The Impact of COVID

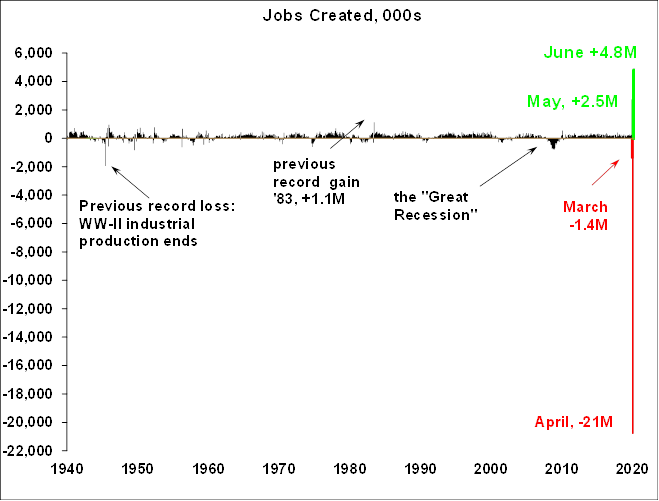

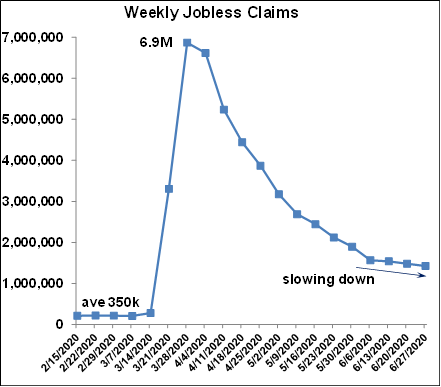

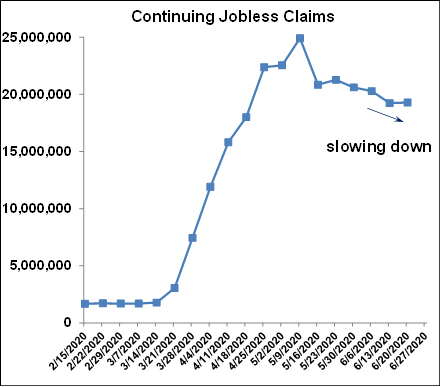

The seeming contradiction between the employment report and weekly jobless claims is not the only anomaly in labor market data. For example, the ISM manufacturing survey still indicates that employment in manufacturing is shrinking – the opposite of what’s in this morning’s employment report. Another labor market survey similar to the employment report is produced by ADP, and that data seems contorted as well. ADP’s May report originally indicated that the economy lost -2.76 million jobs whereas the government’s employment report indicated a gain of 2.51 million. Then yesterday ADP revised its May report to a gain of +3.1 million jobs. A +5.86 million job swing from negative to positive certainly raises question.

