The November employment report was full of maddening contradictions. One economist called it “one of the most confounding that I have ever seen.” Another bluntly said, “I don’t believe these top-line numbers” (as in, they weren’t credible).

The mixed headline numbers were:

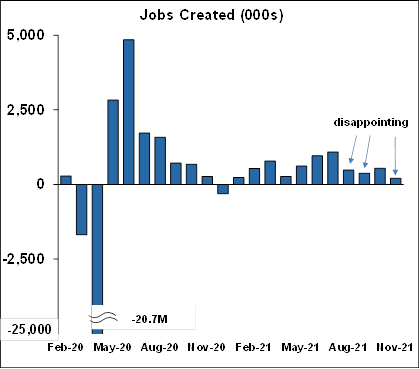

- Non-farm payrolls grew by 210,000 jobs, far below expectations of 550,000.

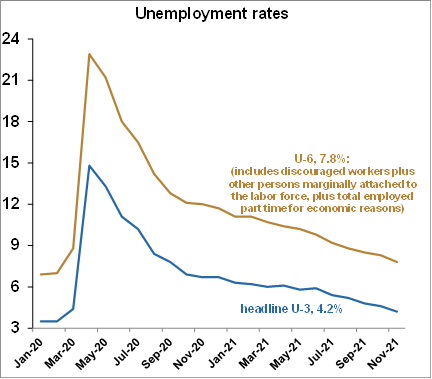

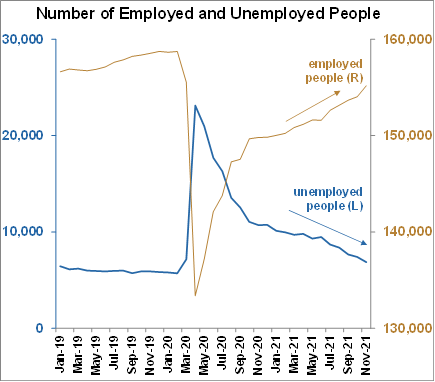

- But the unemployment rate fell sharply from 4.6% to 4.2%.

To explain the difference we have to get down into the weeds of the report just a little bit. The report is actually made from two separate surveys, the “establishment” survey, and the “household” survey. The establishment survey produces the non-farm payrolls number, while the household survey produces the unemployment rate.

Generally speaking, the establishment survey is considered to be more reliable because it uses a much larger sample of about 144,000 businesses, capturing around one-third of all non-farm payroll jobs. The household survey uses a much smaller sample of only 60,000 households. There are many other differences between the two which we will discuss below.