Federal Reserve keeps rates stable.

As expected the Federal Reserve left interest rates unchanged at Wednesday’s meeting and signaled that further cuts in 2020 are less likely than previously thought. The tone of the accompanying statement suggested more confidence about the future, particularly with the addition of the words “is appropriate.” The phrase which specifically suggested that the Fed would be biased towards leaving rates unchanged read “the Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective.” The statement from the previous meetings had characterized those out comes as “the most likely…, but uncertainties about this outlook remain.” As in previous statements however, the Fed did leave itself some wiggle room by saying it would “continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures…”

The dot-plot showing individual Fed member’s projections of the Fed Funds rate suggests no change in rates in 2020. However we still expect that one cut is possible in 2020, particularly as the economy in H1 may be weaker than consensus views. The dot-plot also suggests that two hikes are likely in 2021, and we would agree that is the most likely path as the economy should rebound by then.

Federal government anything but stable.

In other news, the House of Representatives is weighing article of impeachment against President Trump, and a vote in the full House, which is almost certain to pass, is expected next week. In that case, a trial in the Senate would happen in the New Year, and Trump is quite likely to be acquitted. At the time that President Clinton was facing investigation, impeachment and a trial, the economy and financial markets were virtually unaffected, and we expect that to be the same case here.

In a strange turn of events, at the same time that the House is working towards impeaching the President, they are also working together to get the USMCA trade agreement passed. On Tuesday, trade officials from the US, Mexico, and Canada finalized details of the trade agreement. The USMCA has widespread support in the House, the Senate, and the White House, and is expected to be ratified by all three countries. The new agreement is not markedly different than the previous NAFTA, but gives the US more favorable “rules of origin” on autos and parts, more labor protections, more access for US dairy farmers, and new technology protections. The deal is not expected to boost the US economy significantly, but its signing removes one bit of uncertainty over the global trade picture.

Finally, the government faces another shutdown when funding runs out on December 20th. There appears to be broad agreement in both the House and the Senate for passing a continuing resolution to keep the government open. However President Trump could conceivably defy Congress by insisting on funding for his border wall, a move which would likely trigger an impasse and a shutdown.

Our overall economic scenario remains unchanged.

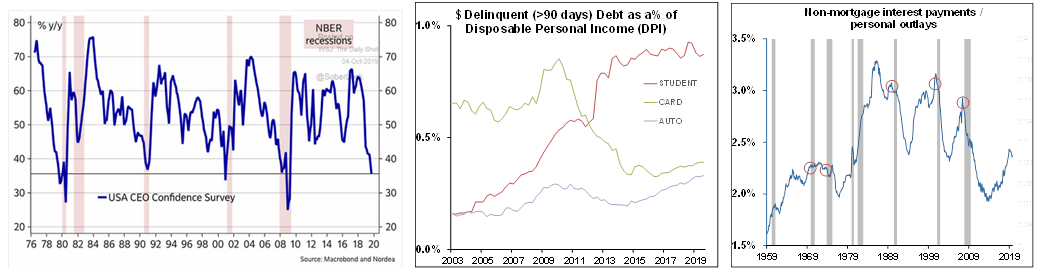

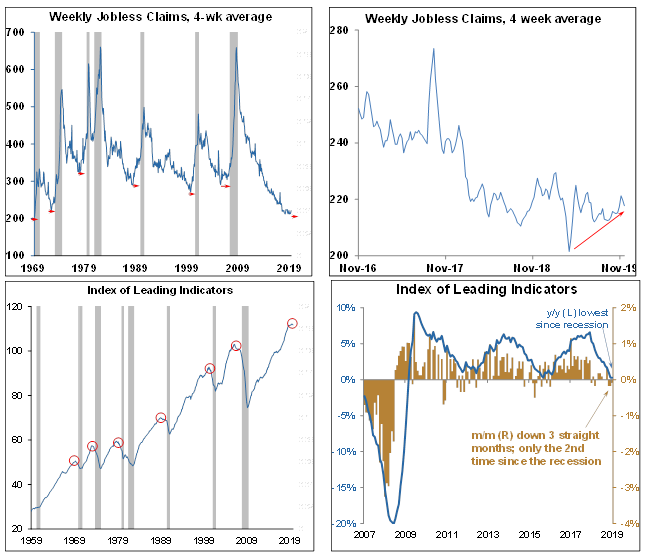

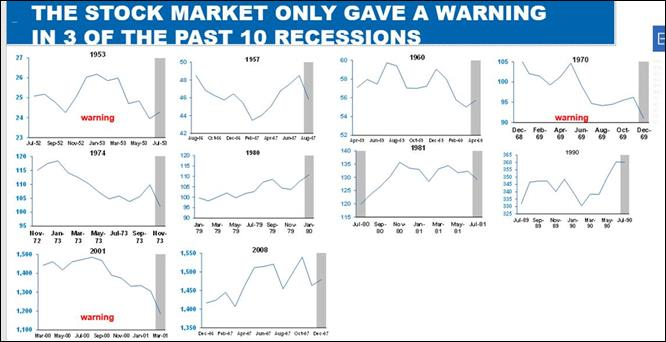

As predicted the economy in 2019 was solid, growing at about 2.3%. However the economy is also decelerating, and leading indicators of a slowdown next year are abundant, suggesting GDP growth for 2020 of only 1.6%. There could be one or two quarters of flat or negative growth, with the greatest chance in Q1 as that has statistically been the weakest quarter. While the probability of a full-blown recession is declining, it is still possible, and if the trade war continues to heat up, the risks are to the downside. Leading indicators of a slowdown we have highlighted before include the inverted yield curve, consumer concerns about the future, and a manufacturing sector already in contraction. In addition to those, other indicators include falling CEO and CFO confidence, an increase in past due reports, rising consumer delinquencies, increasing consumer interest payments, increases in leading unemployment indicators, rising jobless claims, and a deterioration in the index of leading economic indicators.