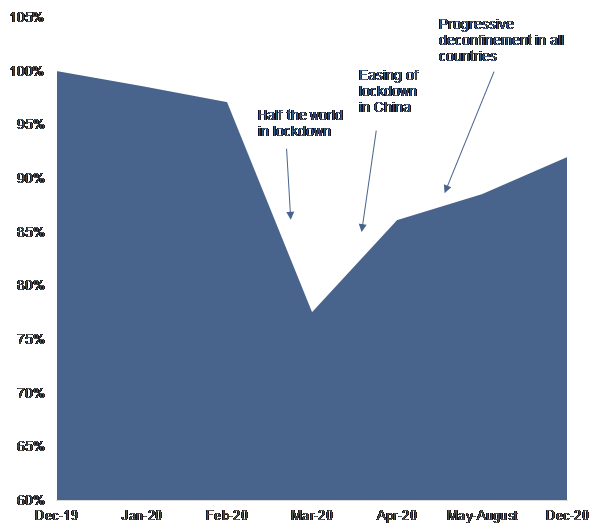

- Global trade could remain below 90% of its pre-crisis level even after lockdowns are lifted and only recover gradually in H2 2020.

- We estimate that lockdowns and the uncoordinated deconfinement could cost merchandise trade a loss of USD2.4tn, the same as if if all countries hiked their tariffs to 17%, i.e. close to levels last seen in 1994.

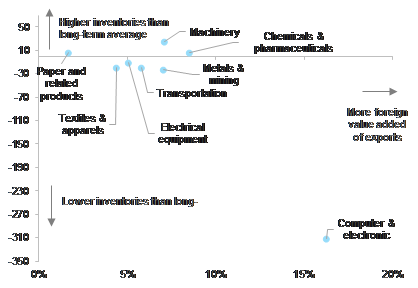

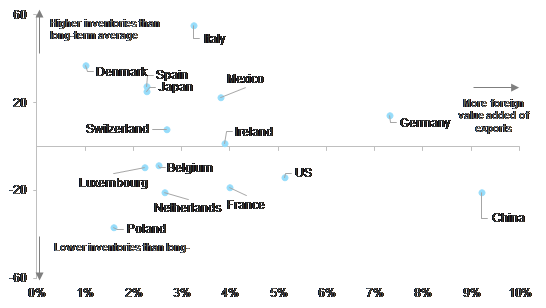

- Computer and electronics, metals and mining, transportation, electrical equipment and textiles are most at risk of continued supply chain disruption during deconfinement. In terms of countries, companies operating in China, the U.S., Germany, France, Ireland, Belgium, Luxembourg and the Netherlands are most at risk.

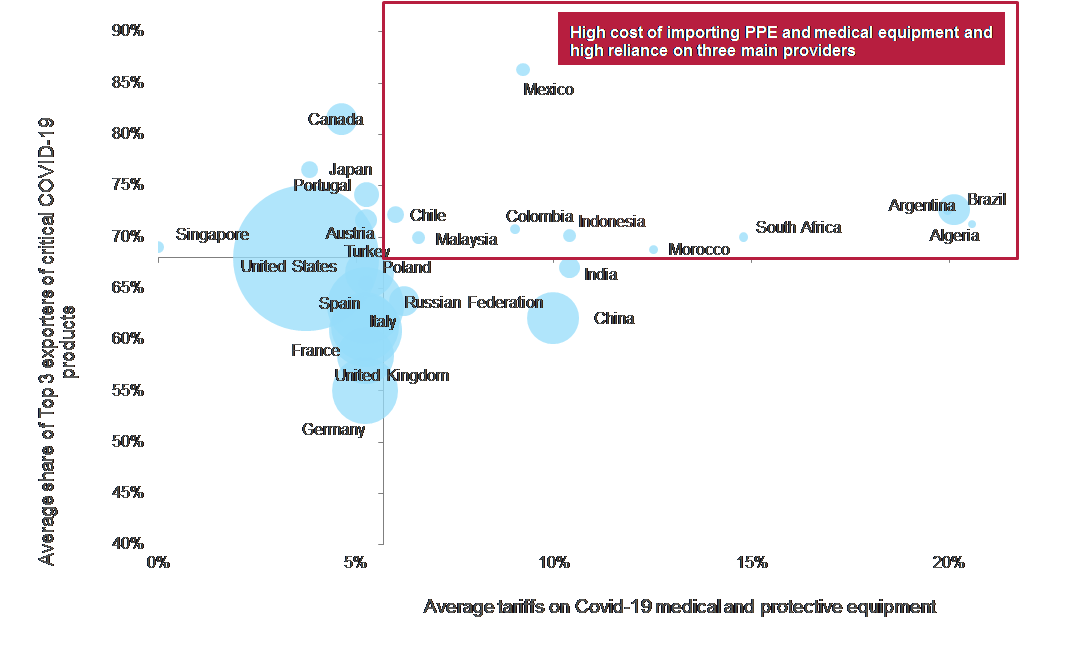

- Watch out for old-school protectionism, which could (i) recreate 2019 uncertainty and harm the investment recovery as U.S.-China tensions flare up; (ii) wipe out USD30bn of trade in Covid-19 related equipment and act as a crisis amplifier for emerging and developing countries.

All countries should have lifted generalized lockdowns by this June. Yet, after a 22.5% shock in value terms, trade could remain below 90% of its pre-crisis level even after lockdowns are lifted. However, we still expect trade of goods to rebound in the second half of the year, following the manufacturing sector recovery. We use the R0, projected end of lockdowns in all countries and the share of each country in merchandise trade to understand at what pace the "lid" on international merchandise trade would be lifted. Figure 1 below shows the share of global trade restored (as a % of pre-crisis trade) in the course of the next months. We see that the end of the lockdowns (which should be announced until end of June in most countries) does not mean an immediate return to normality. Indeed, some countries will continue regional lockdowns, and only gradually open all sectors of their economies, while bars and restaurants would operate at a very low capacity for a few additional months. We expect merchandise trade to recover in H2 2020 and through 2021, pushing the overall growth next year at +10% in volume and +15% in value terms.

Figure 1: Global merchandise trade in 2020 as a share of 2019 level: impact of lockdowns and gradual uncoordinated deconfinement