Housing Market

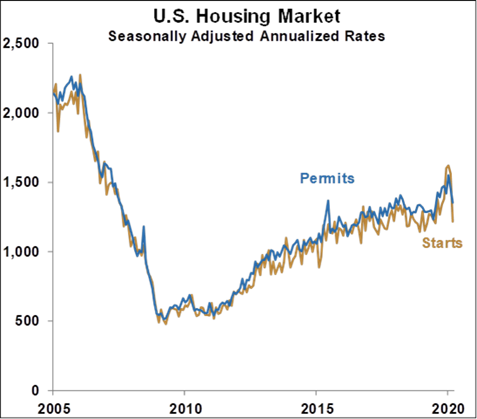

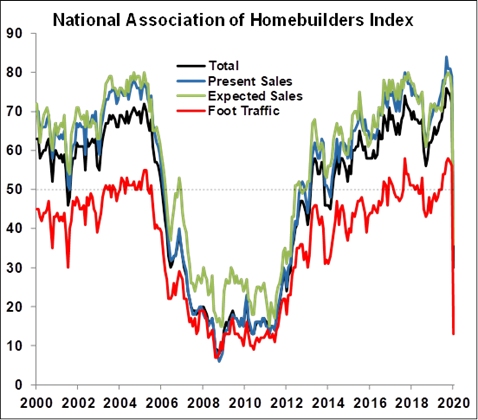

First the worst news of the day, which is that the housing market is collapsing - as you would expect. Housing starts fell 22.3% in March, the 4th largest monthly decline on record since 1959. Permits fell -6.8%. Starts and permits are highly volatile, but I think the plunge in starts is probably indicative of the situation, especially when you look at what homebuilders are saying. The National Association of Home Builders survey, which signals contraction below 50, took a dizzying tumble from a very optimistic 72 to a dismal 30; the -42 point decline handily beat the previous record of -10. There are three components of the survey, all of which fell record amounts, but the one which is the most eye-catching is the “Traffic of Perspective Buyers” (foot traffic) which fell from 56 to an outright morbid 13. Nobody is looking at homes and that can only spell disaster in the coming months. In addition, despite low rates, mortgages are now much more difficult to get as banks have tightened their lending standards.