By Dan North, Chief Economist of Euler Hermes North America | Published April 3, 2020

That was yesterday. Look at tomorrow.

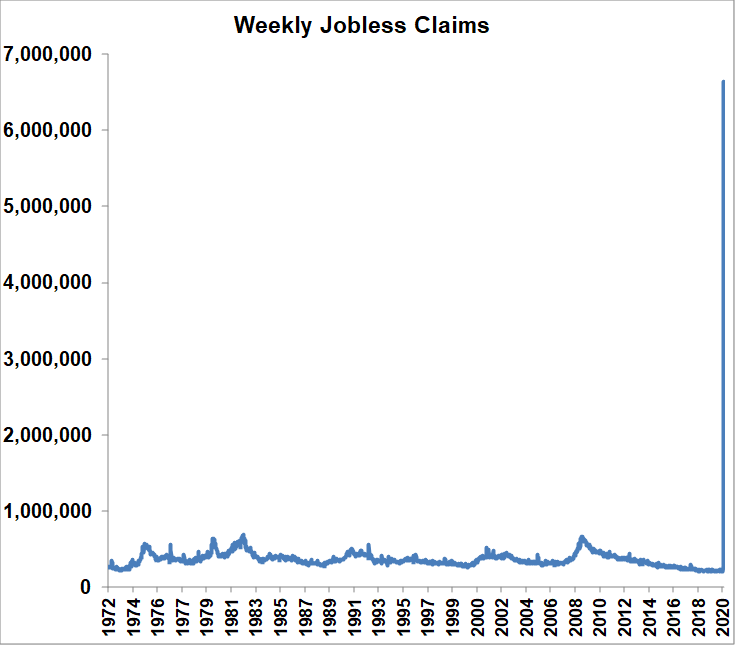

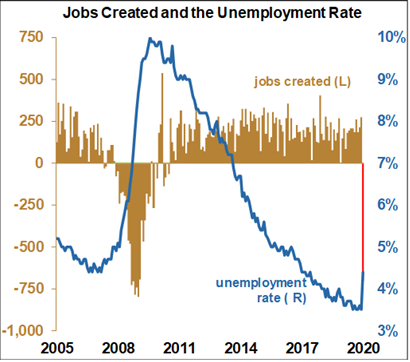

Today’s employment report was worse than expected. The data was gathered on the week of the 12th of March, which was before the massive layoffs started, so it was expected that it wouldn’t be nearly as bad as the weekly jobless claims report from yesterday (or the week before that). Nonetheless, this report does, in fact, show a dramatic decline in the labor market, even before the flood of job losses which began in the second half of the month.

The report is full of negative records.

- The economy lost -701,000 jobs, the worst since March 2009, 11 years ago in the Great Recession.

- It was the 8th worse monthly loss of the 974 months going back to 1939.

- More than half the losses, -459,000 came in the single industry of “Leisure and hospitality services” (casinos, sports, bars, restaurants, hotels). That was by far the largest on record since 1939 with the previous record being -83,000.

- The unemployment rate leaped from 3.5% to 4.4%, the biggest increase in 66 years.

- The broader U-6 unemployment rate jumped 1.7% to 8.7%, the largest increase on record going back to 1994.

- The decline in the labor force of -1.6 million was the largest in the 72 years of records going back to 1948.

- Weekly hours shrank by -0.6%, tied for the second-biggest decline on record going back 14 years.

- Since most of the job losses were in lower-paying industries, hourly wages actually grew +0.4% m/m to 3.1% y/y.