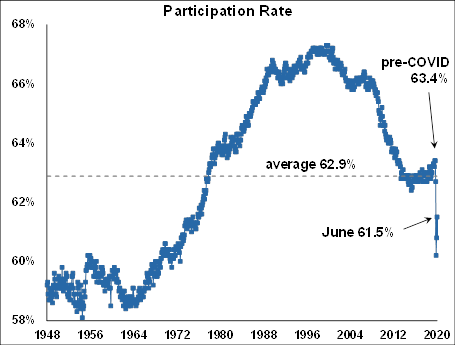

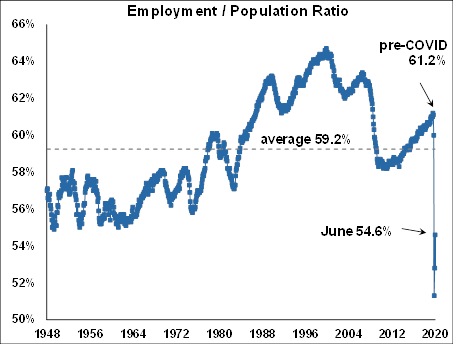

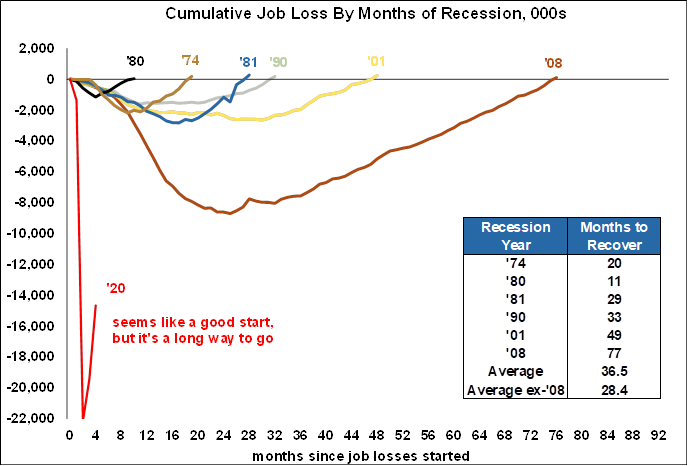

So how do we resolve all of this contradictory, unstable, and rapidly changing data? I think it’s reflective of two things. First we are in an environment we have never seen before, but we are still using the same survey methods to try to measure it. Perhaps those methods don’t fit this situation as well as they could. Secondly, the situation is changing very rapidly. It’s no wonder different surveys with different methodologies over different time periods might show different results. Which brings us to COVID.

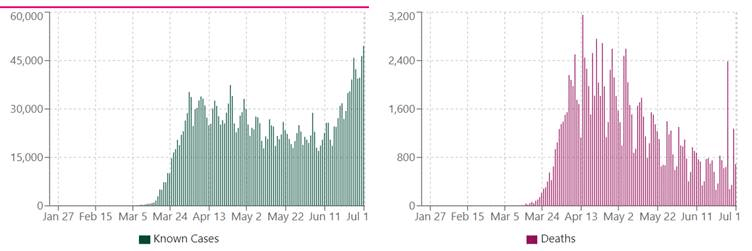

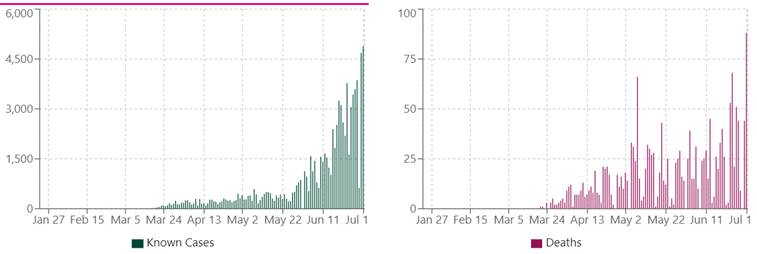

Unfortunately there has been an alarming resurgence of the disease is some states, and more than a dozen states have clawed back or delayed opening provisions. Clearly this situation will slow the recovery and further wreak havoc with employment statistics. Some of just a few examples include:

- Major cities in Florida, and in California, are closing their beaches for the 4th of July weekend

- Arizona has shut down bars, movies, gyms and water parks, and has pushed back public school openings

- Texas and parts of California have shut down bars and entertainment venues

- New Jersey is postponing the restarting of indoor dining

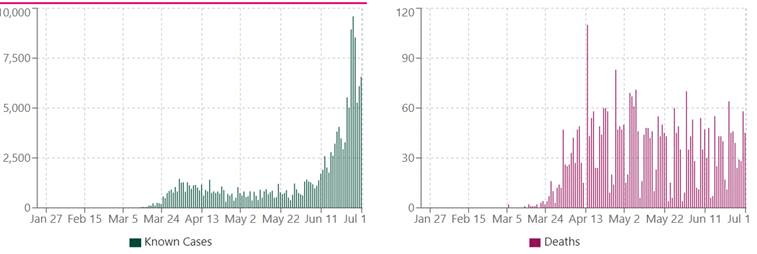

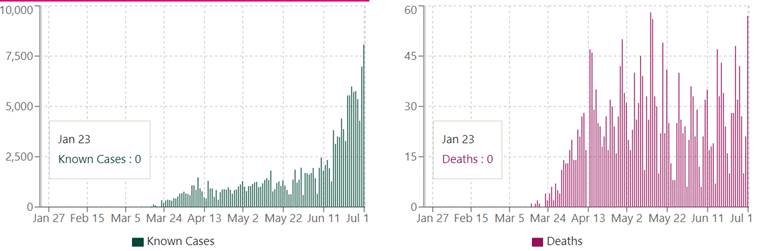

The charts below illustrate the situation in some of the states in question, all showing new daily cases (source: usafacts.org)