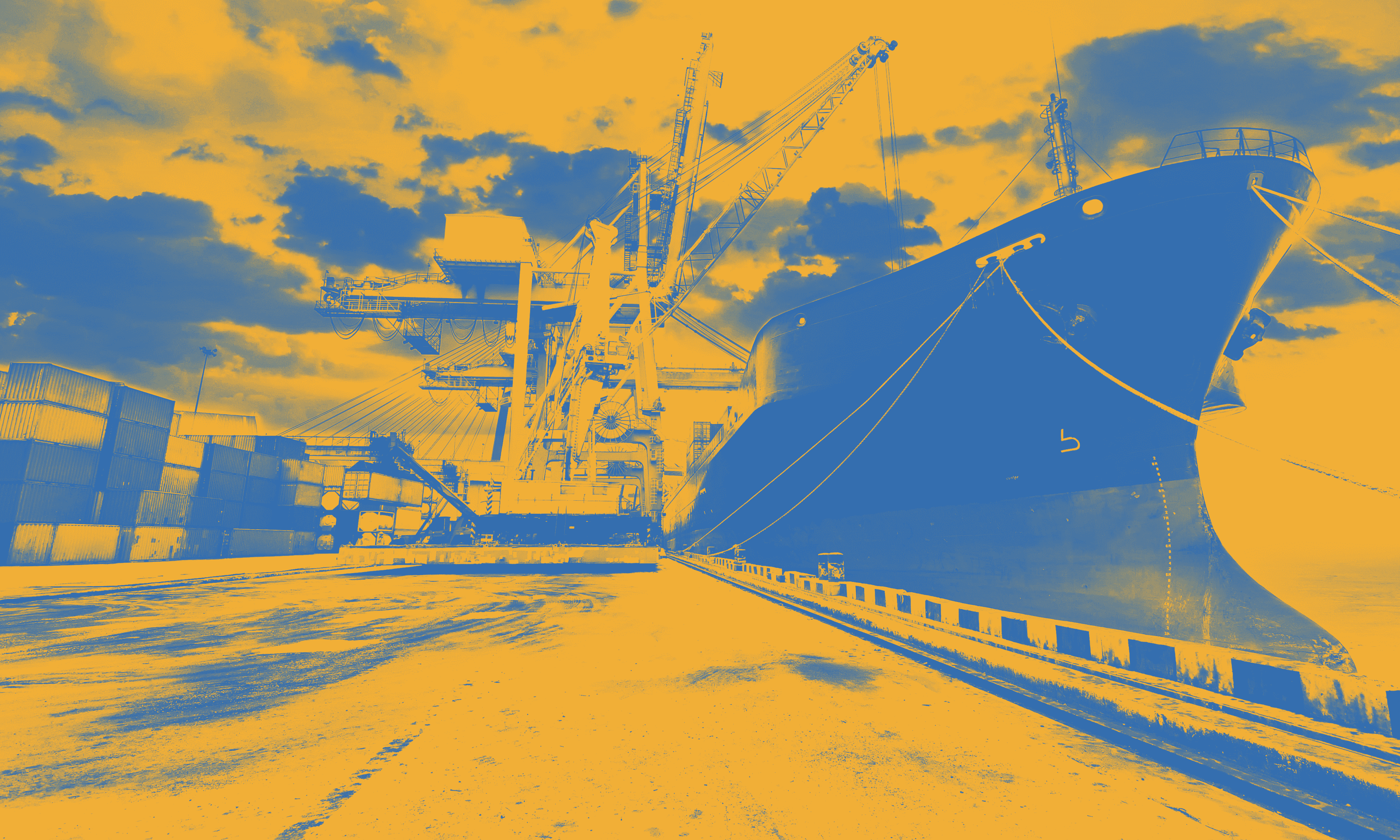

Transactional Cover is a customized policy solution designed for companies protecting assets abroad or seeking import or export transaction protection, and financial institutions offering trade and export financing solutions.

It is designed to mitigate and manage risks such as contract interruption, non-payment, confiscation or political risks.

A transactional cover unit policy provides a non-cancellable limit (€100 million max) for up to eight years.

For international trade, the reassurance of limiting exposure and capital relief, flexibility and cover for single or multiple countries is a distinct benefit of this solution.