The economy is in very good condition and we expect an unusually strong GDP growth rate of 6.3% for all of 2021, the fastest in over three decades. Clearly, the combination of massive stimulus resulting in plenty of consumer firepower, plus the emergence of warmer weather, plus the lessening of the threat of Covid will drive the economy rapidly forward.

However, some recent economic news, such as the May 2021 Personal Income (PI) report, has given a “head fake” which might cause some concern that the economy might not really be on a roll. This head fake is a distortion caused by the “base effect” and I’m going to take a little time to explain it.

Here’s a very simple example. Say you have two bamboo stalks and each grows 1 inch in a day. The first stalk was only 1 inch tall to start with, so when it grew another inch, in percentage terms, it grew 100%. The second stalk was 100 inches tall to start with, so when it grew another inch, in percentage terms, it grew only 1%. It’s the beginning number or the “base” which can distort or mislead.

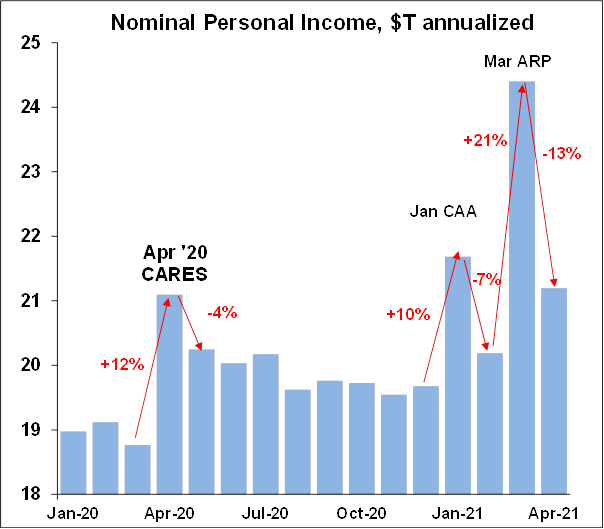

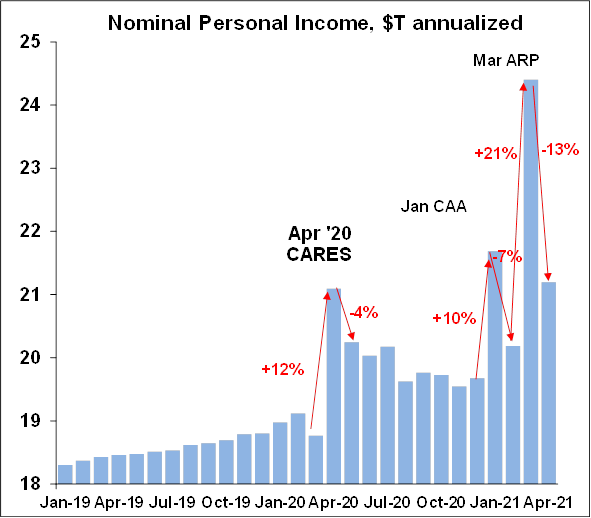

That’s what happened in the PI report. There have been three major fiscal stimulus programs since the pandemic; the CARES act of April ’20 which injected $2T in the economy, the CAA in December ’20 which injected another $1T, and the most recent ARP which injected still another $2T into the economy. During those months there were huge spikes in personal income. But immediately before and immediately after those spikes, income fell – there was no fiscal boost in those months.

The chart below shows the evolution of PI since the beginning of 2020. On the left, you can see the big 12% boost in PI from CARES in April 2020. Since there was no boost in May 2020, PI fell 4% compared to April. In January 2021, the CAA increased PI by a steep 10%, but then since there was no boost in February, PI fell 7%. Finally, in March 2021, ARP boosted PI by a massive 21%, which of course was followed by this month’s 13% decline. These large percentage changes are a result of either very high or very low base levels from the previous month.