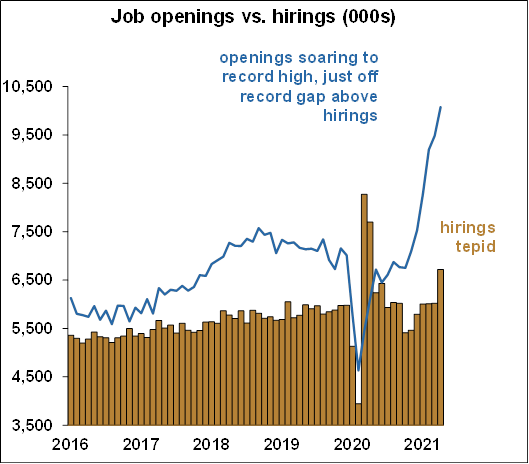

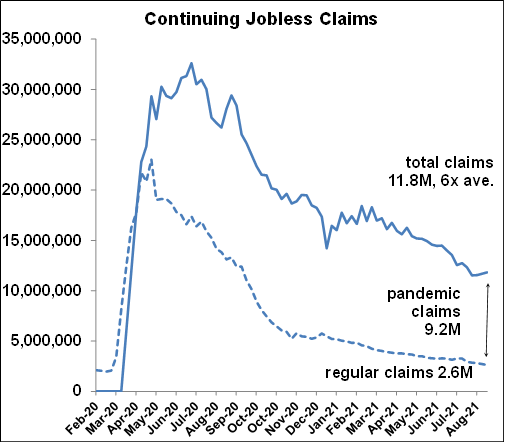

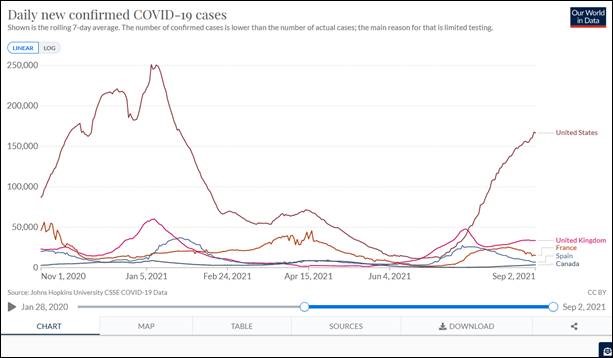

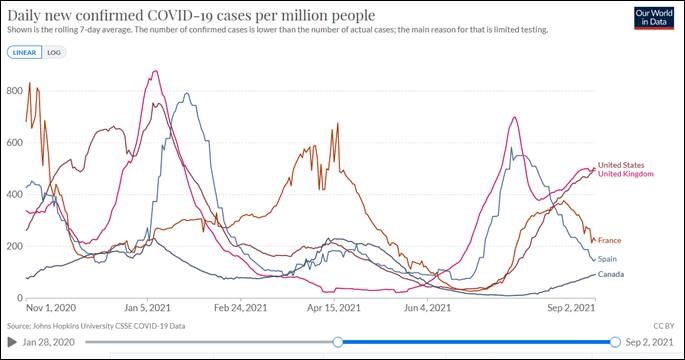

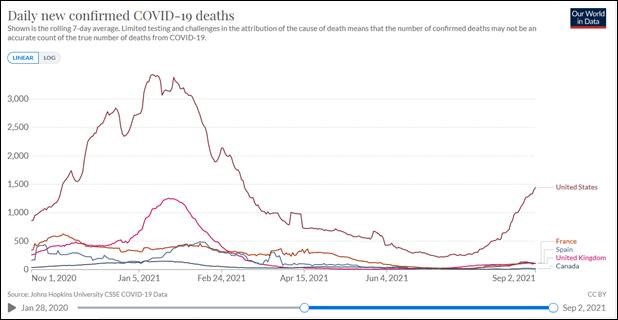

The employment report for August 2021 was a dramatic disappointment. The economy created only 235k jobs vs. expectations of 720k. It was the worst performance of the entire year to date. Leisure and hospitality, which had been driving much of the jobs recovery since the pandemic with an average of 432k per month, came up with 0 job gains in August - none.

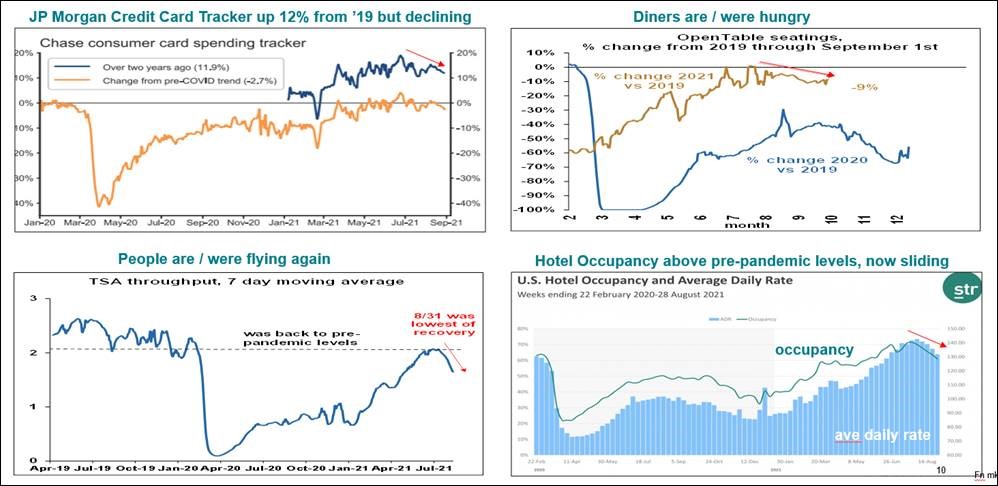

Within that category, “accommodation and food services” (hotels) lost -34.9k, and “food services and drinking places” (restaurants and bars) lost -41.5k. In addition, retail lost -28.5k. There was an increase of about 400k in those who said they couldn’t work for pandemic-related reasons, pushing the total up to 5.6 million. The data strongly suggest that the Delta variant of COVID-19 is indeed putting a damper on economic growth.