But apparently, President Biden can’t wait for ARP. On Friday he signed another round of stimulus relief, which among other things will provide money for more food security and speed the delivery of stimulus checks from previous programs.

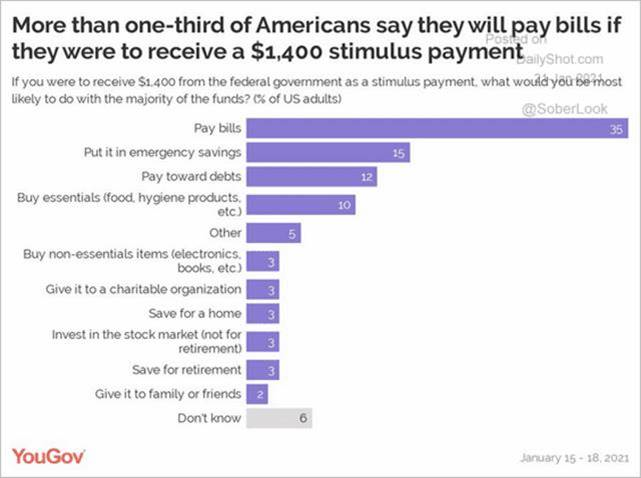

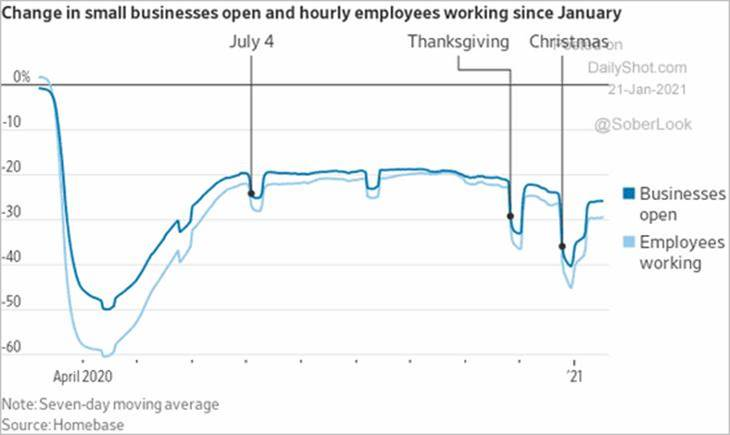

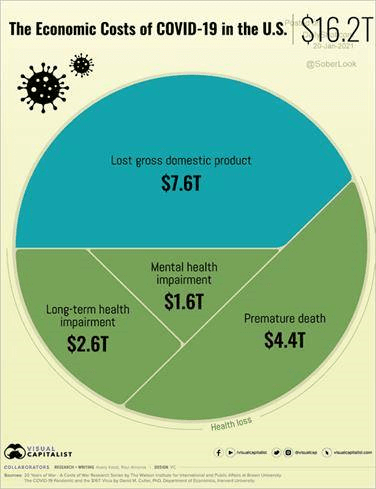

We have maintained that stimulus spending, in particular, income support, has been the right thing to do all along and it still is. After all, thanks to COVID, 10 months later there are still 10 million jobs missing from the economy, and there are still 14.5 million people claiming unemployment benefits, which is five and a half times the long-term average. People need help.

But the term “stimulus” is wearing thin. A more complete descriptor for this policy might be “stimulus-now, depressant-later”.

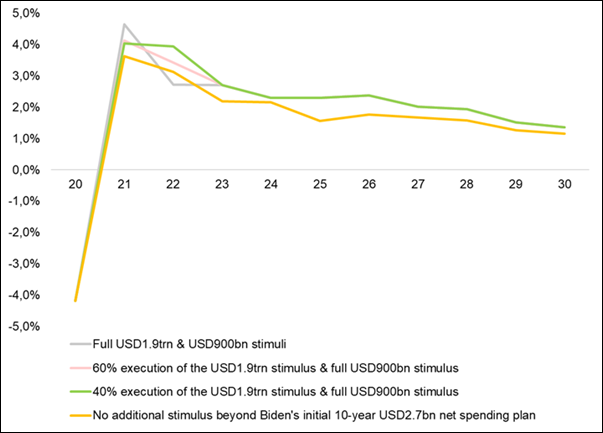

First, let’s look at how stimulus-now is supposed to work. It’s typically meant to apply to a recession when consumers are not spending as much money as they did before and the economy is getting weaker as a result. Then the government steps in and spends instead of consumers. That spending stimulates the economy by creating more demand for goods and services and more demand for jobs along the way. It’s important to note that government spending is no better than consumer spending, and often worse, it’s just that the government is doing it because the consumer is not. In theory, it’s a temporary boost until the economy heals – it’s stimulus-now, and it’s expected to boost 2021 GDP to a very strong 4.1% annual growth rate.

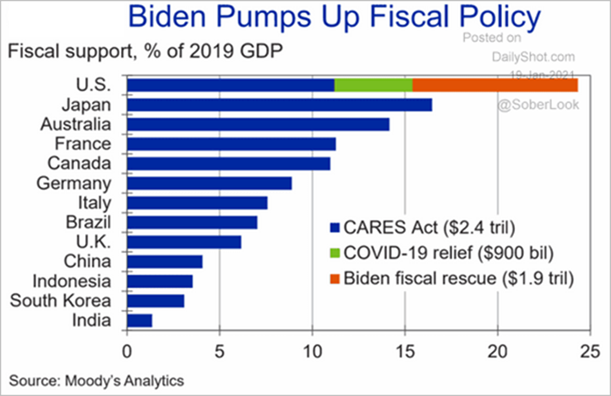

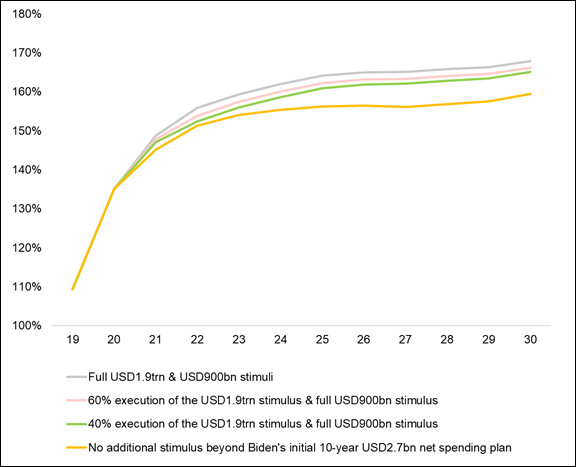

However, there is a downside to this policy as well. We can’t just spend ourselves into prosperity. First, consider that the money for the stimulus has to come from somewhere. The government does not just have a magical, infinite pile of money sitting in a corner. The money either has to come from you the taxpayer now, or the government can borrow it and you the taxpayer will pay it back later. Currently, the government is doing a lot of borrowing to pay for these massive stimulus programs, incurring a tremendous debt load. In fact, our colleagues at Allianz Research have made an estimate of just how much the debt/GDP ratio will rise with all of the stimulus plans. The chart shows four scenarios ranging from getting the full $1.9T ARP program to getting none of it. Right now, the debt/GDP ratio is 126%. By the time we reach 2030, the debt/GDP ratio under these four scenarios will range from about 155% to 165%. For reference, the highest previous record was 118% just after WW-II. (Our massive entitlement programs of Medicare, Social Security, and Income Security (welfare), which account for two-thirds of our budget outlays and are politically untouchable, also greatly contribute to the problem, but that’s another story).