What Risks Should a CFO Consider In Making a Decision?

On a much more frequent basis, CFOs are often asked to play a part in managing and mitigating risks that are not strictly financial. That’s because all risks – including those associated with business growth and IT security – will ultimately impact the company’s financial health and potential profitability. Neglecting any one of these areas could lead to significant financial consequences. There are a few major areas of risk where CFOs need to play an active role in management and monitoring, which include:

- Financial compliance, debt and cash flow management, and merger and acquisition activity

- Credit risk including tighter analysis of customer creditworthiness and stricter trade credit terms

- Operational process and compliance risks, personnel management, and supply chain logistics

- IT security and contractor competency

- Catastrophic and geopolitical risks

Financial Risks

The most common financial risks CFOs have to consider in 2020 include:

- Compliance risk – The CFO and financial team must limit their company’s exposure to legal penalties and censure that result from failing to act in accordance with laws, regulations and policies. That includes ensuring that all financial statements and tax returns are filed on time, ownership documents are properly managed, employment and payroll records are retained, financial records are secured, and that the company meets all obligations to government and industry regulators and shareholders.

- Debt/credit risk – Borrowing is a normal part of business practice and most companies carry at least some level of debt. Banks and creditors have expectations of how and when those debts must be repaid or companies may face serious penalties and even financial ruin. When unexpected events like the COVID-19 crisis cause drastic impacts on demand and profit, companies carrying a lot of debt may be in trouble.

- Liquidity (cash flow) risk – One of the CFO’s major responsibilities is to keep an eye on a company’s cash flow. In a volatile economy, especially one impacted by unexpected large-scale crises like COVID-19, companies with a high level of liquidity will fare better. CFOs must help the company regularly forecast cash flow needs, control costs, continuously monitor customer accounts and suppliers, assess capital expenditures, and look for new revenue-generating opportunities.

- Merger & acquisition-associated risk – CFOs are playing a bigger part in corporate decisions – like mergers and acquisitions. They must weigh in on the risks associated with other companies’ financial health and potential for smooth process and cultural integration. In addition, they must the potential value an integration will generate and if that prospect is worth the inherent risks.

Credit Risk

Managing credit risk for a company is a complex process, as there are a variety of risks to consider. In 2020, some of the common credit risks CFOs need to consider include:

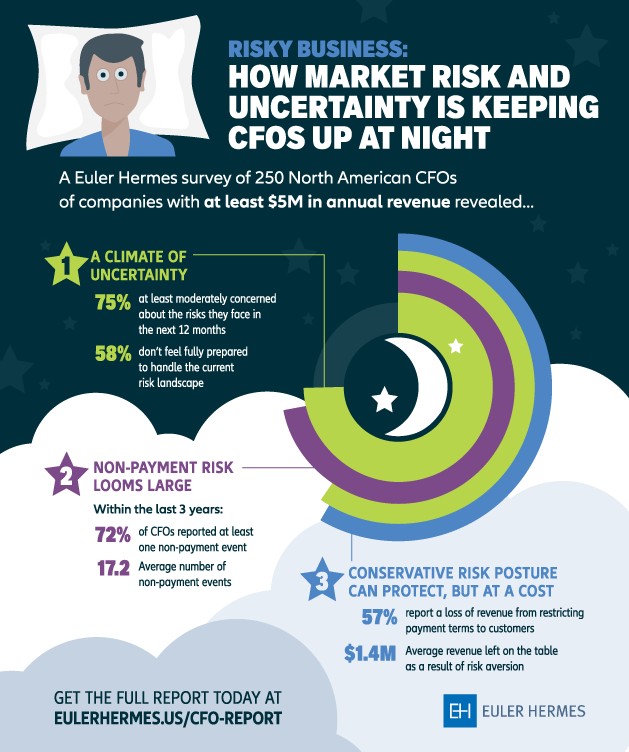

- Non-payment risk – Within the last three years, CFOs have encountered an average of 17.2 non-payment events, and 72% of respondents have had to deal with at least one unpaid invoice during that same three-year timeframe. CFOs’ concerns about this unpaid invoice epidemic are warranted. One out of five bankruptcies among small- and medium-sized businesses occurs due to customers that default on their invoice payments. Learn more about customer credit management techniques.

