How Are Governments Responding

The Federal Motor Carrier Safety Administration has declared an emergency for states ranging from Texas to New York. The emergency waives hours of service requirements, allowing drivers to work longer to deliver fuel.

From a supply standpoint, the federal government is evaluating releasing supplies from the Northeast Gasoline Supply Reserve. The reserve of 1MM bbls of gasoline held in New York, Boston, and Maine would only be a temporary solution, but it might help mitigate higher prices in some northern markets.

How Will This Impact Fuel Prices

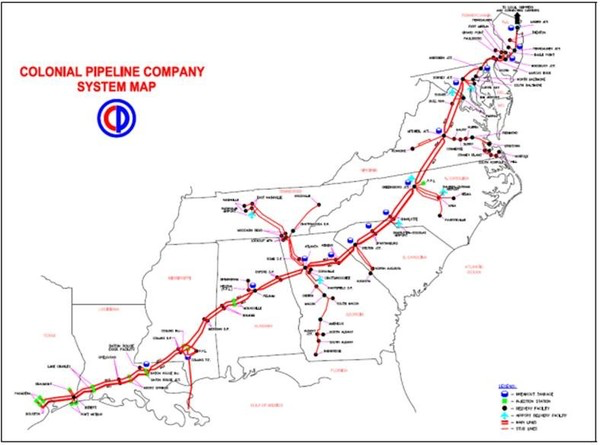

Fuel prices will see different impacts in different areas. Texas, which supplies the pipeline, may see prices fall as inventories rise. For markets along the Colonial Pipeline’s path, expect to see prices rise as local inventories are drawn down. Higher prices can stem both from higher supply costs and from higher freight rates, given driver shortages and logistics constraints.

NYMEX prices, which are based on NY Harbor rates and set the tone for national fuel prices, could be particularly impacted. The Colonial Pipeline transports fuel to New Jersey, so it’s an important supply source for NY consumers. As northeast prices rise, NYMEX Futures will also get a lift. That could affect consumers around the country since many fuel indexes are pegged to the NYMEX. Gasoline prices increased to $2.20 in early Monday morning trading, though since they have fallen lower (As of writing NYMEX Rbob $2.232/gal unchanged from Friday close).

Before the cyberattack occurred, the Colonial Pipeline had not been running at full capacity since fuel demand is lower. Diesel demand tends to be a bit lower in May, which will help prevent shortages. Gasoline demand, on the other hand, is ramping up ahead of summer driving season. Analysts had expected gasoline prices to peak ahead of Memorial Day, but now expect prices to peak much sooner.

Update as of late day May 11 2021

The Colonial Pipeline is making progress in the full restart of its operations, and is working with the US government to help alleviate fuel supply disruptions.

Some regional markets are experiencing supply constraints and/or not serviced by other fuel delivery systems are being prioritized. Colonial is collaborating with the DOE to evaluate market conditions to support this prioritization, Colonial said in its latest statement.

Colonial had previously said it hopes to have the pipeline substantially back online by the end of the week as it restarts one segment at a time. Some additional lateral lines are operating manually to deliver existing inventories to markets along the pipeline, it added.

Colonial said it delivered approximately 967,000 barrels (around 41MM gals) to various delivery points along its system. It had also taken delivery of an additional 2MM bbls (around 84MM gals) from refineries for deployment upon restart.

The US EPA noted late May 11 that it had expanded an emergency fuel waiver allowing 12 states and D.C. to sell off-spec gasoline through the end of the month to deal with the pipeline shutdown.

The expanded waiver runs through May 31 and covers: Alabama, Delaware, the District of Columbia, Georgia, parts of Florida, Louisiana, Maryland, Mississippi, North Carolina, Pennsylvania, South Carolina, Tennessee and Virginia.

The DOT separately late May 11 issued a new order allowing trucks to carry overweight loads of gasoline and other fuels on highways to move more supply along Colonial's route.