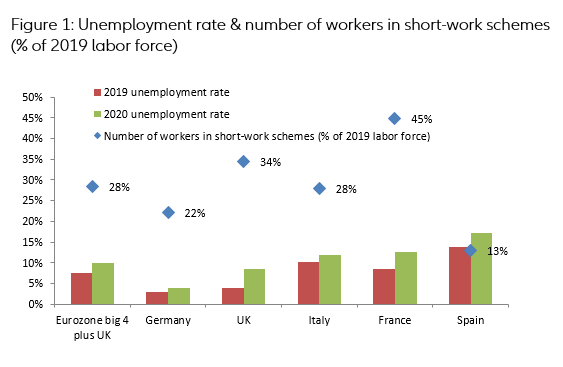

In Europe, blanket job-retention schemes helped prevent mass unemployment in the short-term, contrary to the U.S. experience: Close to a third of Europe’s workforce or 45 million jobs in the five largest economies alone are currently benefiting from national employment support schemes (see Figure 1). The success of Kurzarbeit during the Great Financial Crisis certainly pushed many European governments into adopting short-time working arrangements to cushion the Covid-19-related blow to labor markets. Firms could reduce workers’ hours, with the government replacing a large part of the lost income (between 60% and 100%, see Annex for details). In 2020, and in spite of emergency support measures, we expect 4.3 million additional unemployed in the big five European countries.

Figure 1: Unemployment rate & number of workers in short-work schemes (% of 2019 labor force)

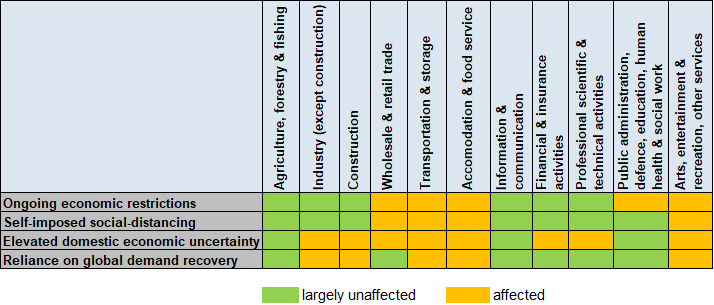

Today, European policymakers are recalibrating partial unemployment towards longer but less generous schemes. “Late bloomer” sectors will be prioritized. In most countries, the generosity of the program is being reduced, except for the most impacted sectors to avoid pulling the plug too early. Second, many countries announced an extension of the job retention scheme to reduce short-run uncertainty for firms, transforming them into a de facto wage subsidy to support the recovery. In the end, it looks like six “late bloomer” sectors (transportation & storage, accommodation & food service, art, entertainment & recreation, retail & wholesale and industry and construction) will receive the bulk of jobs protection efforts, as pre-crisis activity levels will not be in sight until end 2021 for four reasons:

1. ongoing sanitary restrictions continue to directly affect these sectors’ activity - from social distancing rules that limit the number of people in restaurants and shops to outright bans on international travel or events;

2. self-imposed social distancing due to lingering contagion concerns, even as restrictions are lifted, will affect in particular the consumption of goods and services that require direct customer contact / social interaction, including travel, retail and leisure activities;

3. heightened domestic economic uncertainty, driven by widespread job and insolvency fears, will keep a lid on hiring and investment plans; and

4. dependence on recovery of external demand will see some sectors – from industry and transportation to tourism-related activities – trail behind as the uneven economic recovery across countries and regions will keep a lid on global growth dynamics until at least 2022

Figure 2: Recovery headwinds & sector hurdles

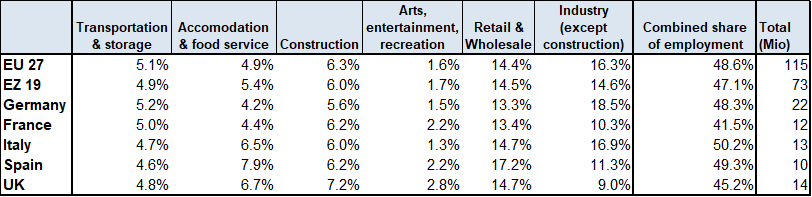

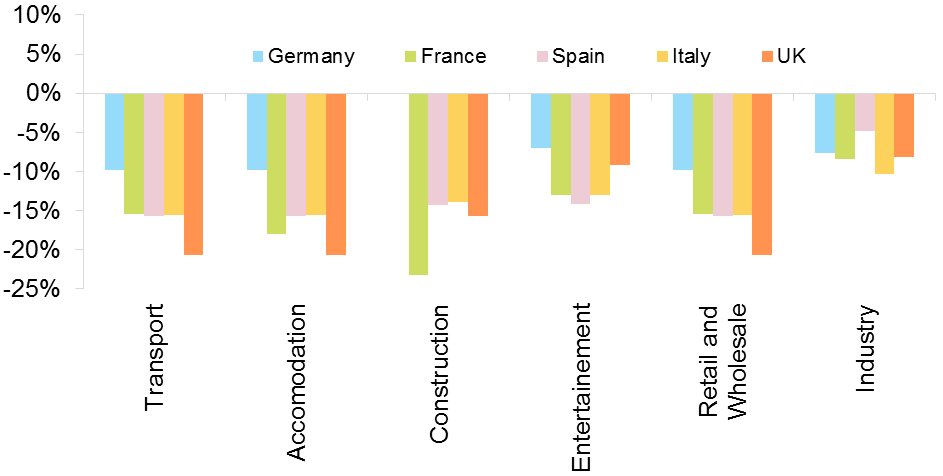

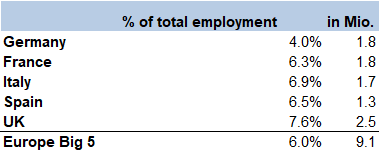

In the five largest European countries, we estimate that 9 million workers or 20% of those currently enrolled in short-work schemes face an elevated risk of becoming unemployed in 2021 because of the muted recovery in late bloomer sectors and the policy cliff effect. We call these zombie jobs; they require ad hoc policies to avoid postponed mass unemployment. As a matter of fact, “late bloomer” sectors employ round 115 million workers across the EU27 i.e. 49% of total employment. At the national level, the share of total employment in “late bloomer” sectors ranges from 42% in France to 50% in Italy. By using the employment intensity by sector in relation to value added, coupled with our recovery expectations by sector in 2021, we end up with a proxy of zombified jobs, for which Kurzarbeit-type schemes may at best postpone job loss. As per our calculation, zombie employment would equate to 6% of total employment. Zombie jobs are more numerous in the UK as well as Italy and Spain – as these countries boast relatively larger shares of labor-intensive sectors such as construction, retail and accommodation & food service – and fewer in Germany. One of the issues policy makers will have to address is the risk that zombified jobs will see some workers stay in “late-bloomer” sectors for income protection, instead of moving to “fast bloomer” sectors (such as health and IT) with better job opportunities in an asymmetric recovery. In this context, combining active labor market policies (up-skilling, intermediation) with wage subsidies is both urgent and important. Complementary schemes to subsidize new hires (especially younger job seekers at-risk of a scarring effect in their school-to-job transition), employees choosing mobility and re-skilling and those starting their own business should also be pursued to lessen the risk of postponed unemployment.

Figure 3: Employment (% total employment) in “late-bloomer” sectors

Figure 4: Forecast loss of employment (% of sectoral employment) based on expected output loss by end 2021

Figure 5: Estimates of zombie employment