Industrial production in March fell -5.4% m/m, with the manufacturing component falling -6.3% m/m, both the worst in the post-WWII era. Once again, motor vehicles and apparel were the biggest losers and every industry fell. Fifteen of 19 industries are now in contraction on a y/y basis.

Canada

Statistics Canada has developed a new “flash” monthly GDP, which essentially is an estimate coming out two months faster than it normally would. The report showed that in March, the economy plunged an incredible -9% in one month; the previous record was -1.4%. The 9% m/m drop in March GDP implies a disturbing Q2 loss of -10% q/q annualized. The previous record was -8.7% and the record before that was -5.6%.

It gets worse. At its normally scheduled policy meeting this morning, the Bank of Canada (BoC) took the extraordinary step of simply giving up on updating its usual forecasts saying “Governing Council agreed that it would be false precision to offer its usual specific forecast.” Instead it gave scenarios indicating that compared to Q4-19, Q2-20 GDP could contract from -15% to -30%, NOT annualized. That -30% number requires some contemplation. It means that almost a third of the economy would have disappeared in just two quarters, once again harkening back to the Great Depression.

But to counter that scenario, again, there was good news in terms of added support to the economy; the Bank announced two new programs this morning to ease strains in credit markets by buying up to $50 billion in provincial bonds and $10 billion in high-quality corporate bonds. And just a few days ago the government provided more fiscal stimulus of $C73 billion in the form of the Canada Emergency Wage Subsidy (CEWS) which provides a 75% wage subsidy for up to 12 weeks. Total fiscal stimulus is now in the neighborhood of 10% of GDP, similar to the US.

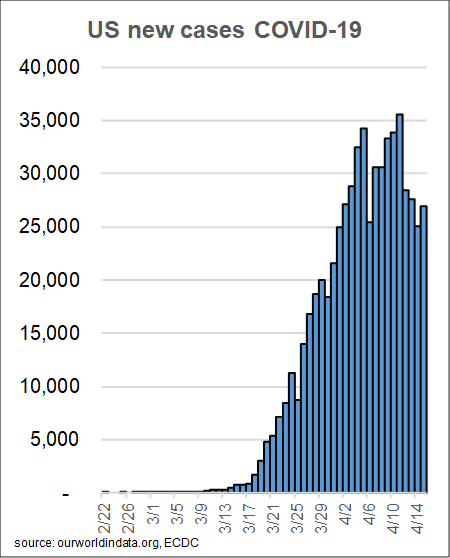

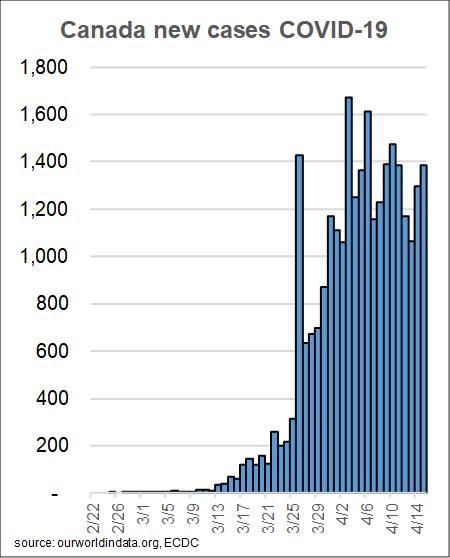

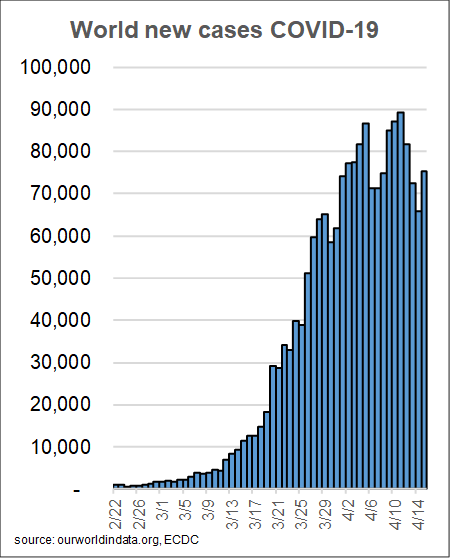

Here are some facts about COVID-19. These charts show the new cases through yesterday – note they are not the same scale.