There was an American baseball player named Yogi Berra who was famous for his witty statements which were either self-contradictory or redundant. One of them was “It’s like déjà vu all over again.” That’s the case with the December employment report compared to the November report in many ways.

The two surveys which make up the report were strongly contradictory, again, which is rather unusual. The Establishment survey was much weaker than expected while the Household survey was much stronger than expected— just like in November.

The Establishment survey badly disappointed, just like in November.

- December Non-farm payrolls grew by only 199k vs. expectations of around 440k, or less than half as much, just like in November.

- December was the fourth disappointment in five months.

However, the Household survey was stronger than expected, just like in November. Almost all of the important measures moved in the same way qualitatively in both months.

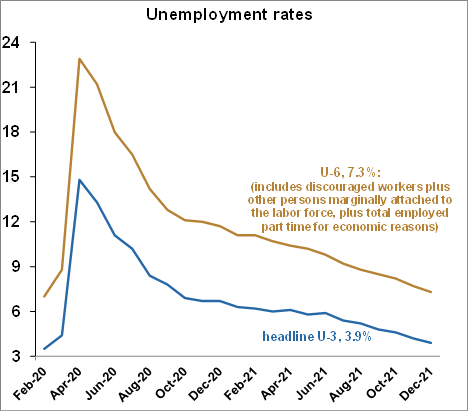

- There was a sharp drop in the unemployment rate from 4.2% to 3.9%, easily beating expectations of only moving to 4.1%.

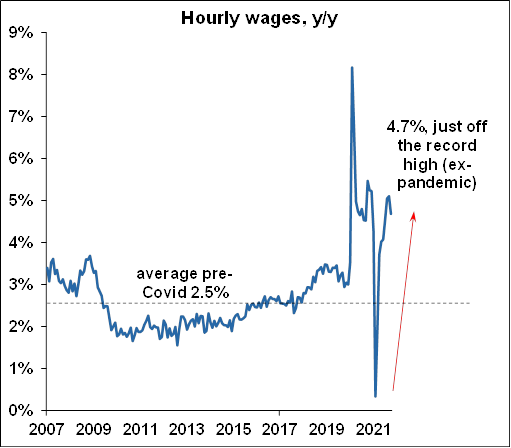

- Wages rose 0.6% m/m, doubling expectations of only 0.3%. The y/y beat was even bigger at 4.7% vs. expectations of 4.2%.

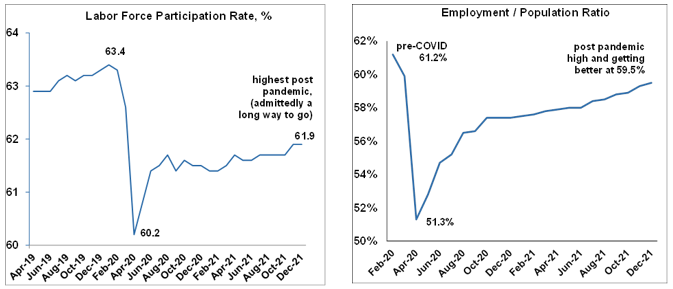

- The labor force participation rate was revised up over prior months, putting it at 61.9%, a post-pandemic high.

- The number of employed people rose by 651k, more than three times the size of the Establishment survey’s gain of only 199k.

How can there be such a disconnect? Well, like the two reports, the theoretical explanation is like… déjà vu all over again.

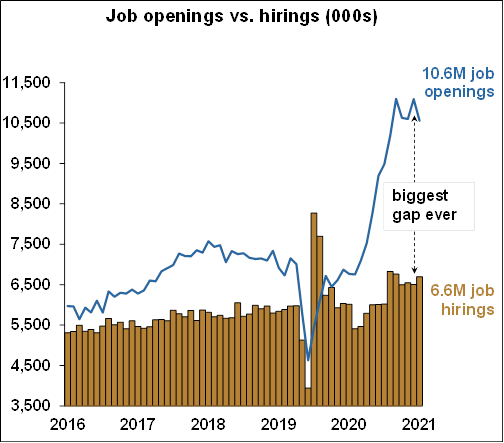

- Simply put, the Household survey includes self-employed people but the Establishment survey does not. More people are becoming self-employed from a combination of being able to work from home, a tight labor market, and a strong economy.

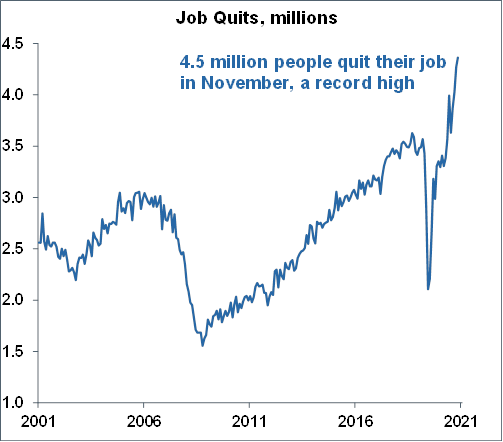

- The record-high number of quits supports the case—more people are quitting, and while some are switching jobs, some portion is also becoming self-employed.