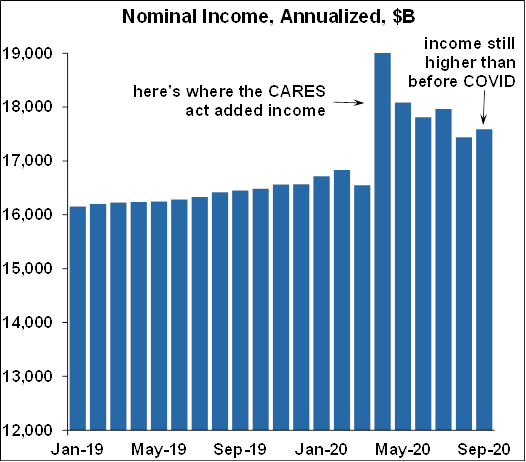

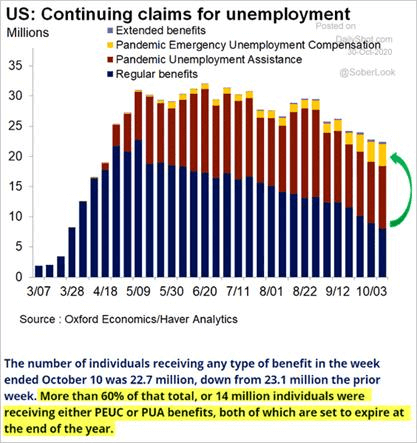

Speaking of income, the CARES act has made unemployment benefits a bit complicated. Normally, an unemployed person first applies for Unemployment Insurance (UI) through their states, and in most states, these benefits run 26 weeks or more. The CARES Act created an additional Pandemic Emergency Unemployment Compensation (PEUC) program which provides an extra 13 weeks of benefits, but those will run out no matter what on December 26. So someone who filed for state UI early on in the shutdowns, say in the middle of March will have neither regular state UI nor PEUC income at the end of the year. Someone who filed for state UI later, say August, will also lose PEUC on December 26, but they will still be receiving regular state benefits through February 2021. The CARES act also provided one more type of UI for those who typically wouldn’t qualify for state UI such as the self-employed or gig workers, and that’s called Pandemic Unemployment Assistance (PUA) which gives benefits for up to 39 weeks through December 31.

The point is, at the end of the year, both the PEUC and the PUA will be gone, and state UI benefits are going to start tapering off. It’s an income cliff followed by an income slide. It’s a disaster in the making. Oh yeah, and moratoriums on evictions and utilities shut-offs are ending as well. Really? It’s awfully cold recently. Nonetheless, it seems like Congress will not provide another round of income support until January of 2021. I’m not a fan of more government spending, but people need help, and Congress should act.

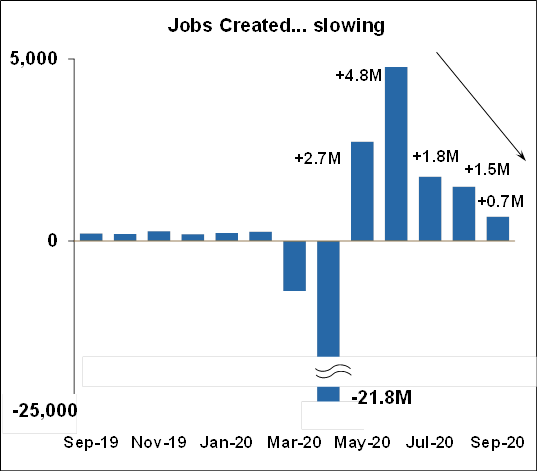

The WSJ had a nice chart that someone else already made up which helps explain the situation:

“This chart shows the total number of people receiving jobless benefits. Below the chart is a comment from Nancy Vanden Houten (Oxford Economics). This year-end income cliff is one of the key reasons economists would like to see another stimulus bill.”