As a reminder, we have been saying for a while to expect really awful data for several months, and today’s report is no exception.

Let’s just reel them off - they are all terrible and there’s not much point in discussing them.

- Existing home sales fell 8.5% m/m in March, the biggest decline in over four years.

- New home sales fell -15.4% m/m, the biggest decline in almost seven years.

- Markit PMI indexes, which signal contraction when they are under 50, recorded breathtaking drops. The manufacturing index plummeted from 48.5 to 36.9, while the services index, covering 85% of the economy, crashed down to earth from an already sickly 38.9 to a disastrous 27.0.

- New orders for durable goods fell -14.4% m/m in March, the second-largest decline ever. The good news here is that most of the drop was due to steep declines in volatile orders for autos and aircraft. After stripping these and other volatile items out, “core” orders actually gained +0.1% m/m (don’t expect to see that again any time soon).

- The University of Michigan’s Consumer Sentiment survey fell from 89.1 in March to 71.8 in April, still maintaining a surprising degree of optimism. Note that the survey was at 101 in February, the highest level in almost 15 years.

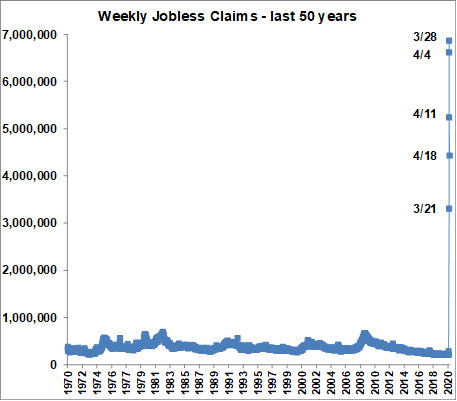

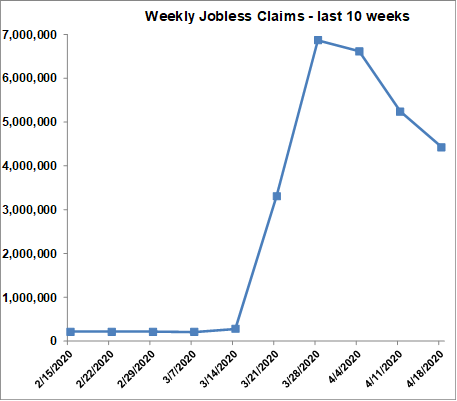

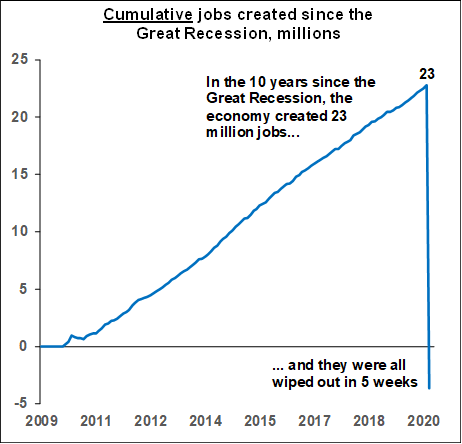

Which brings us to the hottest thing in economics, weekly jobless claims. They have been the most carefully watched piece of data recently because they are so fresh, or as the economists put it, there are “high frequency”. So we got another astronomical number yesterday, showing 4,427,000 new people applied for jobless benefits last week. But, looking for the silver lining, note that in the second chart, it’s the third straight decline, it’s 15% below last week, and it’s 36% below the record high set four weeks ago.