The collateral damage of too-low growth and tightening financial conditions

- At a global level, the upward trend in business insolvencies continued in 2018 (+10% y/y), mainly due to the surge in China (+60%) and, to a lesser extent, an increase in Western Europe (+2%)

- This higher number of insolvencies was complemented by a persistent high level of large business insolvencies, with 247 major insolvencies totaling more than EUR100bn in turnover in Q1-Q3 2018. Hot spots were Retail in North America; Construction in Asia; Retail, Agrifood, Services and Construction in Western Europe

- In 2019, business failures are set to rise for the third consecutive year (+6% y/y). The softening economic momentum, coupled by the global tightening of financing conditions, will drive up insolvencies in a majority of countries

- Western Europe, where economic growth will drop below the historical threshold which stabilizes the number of insolvencies (+1.7%), will see an increase in most countries, notably in France, Italy, Spain (+2%) and the UK (+9%)

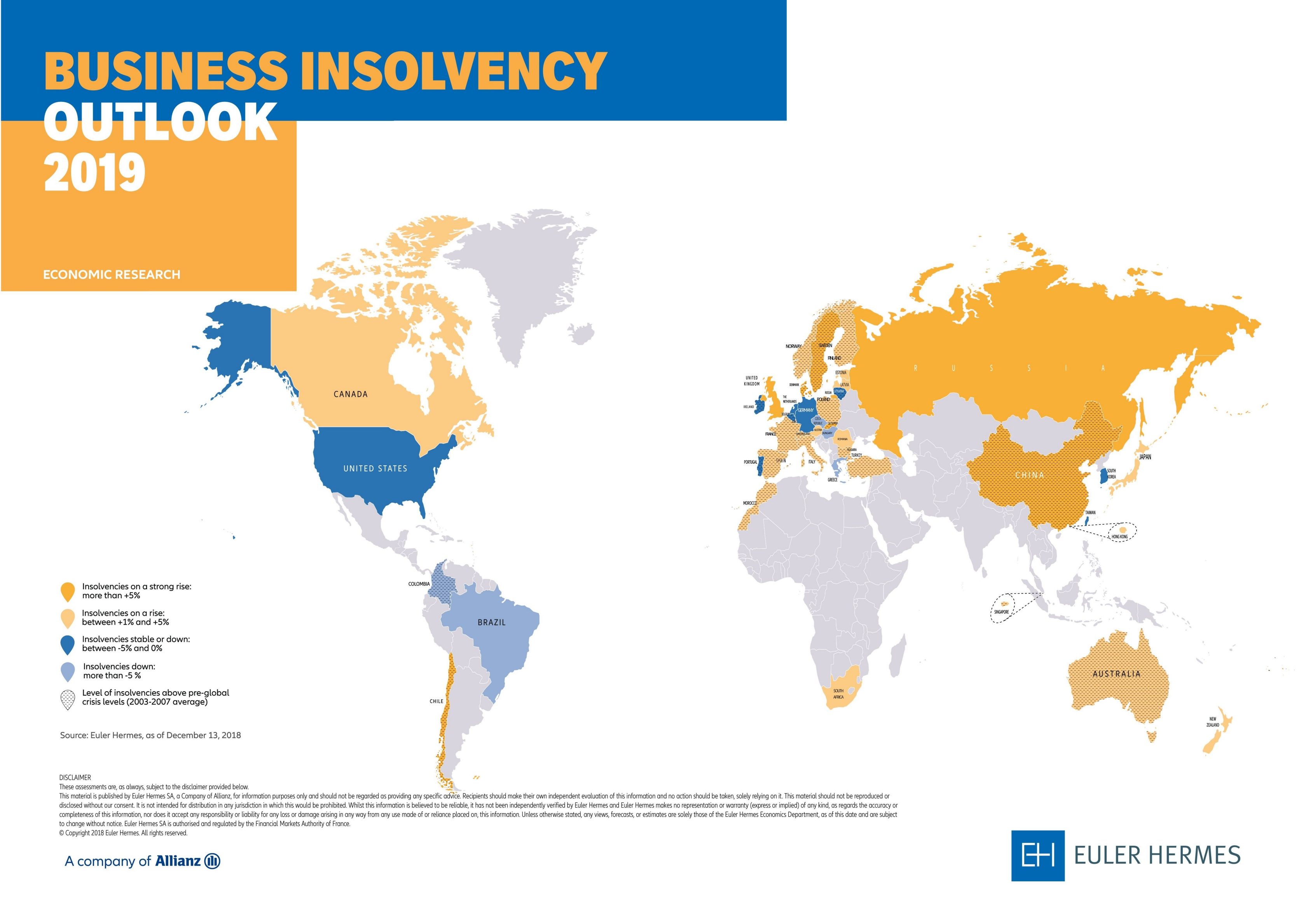

- All in all, 2 out of 3 countries will post a rise in insolvencies in 2019, with the US (+0% y/y) and Brazil (-6%) as key exceptions. As a result 1 out of 2 countries will register more insolvencies than before the financial crisis

Business insolvencies are on the increase at a global level.

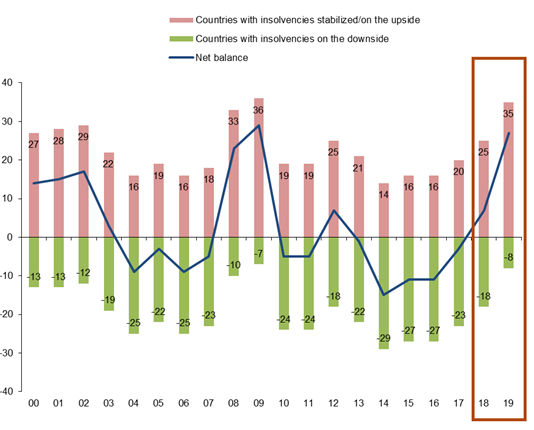

In 2018, global insolvencies confirmed their upward trend which started in 2017 after seven consecutive years of sizable declines. Indeed, our Global Insolvency Index which covers 43 countries totaling 83% of global GDP is to post a +10% y/y increase for 2018, an estimation supported by the latest available data. All in all we expect 20 countries of our sample [of 43 countries in total] to see in 2018 more insolvencies than in 2017. Three factors