There were several other important data releases this past week, and most of them were pretty positive.

- Construction spending in January exceeded expectations, growing 1.8% m/m, the biggest increase in two years. The y/y rate is now 6.8%, well above the longer-term average of 4.2%.

- Weekly jobless claims fell from 219,000 to 216,000, despite expectations of an increase due to supply chain disruptions.

- The ISM services index, which indicates expansion when it is above 50, rose from 55.5 to 57.3, and the details of the report were terrific: all 10 components are above 50, 7 of them rose including big gains for new orders, a backlog of orders, and export orders.

- The ISM manufacturing index wasn’t as pretty, falling -0.8 points but it did remain in positive territory, barely, at 50.1.

But there’s one big problem with all of this data: it’s from yesterday.

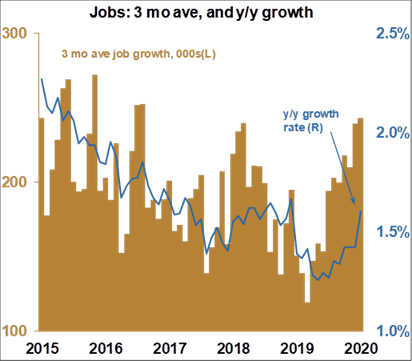

It’s true that any release of economic data is taken from some measurement, or from some survey taken some time ago, but we accept that because it still helps us evaluate the economy and build forecasts. But this time it’s different because as we all know, the effects of the coronavirus have yet to appear in the data, and we know it’s coming. For example, the surveys for the employment report are always taken during the week which contains the 12th day of the month. That was a month ago now, and that was significantly before the coronavirus started having effects on the economy such as a sharp drop in travel and cancellation of many major conferences and events. So we can be sure that next month, most measures will show a shakier US economy. And next month’s employment report will be the most closely watched in a long time.

As we mentioned last Monday, markets were expecting the Fed to come to the rescue, riding over the horizon with all guns blazing. And boy did it ever, shooting interest rates down like they were bad guys, both between meetings and by 50 basis points (0.5%) instead of the usual 25, for a doubly dramatic effect. But the financial markets weren’t sure if they liked it or not, and swung back and forth all week. So they apparently want to see that scene replayed again at the March 18th meeting. They are already pricing in another 50 bps cut. Unfortunately, it won’t really help most of the economy. It won’t get machine parts out of China any faster. And if an event organizer is contemplating canceling an event because of the coronavirus, he is unlikely to think “Hey now we don’t have to cancel - the overnight Fed Funds rate was cut by 50bps! We’re on!” No, the Fed did it to soothe the financial markets, and if it does, in fact, calm the markets (not working today!!!!), it may help keep consumer confidence from plummeting in the short run.

In the long run, however, such moves are hazardous, because the Fed is supposed to balance inflation and unemployment, not support the financial markets. And by supporting the financial markets with so much cheap money for so long, it could cause investors to take too much risk. This a “moral hazard” where investors and institutions act with less prudence because they start believing that the Fed will always be there to bail them out. That appears to be the case now, and you will likely be hearing a lot about the “Powell put” (a put option protects investors against losses) to backstop markets. Finally, as the Fed continues to cut rates, it will rapidly run out of ammunition to battle a recession (although it does have other tools to boost the economy).

Since investors were not enticed by the Fed’s generosity they chose to avoid risk instead. They bought the perceived safety of US Treasury securities, bidding up their price and down their rates (prices and rates move in opposite directions). In fact, investors have become so concerned about the effects of the coronavirus, they drove the yield on the benchmark 10 year Treasury to record lows, all week long.

There are some winners in this environment. Mortgage companies are said to be hiring as many people as possible to handle the huge increase in applications. Homebuyers and re-financers will make strong gains. Grocery stores are also doing very well as people are stocking up on goods for the long haul. Netflix, Amazon, and other streaming services are expected to see a dramatic increase in demand as people stay home.

The effects of the coronavirus will slow the economy this month and in Q2, and it will be a significant downdraft. However we do expect a recovery thereafter, and we maintain our forecast of weak but positive GDP growth for the entire year.