As expected, the April 30th Personal Income (PI) and Personal Consumption Expenditures (PCE) report for March was nuclear-powered and contained several records for the 62 years of data since 1959.

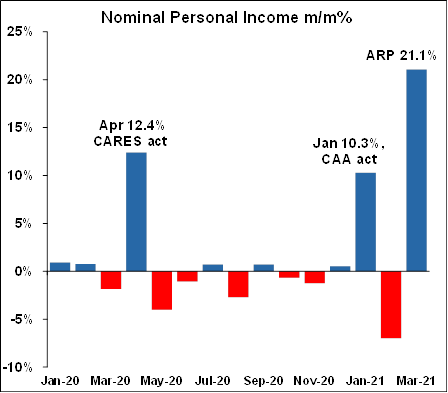

- Personal Income growth on a m/m basis set a record high, by a long way, at 21.1%; before the pandemic stimuli, the previous record was only 4.6%, one fifth the growth in March. And note that is only March compared to April, not annualized.

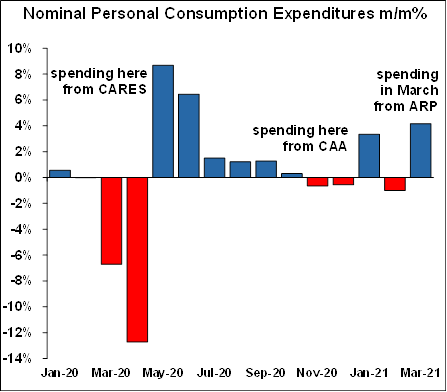

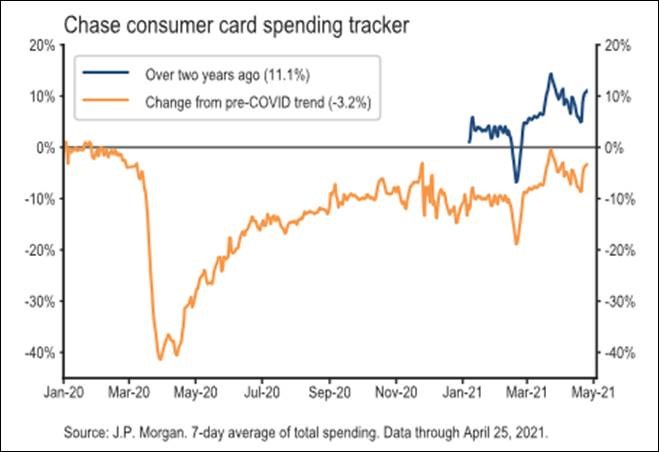

- Spending growth was spectacular at 4.2%, and again outside of the pandemic recovery months, was a record high.

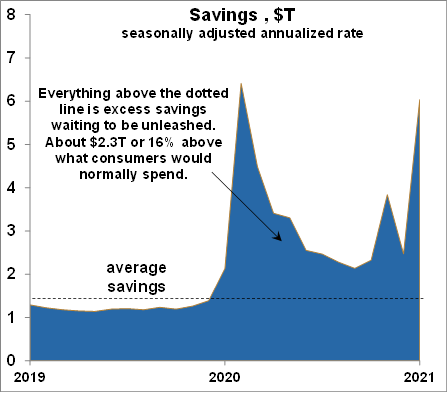

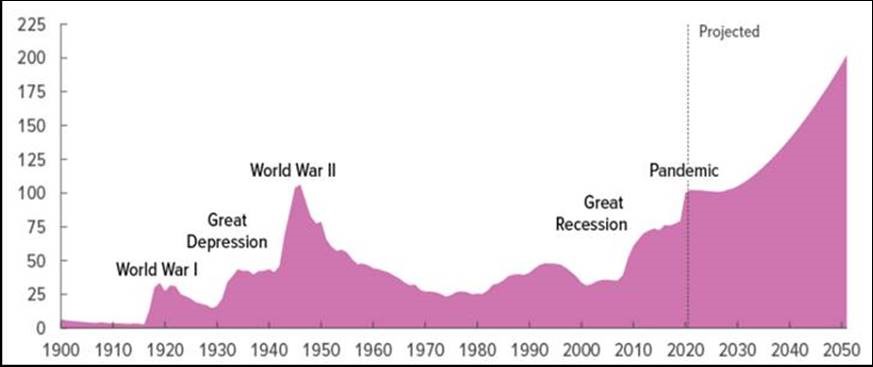

- But once again consumers just couldn’t spend all of that extra income, so excess savings set another record high at about $2.3T (on an annualized rate), or a gigantic 16% above what consumers would ordinarily spend. It also represents about 11% of GDP.

- Disposable (after tax) personal income (DPI) also set a record high growth rate of 23.6% m/m, far eclipsing the pre-pandemic record of only 6.2%

- Real DPI, adjusted for inflation also set a record at 23.0%, again easily out-running the pre-pandemic record of only 5.8%.

- Real PCE, outside of the pandemic, of course set a record high of 3.6%.