Question: What does the risk monitoring team do?

I work in a dynamic and ever-changing retail industry. On a daily basis, I speak with both public and private companies to gather insights about their financial performance, their strategies, how they execute on their operational plans, and more. I then develop a risk profile on how these buyers are doing which in turn helps our underwriters decide the coverage needed.

Question: Sometimes Euler Hermes might have the tough job of denying coverage or only partially covering it. Can you explain why that might happen?

When you sign or prepare a policy with Euler Hermes, it’s not only an assurance that your claims will be paid out if a buyer does not pay on time, it’s also leveraging our unique credit team, underwriters, and all the confidential and public information we analyze on a daily basis. We build relationships with a lot of these buyers and gather a lot of context behind their business operations, their strategy and why they do what they do. So that alone is a great reason to work with Euler Hermes. And we also have a lot of proprietary information as far as which buyers are paying more slowly than others and which ones may be experiencing some cash flow issues. So you may not always be thrilled when you don’t get a full limit or even get fully defined on a limit that you request, but there’s usually reasons for that and information you can take back to your company on how to approach the relationship with that particular customer.

Question: Do you have an example when Euler Hermes had to reduce or decline coverage and it actually ended up helping a customer in the long run?

I can actually think of a number of examples when that’s happened. And a lot of times, it’s driven by the fact that we do have some financial information on the buyer, whether it’s confidential or otherwise, and then we also receive reports of slow pays and past dues from other policy holders. So we can kind of juxtapose the two together and realize this buyer is a little bit more sensitive and risky than either of those pieces of information by themselves. I can think about at least a few times when we decided to withdraw coverage and then, there you have it, about three to six months later the company is filing for bankruptcy.

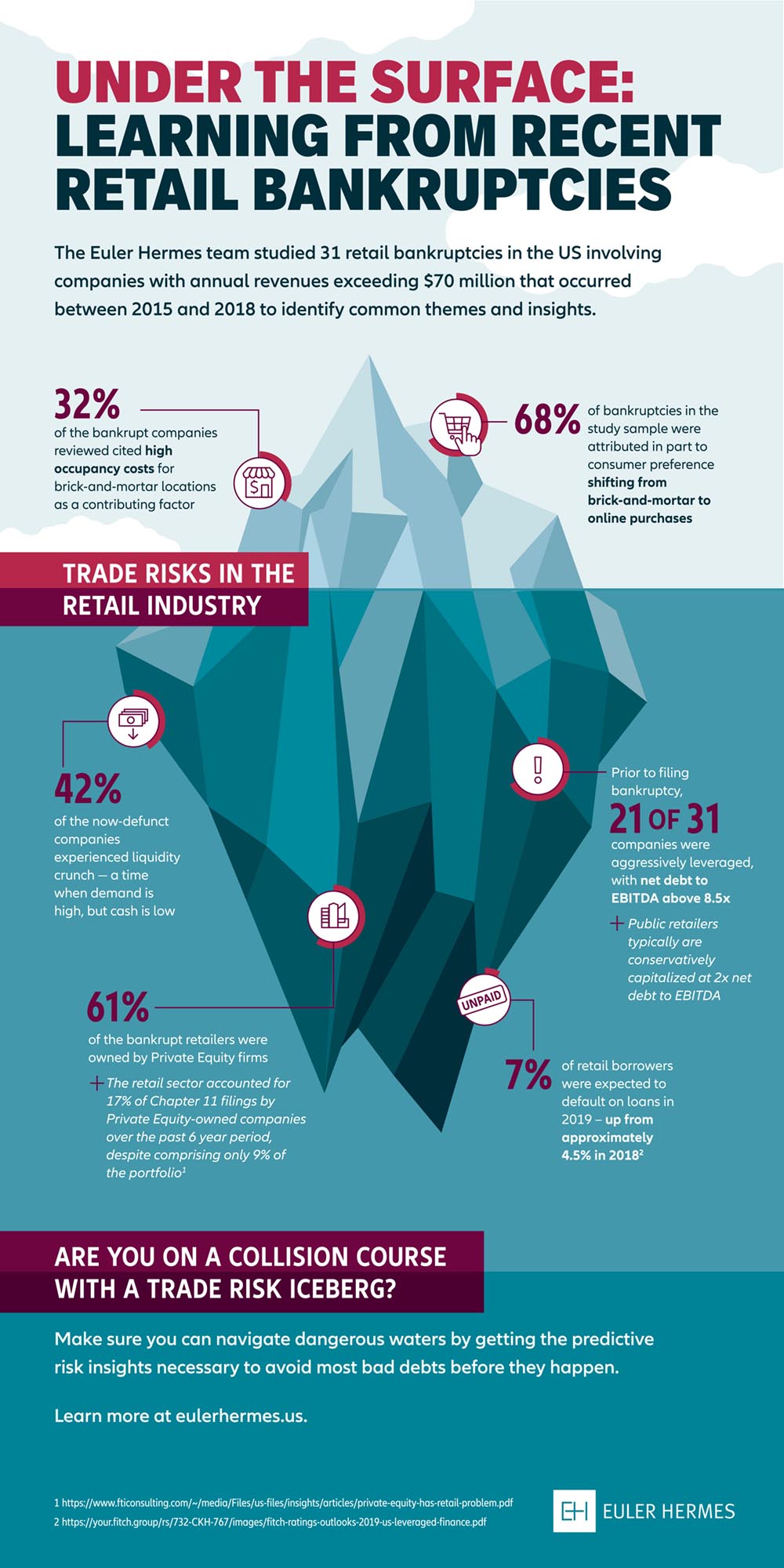

Question: What would you say are some recent retail bankruptcies that risk experts didn’t actually expect to unfold the way they did?

One I think is probably top of everyone’s mind would be Toys R Us. And a lot of that was driven by the timing of it, not the fact that Toys R Us was kind of a deteriorating company. It was a market leader in the toy industry, and it actually had some success refinancing debt and pushing out those maturities. So it didn’t seem like anything was imminent when the bankruptcy actually occurred, which was actually right before the crucial holiday selling season. So that definitely came as a surprise that they decided to file.

And then another one I can think of that wasn’t your traditional bankruptcy was Mattress Firm. They have stores everywhere. And more so the reason they decided to go into bankruptcy was just to get out of all the operating leases they had, just way too many stores and that was kind of dragging the company’s results down.

Question: How did Euler Hermes help our customers when these surprises happened?

Euler Hermes is down in the trenches all the time. We talk to buyers on a daily basis. We gather information pretty much nonstop. We have a vast portfolio of buyers we cover. So we always have the most current, up to date information on buyers and we’re always in the process of updating that. At the same time, if we start to see some concerning trends maybe we can raise the alarm bells and say hey, maybe it’s time to take a step back and be a little bit more conservative. At the same time, if we do get updated information and it’s trending positive, we can reach out to policy owners and be like hey, this is a buyer you’re interested in working with, maybe we have some additional capacity. It can also help you safely grow your sales with the company you may not be comfortable with or you may have a lot of unknowns.