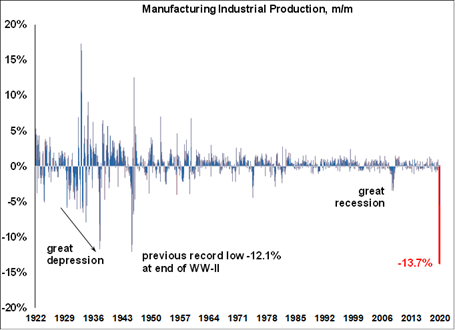

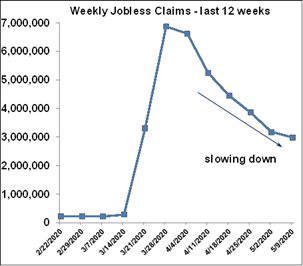

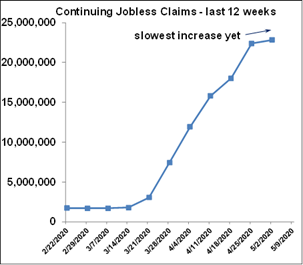

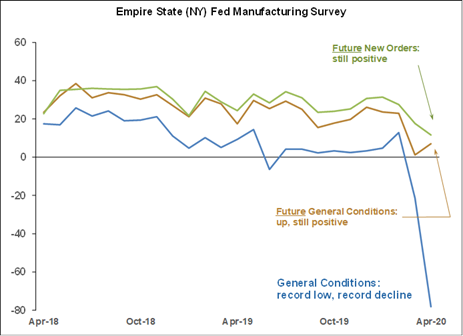

Naturally, economic data continues to report horrendous new lows. And while I have struggled over the past few weeks to ferret out and present any positive news, it actually hasn’t been so hard this week. The data is full of devastation but is also showing the emergence of redemption.

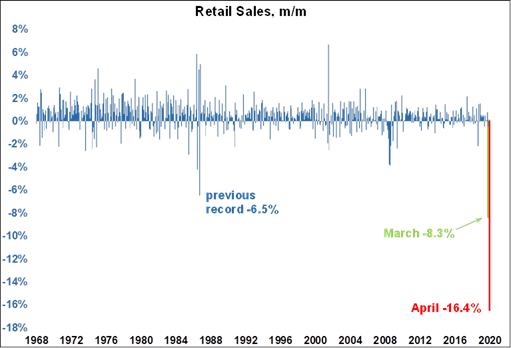

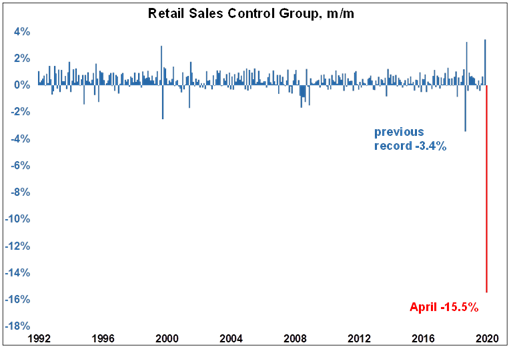

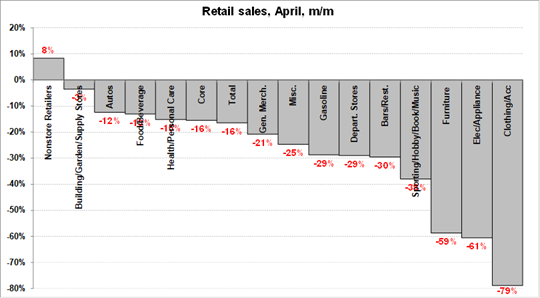

Retail sales fell -16.4% m/m in April, far worse than the already gruesome expectations of -12%. The previous record before the past two months was -6.5%. After stripping out volatile components, the “control” group fell -15.5%, about three times as bad as expectations. Losses were enormous across all major categories - numbers in the -20% range might be what you would expect to see in a very bad year, not in just one month. The lone exception was nonstore retailers, which is mostly e-commerce. Amazon and the like have apparently rescued consumers. However, we are quite likely to be through the worst of it. April was a total shutdown, May will be only a partial shutdown, and June will be a slow recovery, so as a result, we will probably see an increase in overall sales in the next report.