Stocks and the macroeconomy disconnect, again.

Once again, we are in the uncomfortable position of having to give a rational analysis of the macroeconomy in the face of a euphoric stock market. The stock market frequently disconnects with glee from the macroeconomic data. They just aren’t the same thing. The Dow gained 223 points, or +0.8% today on – wait for it – hopes over trade talks! Really? Don’t stock investors know that hopes and fears on trade talks flip-flop virtually every day? Apparently not, as the stock market only pays attention to the good news, and simply ignores any reports of difficulties. You can’t fight a market, even if it is being driven by “irrational exuberance”, but you can take a look at the “rational” data. Here goes.

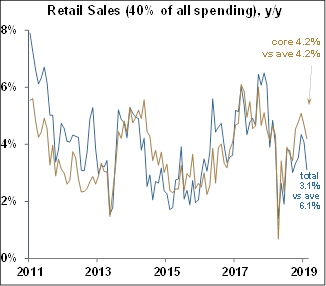

Retail sales in October were ok at the headline, but the details were pretty mushy.

Overall sales rose +0.3% m/m, reversing September’s -0.3% loss, but on a y/y basis, sales still fell from +4.1% to +3.1%. Gasoline sales rose a sharp +1.1% m/m due to a jump in prices, but the y/y rate was still down -5.0%. Auto sale were also strong, gaining +0.5% m/m to a solid +4.5% y/y rate. As always, non-store sales (mostly e-commerce) were vibrant at +0.9% m/m and +14.3% y/y. But that’s where the highlights end. Keep in mind that e-commerce sales are still only about 12% of total retail sales. Other critical categories fell sharply; furniture and home sales -0.9% m/m, electronics and appliance stores -0.4% m/m, building material/garden stores -0.5% m/m, clothing and accessories -1.0%, sports/books/hobbies -0.8%, and an indicator of consumer discretionary spending, bars and restaurant sales, fell for the first time in 11months, losing -0.3%. Without the gains in gas and autos, sales were up a mere +0.1% m/m. And after stripping out other volatile items, core sales, which are an input to GDP, gained only a modest +0.3% m/m. And core sales on a y/y basis have dropped from +5.1% just two months ago to +4.2% currently. Finally, remember that retail sales are only 40% of all personal spending, that critical component producing 70% of all economic output, and that spending is drifting downwards as well.