- Conservative credit risk – Some companies might re-evaluate relationships with buyers and take on a more conservative credit risk posture, but this can backfire. Fifty-seven percent of respondents reported losing revenue as a result of restricting invoice payment terms to customers. On average, $1.4M in revenue was left on the table as a result of financial risk aversion.

Operational Risks

Operational risks come down to a company’s processes, people, suppliers, and applicable regulations. Here are some common operational risks CFOs need to consider in 2020:

- Process risks – Best-in-class organizations focus on developing processes that are efficient, effective, and safe. The CFO must continually assess their process, particularly if the company faces increased or decreased demand, revenue or supplier issues, and other unexpected factors.

- Personnel risks – Employees are often a great asset to your company but also a significant risk. Ensuring workplace safety, equal-opportunity, non-discrimination, legal, and insurance compliance are key to protecting those employees and the business as a whole. A focus on fair and competitive salaries and benefits and adequate training processes can help a company retain valuable employees and minimize risks for negative financial impacts associated with their departure.

- Supply chain risks – It is important to assess and continuously monitor the financial health, security, and quality of every supplier to minimize risks to your business.

- Operational compliance risks – Rules and regulations regarding the safety and quality of your company’s products, services, personnel policies, shareholder communications, and more vary by industry and location. Continuous monitoring of all applicable regulations and processes to remain compliant are essential to minimize risk.

IT Risks

New technology promotes greater efficiency, collaboration, and potential profitability, but it also carries risks. CFOs must help the company focus on managing and mitigating:

- Security risks – Your company has a responsibility to keep client, partner, investor, employee, and supplier data safe, as well as protect the confidentiality of operational information. Security breaches can result in major losses of both money and trust. The CFO should be regularly involved with IT security monitoring and communications so they can flag any potential risks with financial and overall business health impacts.

- Contract risks – Outsourcing any IT functions – whether to a separate team or a cloud-based platform – requires intensive upfront examination and continuous monitoring of the provider’s security protocols and record, quality, competence, and delivery on contract requirements.

How CFOs Manage Risk

Effective risk management requires a collaborative approach, meaning the CFO must work with the CEO, CTO, and divisional leadership to create risk management monitoring and mitigation protocols that can be integrated into every department’s processes. The CFO should work with this leadership team to:

- Understand the specific risks the company faces – Together, company leaders must perform a thorough evaluation of a variety of business risks, as well as any additional risks specific to your industry, client base, global presence, partnerships, and technical requirements.

- Evaluate potential risks and their impacts – Some scenarios are more likely than others and some risks may carry greater consequences for your company, especially when it comes to your business’s financial health and reputation.

- Periodically report on and update risks – Regular departmental and leadership reviews of risk exposures, risk management, and troublesome trends or warning signs that may indicate new risk areas are critical to staying on top of threats to the business.

Utilize Risk Analytics to Inform Business Decisions

Applying the right business intelligence tools and financial and risk analytics can help the CFO guide financial and strategic aspects of important investment and business decisions. For effective value vs. risk assessments, the CFO should use a mix of internal and external data to project potential scenarios involving key business decisions and investments, which could reveal unexpected risks. Once implemented, the CFO can also use analytical tools and strategies to continuously monitor the value of those decisions, gaining valuable insight into warning signs for future risks in the process. Many CFOs are turning to trade credit insurance solutions for a wider range of insights they can use to guide smarter trading decisions.

Learn how one company chose to implement a seamless preemptive strategy to help mitigate its risk and protect its industry-leading market share.

Combine Risk Management with Business Planning

The CFOs role in risk management and business planning go hand-in-hand. A forward-looking risk management strategy helps a company identify and manage existing and emerging risks by analyzing past trends, predicting potential scenarios, and preparing for those scenarios so they can effectively adapt if the need ever arises.

The right risk management strategy allows CFOs and their leadership team to identify how specific risks will affect the business plan and to incorporate regular stress testing to ensure the plan can stand up to projected scenarios. In turn, this can help them to gain insights on the probability of business decisions’ success, and indicate areas of weakness in business planning.

See how one company uses credit insurance to accurately monitor its customers’ financial health and protect its business against bad debt.

Leading the Discussion on Risk Preference

A company must take on some level of risk in order to grow. CFOs control risks and play an integral role in identifying what risks could result in the greatest potential ROI with the least damaging impacts on company growth and financial stability. Supported by key insights gained from collecting and modeling data, the CFO can help guide strategic decisions with a clearer knowledge of their impacts on every level of the business.