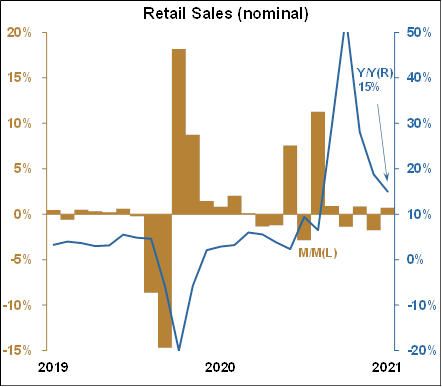

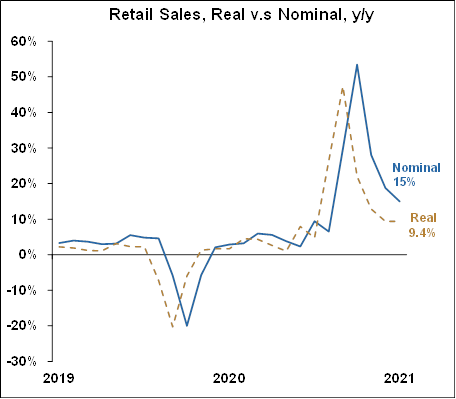

The retail sales report for August 2021 blew past expectations of falling -0.8% and instead rose +0.7% to a 15% y/y increase. Gains were widespread across industries with the notable exception of autos which fell for the fourth consecutive month, losing -3.6% m/m and driving the y/y rate to +10.3%.

While that would normally be a terrific number, it was 107% in April. There aren’t enough cars to buy as the global chip shortage continues to weigh on auto manufacturing. Total retail sales excluding autos, therefore, looked even better, rising 1.8% m/m to a 16% y/y rate. It’s a strong report.