Trade credit insurance for medium-sized companies

Credit insurance: What does it cover?

If a customer is unable to pay not only one but multiple invoices by their due date, this can have disastrous consequences for your company. With that in mind, our insurance serves not only as insurance against bad debts; we also provide you with an ongoing review of the credit standing of all your current customers. This means that you are always in the picture should one of your business partners or customers get into financial difficulties. We align our insurance solutions to your specific needs, taking into account how big your company is, which field you work in and the amount that needs to be covered. Generally speaking, credit insurance encompasses payment defaults and bankruptcies on the part of customers as well as regular credit checks. You will also be indemnified by our credit insurance if your customers are unwilling to pay.

When is the right time to take out trade credit insurance?

Manage credit limits online – simply and conveniently.

Our online portal now makes it even easier to manage and update your credit limits. All you have to do is log in with your access data. You can then adjust and manage the credit limits you want at your convenience. The portal is provided to you free of charge. In the event of a limit enquiry, we will charge the costs of this together with your credit insurance.

Our online platform Customer Service Guide helps you with all your questions about your credits and policy.

How does it work?

- Credit check of customers: We analyse the credit standing and financial stability of your customers.

- Calculation of credit limit: Every customer has a credit limit set for them. That is the maximum amount we will indemnify in the event of non-payment.

- "Business as usual": You go about your business with your customers as usual – but are now covered up to the credit limit.

- Updated limits: We keep you updated about adjustments to limits if these are raised or lowered due to changing circumstances.

- Expanding your business: When you are approached by potential new customers, you check their credit standing. Following this you receive a confirmation from us – or an explanation why your request was denied.

- Notifying a claim: Has a customer failed to pay? Simply send us all pertinent information. We will then investigate the case and reimburse you in the amount of the insured loss resulting from the default, subject to compliance with the applicable conditions.

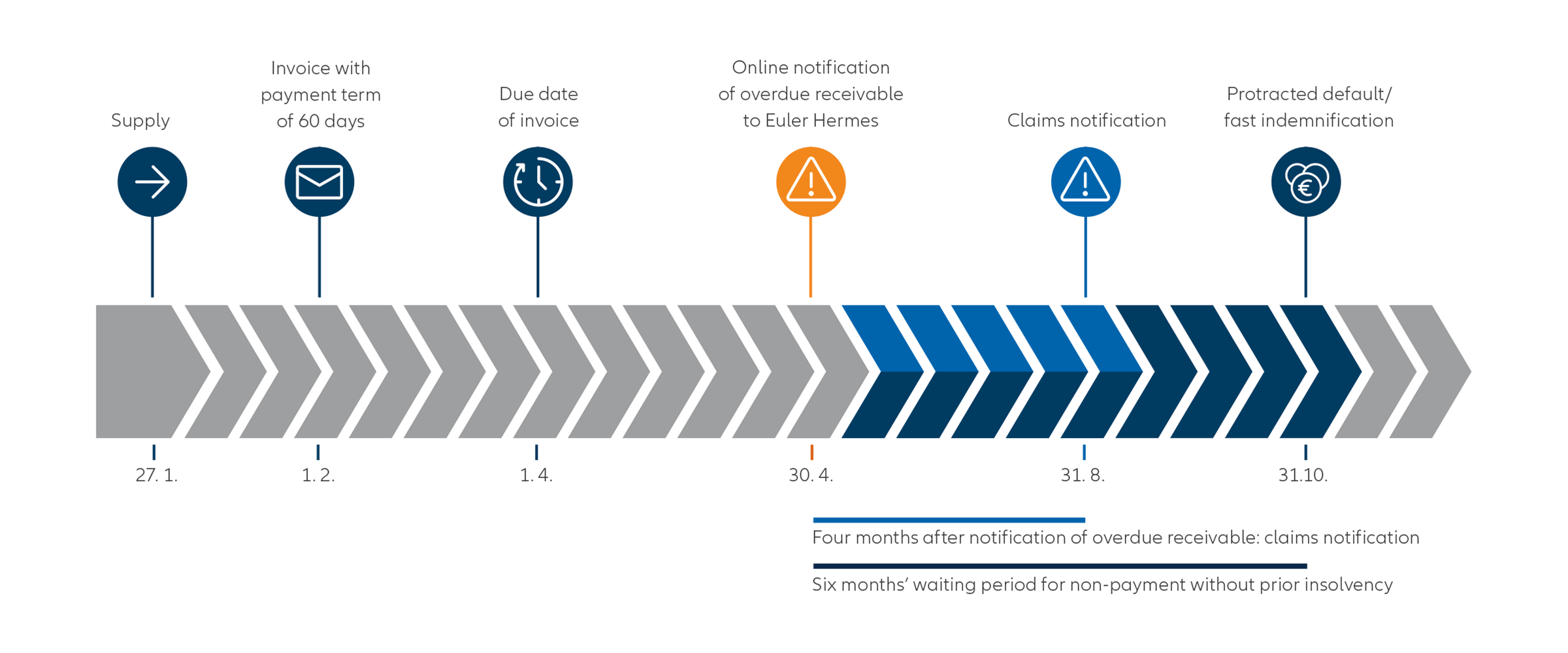

Example of an indemnification process in the event of unwillingness to pay (protracted default):

The benefits of credit insurance speak for themselves

Get non-binding consulting now

Why you should choose Euler Hermes

We are the global market leader in the field of credit insurance and want to put our expertise to work for you. With us as a reliable and strong partner by your side, you will receive speedy claims settlement, indemnity in line with the claim, as well as optional collection services. We check the credit standing of your customers and provide you with personal service, combined with our convenient online service EOLIS. Are you interested in working together? Find out more!