The Federal Reserve left interest rates unchanged at 0% - 0.25% and left all its other existing lending programs unchanged as well, clearly indicating that the economy will need all the monetary support possible for the foreseeable future. The outcome had been widely expected. There were few substantive changes in the accompanying statement, but the Fed did acknowledge that the economy still had a long way to go to completely recover, saying that, “Following sharp declines, economic activity and employment have picked up somewhat in recent months but remain well below their levels at the beginning of the year...” And the Fed pointed squarely at COVID-19 as largely driving policy, saying, “The path of the economy will depend significantly on the course of the virus” and as a result, “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events…”

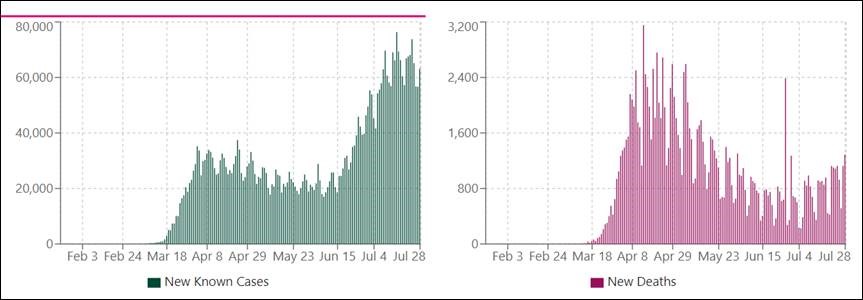

In a related note, yesterday the Fed extended the deadline for its array of new lending programs from the end of September to the end of December. Clearly, the Fed is concerned that COVID-19 could drive demand for those programs at least later in the year, and they are probably right. As shown in the charts below, new cases are remaining stubbornly high, while new deaths continue to rise.