The economy took a breather in the third quarter, as GDP slowed to a 2.0% q/q annualized rate, significantly weaker than already soft consensus estimates of 2.7%. It was the slowest quarter of the recovery, by a long way, but the details paint a different picture. Consumption grew by only 1.6%, but it was because auto sales fell by an extraordinary -54%.

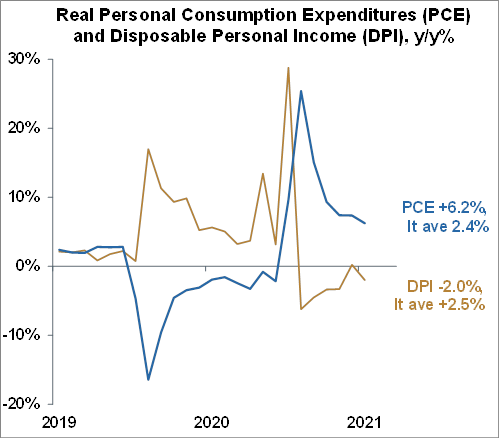

Apparently, due to the chip shortage, there are no cars to buy. If auto sales had stayed at the same level as in Q2, GDP in Q3 would have grown 4.6% and consumption would have grown 5.2%. So consumers didn’t buy cars. But they did buy services at a q/q annualized rate of 7.9%, and that was after last quarter’s 11.5.