explain this outcome: first, a weaker macroeconomic context for some countries; secondly the implementation of new types of insolvency procedures and the cleaning of business registers through the official insolvency procedures in a few other countries; and thirdly, but more significantly, the stronger willingness to use the insolvency framework in China.

In our view, the upside trend in insolvencies will continue in 2019 (+6% y/y). However, this outlook will reflect a more universal reason: the softening of the global economy to a too-low pace of growth. Most economies, notably the advanced ones, are expected to revert to and even cross their respective tempo of GDP growth which has historically proved to be necessary to stabilize the level of insolvencies (+1.7% for Western Europe). In other words, we expect economic growth to gradually become insufficient for a higher number of companies in a higher number of countries in regards to their production costs, (re)financing costs and structural challenges. De facto, the lowering demand is increasing the vulnerability of companies with high-fixed costs and firms with larger inventories or working capital requirements issues. At the same time, the end of easy financing is increasing the vulnerability of debt intensive sectors and more globally of most indebted companies.

In this context, we foresee 2 out of 3 countries will post an increase in business insolvencies in 2019 (compared to 2 out of 5 in 2018) and 1 out of 2 countries to register more insolvencies in 2019 than observed in average over 2003-2007, before the financial crisis of 2008. Countries which exhibited a dynamic business creation over the past years would face an extra volume of insolvencies due to the young companies too weak to survive.

Chart 2 Countries with insolvencies stabilized/on the upside and on the downside (in number, yearly)