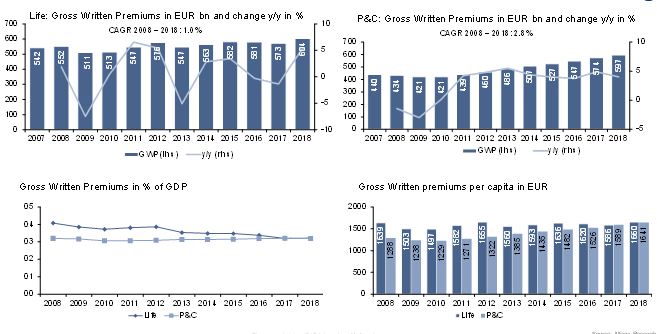

The greatest total premium growth in the region in 2018 was observed in Portugal at +9.9% year-on-year. Life insurance in Portugal grew by +14.5%, mainly due to the income from retirement products, which have increased their weight in the life market to up to 45% of life insurance products, according to ASF. The four biggest insurance markets in the region – the UK, France, Germany and Italy – showed more modest growth, with the German market achieving the highest rate: +2.2%. This was mainly driven by a healthy +3.4% increase in the p&c segment; the life business grew only by +1.3%, recovering slightly from three years of negative growth. The British market clocked growth of +2.1% and the Italian one of +1.9%; growth in France was even more subdued (+1.1%).

Regarding insurance density (premiums per capita) and penetration, however, Germany lags behind the others. In 2018, insurance density stood at EUR1925 in Germany (against a regional average of EUR2395) and penetration at 4.7% (against 6.5%). In neighboring France, for example, people and companies spend EUR3102 per year on insurance and penetration is almost twice as high as in Germany (8.6%). The regional economic giant is an insurance midget.

Northern America

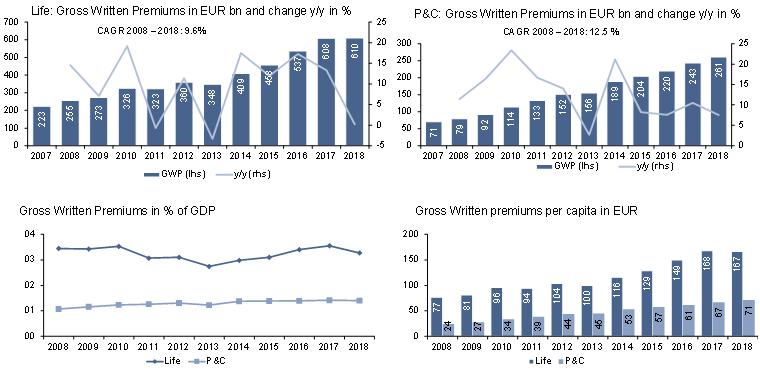

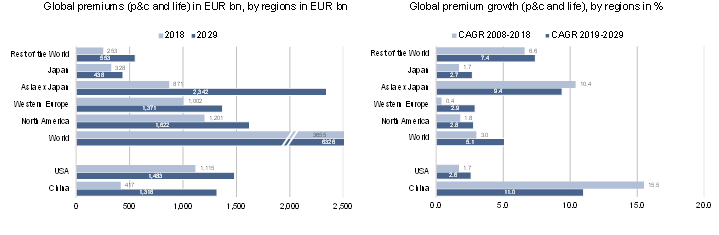

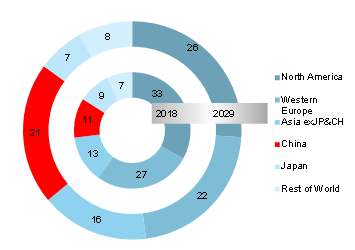

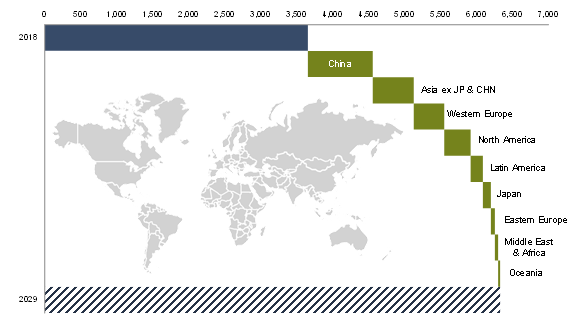

2018 was a good year for insurance in the U.S., where overall premium income rose by +4.6%, the strongest increase since 2012. While life premiums grew by +5.2% (also the strongest growth since 2012), premiums in p&c increased by a more modest +4.1%, slowing down from the previous year’s +4.9%. All in all, total premiums rose by EUR54bn, contributing a whopping 42% to global premium growth in 2018. With that, the U.S. cemented its status as the leading insurance market in the world: At EUR1115bn, the U.S. is by far the largest single market; China, the runner-up, stands behind at EUR417 billion. 30.5% of the global premium pool is written in the U.S.. Its lead over all other markets is even more impressive in p&c: Here, the global market share of the U.S. is an impressive 40.3%. This reflects one of the peculiarities of the US market: As far as the spending structure goes, the distribution of expenditures between p&c and life is quite balanced, fluctuating at around 50% each. In most other markets, life is clearly dominating.

However, not all is rosy on the other side of the pond. Density (total premiums per capita) increased only by less than +1% p.a. since 2007; in the life segment, it even stagnated: People spend more or less the same amount in nominal terms today as ten years ago. Consequently, penetration has been consistently going down for some time. The maximum reached by the U.S. was 8.5 in 2003. As of 2018, U.S. insurance expenditures represented 6.5% of its nominal GDP. And as in most other mature markets, this decline was mainly driven by falling penetration in the life segment. The financial crisis left its scars in the U.S., too.

Figure 5: Insurance markets in North America