More unfortunate records. But it was May Day

It’s been another huge week for economic developments, and of course, most of the news has been grim, but not all of it. Let’s start with the worst.

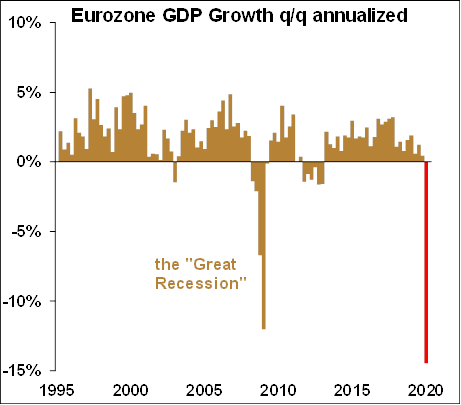

Eurozone Q1 GDP

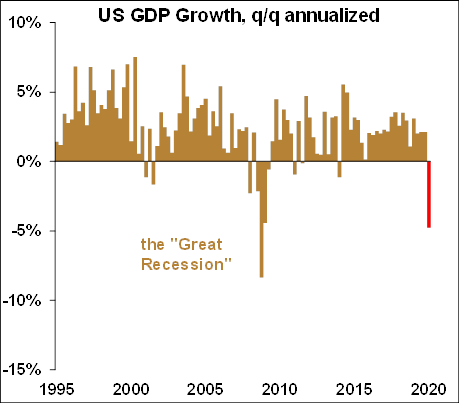

From the “You think you have it bad” Department, comes news out of Europe. As noted below, Q1 GDP in the U.S. fell -4.4% q/q annualized, worse than expectations, and the biggest decline since the Great Recession. However, in the Eurozone, things are much worse. Remember, the lockdowns and shut-ins started earlier there, and they are more severe than they are here. As a result, Q1 GDP in the Eurozone fell -14.4% q/q annualized, and of course, that’s a record low. Compare the Eurozone and the US GDP charts below and you can see how much more the European economy has suffered than ours. Looking ahead, our forecast for US Q2 GDP is around -30% q/q annualized. The forecast for the Eurozone, however, is for a much, much bigger loss. So if you think you have it bad… just take a second to think of our friends in Europe and what they are going through.