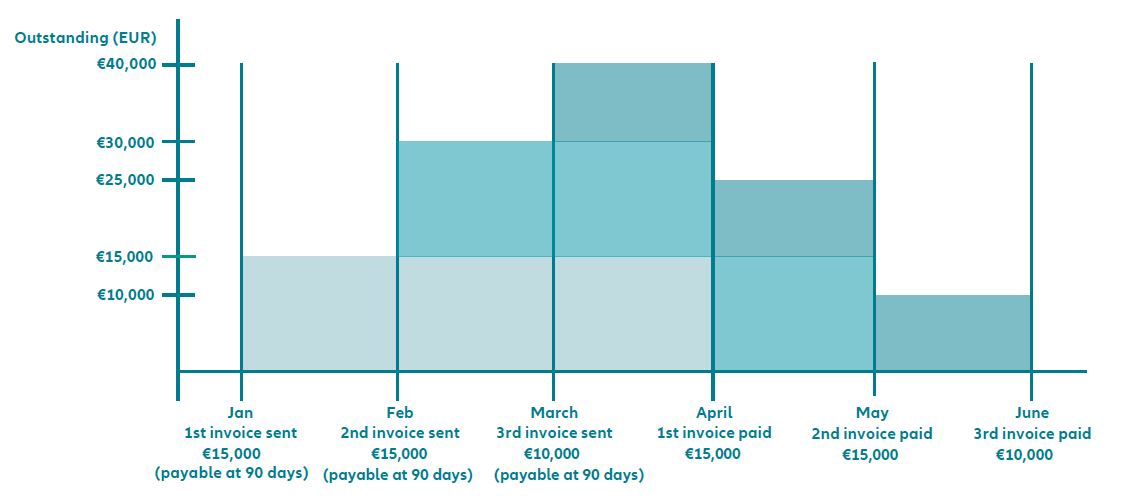

In this case, the outstanding amount will be €15,000 in January, €30,000 in February and €40,000 in March. The maximum outstanding is €40,000. You should set your credit limit at €40,000. If there are further orders, then you will need to reassess this maximum amount.

You should consider a few things when setting your credit limit:

- Does your customer regularly pay you on time?

Adding additional unpaid invoices will increase the amount

outstanding. Your credit limit should be higher.

- Is your business cyclical?

If your orders are higher over Christmas for instance, you may need to increase your credit limit and your cover temporarily.

- Are your sales regular over the year?

Here’s a trick for calculating your average outstanding per month: [annual sales / 360] x terms of payment, or [monthly sales / 30] x terms of payment

Example of average outstanding calculation for regular sales. You are trading with company ABC Inc. Your yearly sales to them are €60k, you invoice regularly and your terms of payment are 30 days. Following the above calculation, your average outstanding amount is (€60,000 / 360) x 30 = €5,000.