- Practically worldwide protection of your claims against economic and, if necessary, also political risks.

- Existence insurance for your company, which is particularly important in view of the often large individual risks associated with capital goods.

- Guaranteed company liquidity through secured income.

- Maximum planning reliability, even in the case of long production times.

- Extension of bank credit lines if compensation claims are assigned.

- Ongoing credit checks using the unique Euler Hermes information pool with access to over 40 million company data sets worldwid

As a company, you are continually confronted with all kinds of risks to your business. Whether a service provider or manufacturing firm, every company is dependent on the liquidity and solvency of its customers. A payment default can be expensive, especially when capital goods are involved. And even more so if the ordered goods have already been produced in full and possibly already delivered. If the customer does not pay, not only can this harm the company and its balance sheet, but it can also post a threat to jobs and livelihoods.

To protect against just such an eventuality, Euler Hermes offers capital goods insurance – providing you with a comprehensive service package from an experienced insurer. This allows you to go about your daily business with peace of mind. Even in the event of non-payment, you have nothing to worry about: you are completely covered.

Do you have receivables from delivery and service contracts or leasing agreements?

Losses on receivables, for example if a customer goes bankrupt, are a problem for every company. But it can be particularly serious for you as a manufacturer or supplier of capital goods, since this almost always involves large machines and production systems worth millions – and a loss can quickly jeopardise a company's very existence. That is why Euler Hermes has developed INVEST, which protects you against losses on receivables arising from precisely these kind of risks. This individual insurance is geared towards expensive custom-made products with traditionally exceptionally long production times, and allows you to choose the insurance amount and duration accordingly. In addition, you have the option of starting protection as early as the production stage in order to cover the often high investment risk before delivery.

Our capital goods credit insurance offers you tailor-made protection for your business. Do you have receivables from delivery and service contracts or leasing agreements? Do your terms run up to 60 months? Then you have already fulfilled two important criteria for taking out this insurance. If the transaction you want to cover has a positive credit rating, as verified by us, then it’s a go: we can insure it for you. What’s more, we will indemnify you for the loss incurred within 30 days if the insured event and the necessary documents are available.

What is capital goods insurance?

If you want to be able to continue to do business even with insolvent clients, we recommend you take out capital goods insurance from Euler Hermes. As a special form of trade credit insurance, capital goods insurance protects you against bad debt losses relating to capital goods such as machines, plants, production systems and many other goods in this area.

Our capital goods credit insurance offers you tailor-made protection for your business. Do you have receivables from delivery and service contracts or leasing agreements? Do your terms run up to 60 months? Then you have already fulfilled two important criteria for taking out this insurance. If the transaction you want to cover has a positive credit rating, as verified by us, then it’s a go: we can insure it for you. What’s more, we will indemnify you for the loss incurred within 30 days if the insured event and the necessary documents are available.

Capital goods insurance – What can be covered?

If you decide on capital goods insurance from Euler Hermes, it can be used to cover a wide range of risks. These include so-called del credere risk, which manifests itself in the form of losses after delivery and performance, as well as hedged manufacturing risks for custom-made products (in the amount of the cost price), political risks and also unfair calling (unjustified drawing of guarantees).

When does the insurance cover commence?

The insurance cover under our capital goods insurance commences at the start of production, but no later than upon delivery or performance.

Optimal solution for:

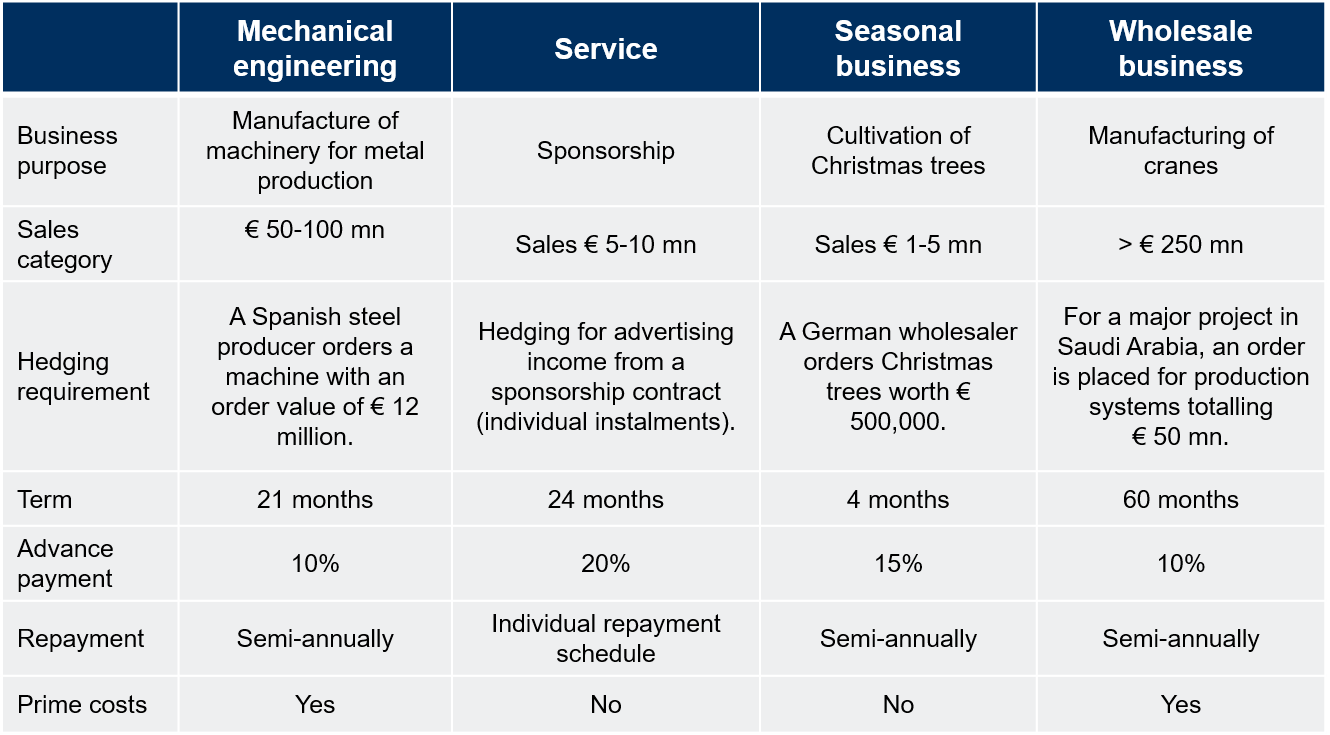

Capital goods insurance: Case studies

To give you a better overview of what capital goods insurance is and which risks are insured, we have compiled a few concrete case studies for you:

Amount of premium

We always aim for fairness: The premium is therefore based on the individual amount of the claim and the term of the insurance. In the event of early redemption in full, you will of course receive a partial refund of the premium.

Flexible scope of application

Flexible scope of application

Our capital goods credit insurance offers you protection that is tailored to your needs and can meet the special requirements of a wide variety of businesses. With that in mind, we can also offer you cover for:

The benefits are clear

Why do I need insurance?

I know my business partners, so I can assess the risk. So why should I get insurance?

Even if you have enjoyed a business relationship with a customer for a very long time, an economic crisis or even insolvency can arise through no fault of the customer – for example, due to external events. When capital goods are involved, however, it often takes years from the start of production to the payment due date, and the risk of default increases commensurately over time.

You can find further information on sector and country risks here.

Important information for your quote

So we can provide you with a quote that precisely meets your specifications and requirements, we need some additional important information from you: